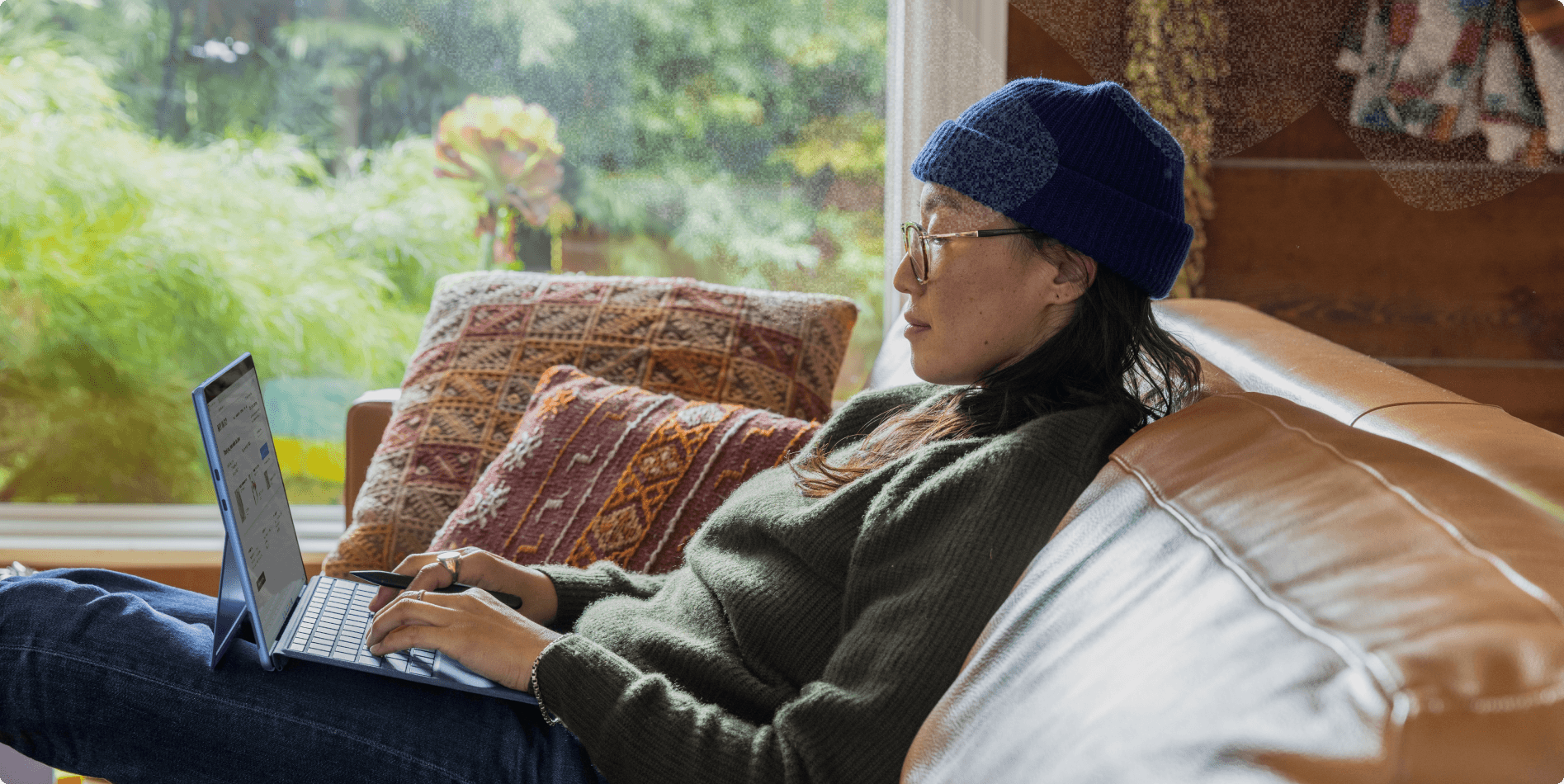

For Small Businesses

Say hello to the best invoicing software for small businesses

Gaps in cash flow are the #1 killer of small businesses. With Hopscotch as your invoicing partner, you can de-risk your business, protect against the threat of late payments, and keep growing consistently.

Supercharge cash flow, one invoice at a time

Hopscotch is the best invoicing software for small businesses, making it easy to send invoices, get paid instantly, and pay bills all from one streamlined dashboard. Use Hopscotch to get paid on-time and keep your finances moving forward.

Pay and get paid in one place

Hopscotch is the all-in-one invoicing software with bill pay and cash flow control. Save time and reduce errors with a side-by-side payments ledger.

Finetune your financial growth

Dealing with late-paying clients or long net-terms on your invoices? Use instant payments to unlock revenue in just a couple of clicks. Hopscotch Flow is a great alternative to traditional invoice factoring, without the high fees or strict terms.

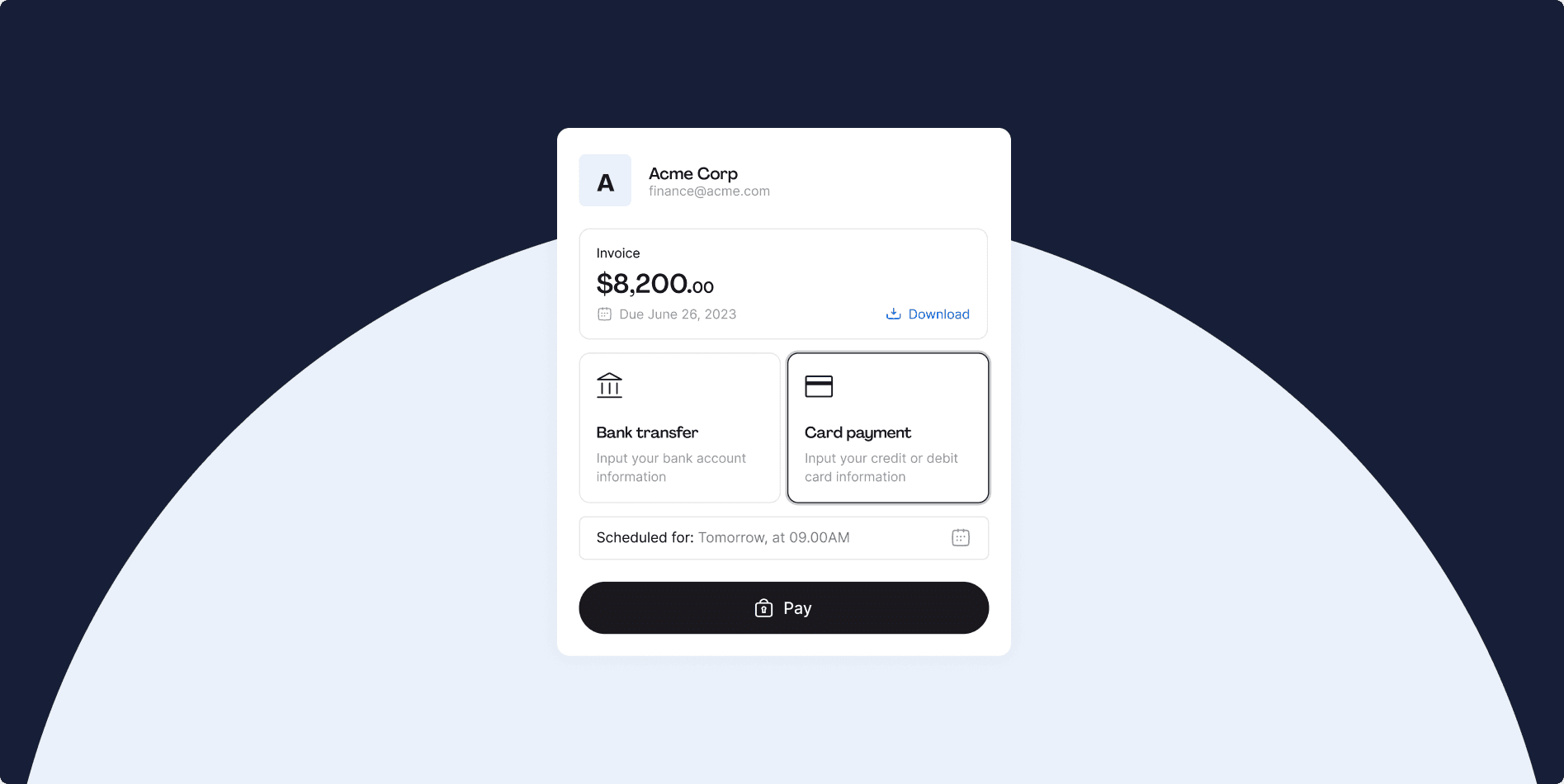

Dynamic payment options

Decide how you want to send and receive funds. Choose from zero-fee bank transfer, credit/debit cards, or Hopscotch Balance instant transfer—whatever works for your business. This helps control what you pay in fees and leverage card benefits like cash back, points, and other rewards for your business.

Why small businesses prefer Hopscotch

Simple, streamlined ledger

Whether you need to send invoices or review and pay bills, Hopscotch makes it easy to manage all your financial admin in one place. Use the all-in-one dashboard to easily pay and get paid, no more jumping between different platforms and wasting time. Save time every month and integrate with accounting software like quickbooks to accurately track data.

Cash flow solutions that work for small businesses

Never worry about a late payment again. Supercharge your revenue with instant, fee-free invoicing, and fortify your finances with 2-click cash flow that advances funds on-demand. Having Hopscotch Flow in your back pocket protects your business from late payments. This tool is a great alternative to traditional invoice factoring, allowing small businesses to get paid on their terms instead of net terms. Get instant access to capital so you can make payroll, reinvest in your business, or cover other critical expenses.