Financial technologies have the potential to improve access to capital and remove bias from historically discriminatory industries like banking and lending. As the small business category has expanded in recent years to include gig workers, freelancers, contractors, consultants, and more, the need for fast, reliable, and adaptable fintech solutions is greater than ever.

By creating innovative products and services, these founders are all propelling their respective categories forward and pursuing financial equity for business owners of all different backgrounds. Get to know each of these Black founders and the work they’re doing to address pain points related to cash flow, financial literacy, and more.

1. Reed Switzer

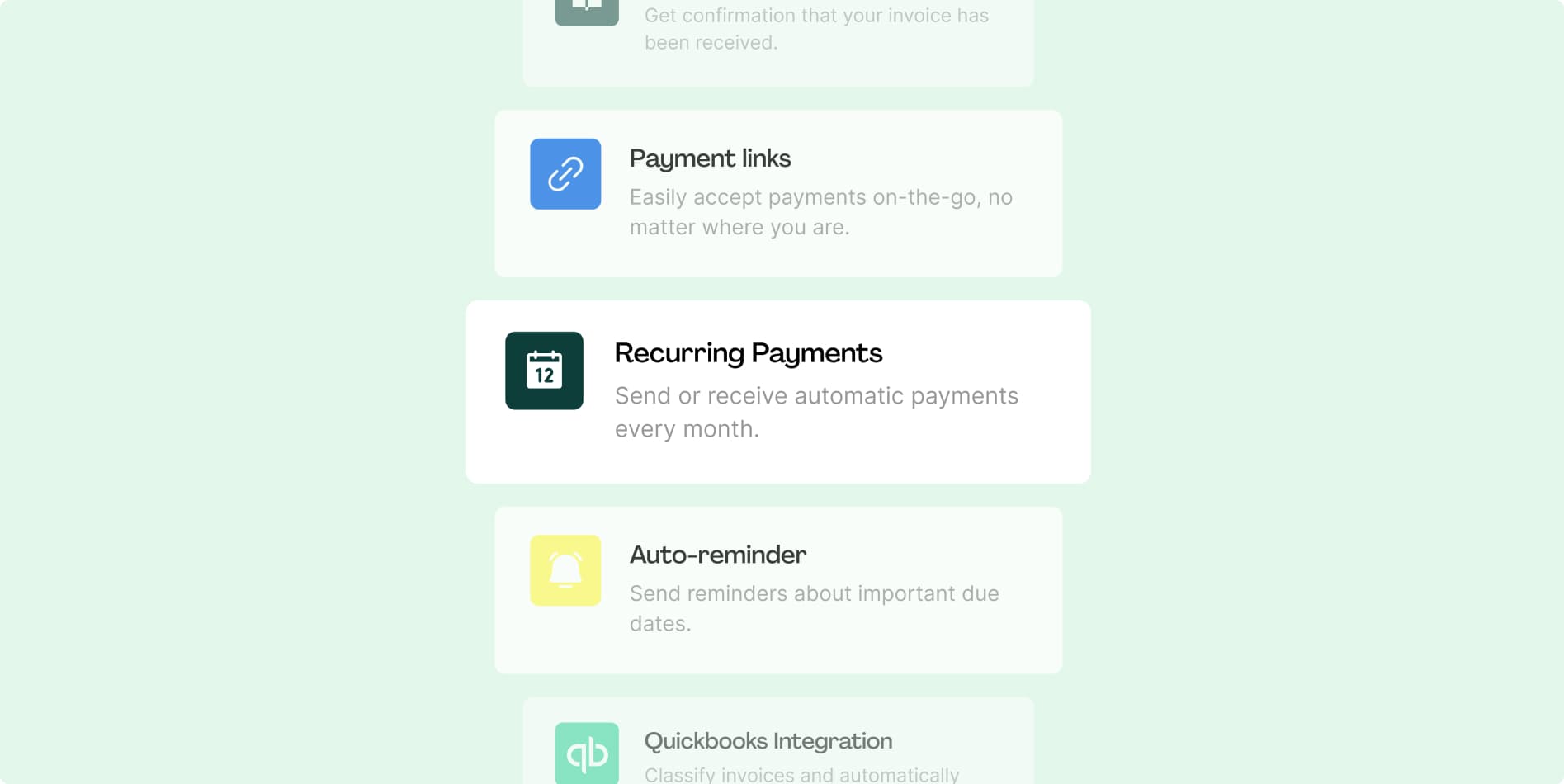

Hopscotch, a B2B invoicing platform with built-in AR lending

Hopscotch CEO Reed Switzer was bit by the entrepreneurial bug early on. First, he founded a clothing company; then. he transformed a focus group gig for a music streaming company into a job as its operations lead—all before graduating high school.

He dropped out of Wharton School of Business to found Hopscotch. The idea was simple but revolutionary — B2B payments should be as easy and fast as payments between friends. Inspired by P2P payment apps like Venmo and Zelle, Reed set out to create a similar solution for small businesses, with built-in lending products that made it easy to get paid exactly when you need to. Fast forward a few years, and Hopscotch users can access invoiced amounts before clients even pay, reducing their reliance on traditional forms of financing to enable growth.

2. Craig J. Lewis

Gig Wage, a payroll platform built for 1099 workers

After starting his career in professional basketball and sports marketing, Craig J. Lewis found a different niche—fintech, and more specifically, payroll. He was motivated by solving an important dilemma: why can’t we pay workers in the gig economy (freelancers and contractors) as easily as we pay full-time employees? Lewis launched Gig Wage to bring more stability and consistency to the payment experience for this critical segment of the workforce.

Gig Wage simplifies payment processing for employers by offering automated, scalable solutions for paying independent contractors, freelancers, and gig workers. It supports a variety of payment methods, making it easy for employers to manage payroll without manual tasks. For gig workers, it provides fast, secure payments with real-time tracking, and it supports multiple payment options like direct deposit. The platform reduces administrative overhead for both employers and workers, ensuring timely and accurate compensation. Additionally, it helps employers stay compliant with tax regulations for gig work.

3. Everett K. Sands

Lendistry, a fintech CDFI loan provider focused on minority-run small businesses

Everett K. Sands has testified before Congress about the persistent challenges of getting a loan as a small business, with particular focus on how traditional lending systems often overlook minority-owned enterprises. Sands advocated for more inclusive lending practices and the need for programs that provide equitable access to funding. He emphasized the critical role of community-based lenders in helping small businesses grow and recover. His testimony underscored the importance of improving access to financial resources to support economic recovery and growth in underserved areas.

After decades working in community lending, Sands created Lendistry to counteract these trends. Lendistry is a fintech company dedicated to providing financial solutions to small businesses, particularly those in underserved communities. It offers access to funding through loans, including SBA loans, helping businesses secure capital for growth, operations, and recovery. Lendistry’s mission is to empower small businesses by offering fast, flexible, and affordable financing options, particularly for minority-owned, women-owned, and rural businesses. The platform simplifies the application process, providing a user-friendly experience and a higher chance of approval for businesses that might not traditionally qualify for funding. Their goal is to foster economic growth and inclusivity for small businesses across the country.

In its first decade, Lendistry has granted $10 billion in loans and grants to 640,000 small businesses, most of them minority- or women-owned.

4. Angel Rich

The Wealth Factory and CreditRich, financial literacy and credit management apps

What if building financial skills felt more like a game and less like a chore? Angel Rich built an app for that. Credit Stacker is a financial literacy tool designed to help users improve their credit scores. A renowned entrepreneur, Angel Rich is often referred to as the “Credit Guru,” and has a strong background in technology and financial education. Rich has been recognized as a leading voice in fintech and has received numerous awards for her work in empowering underserved communities with financial tools.

As a follow-up to Credit Stacker, Rich developed CreditRich with her Hampton University classmate Courtney Keen. She also founded Wealth Factory, a platform that aims to provide accessible and actionable financial education, and close the wealth gap by empowering users to make more informed financial decisions.

5. Michael Broughton

Altro, a fintech solution for building credit as you pay for subscriptions

Remember your first major job search? When all the entry-level roles somehow required 3 years of experience? Building a credit history feels the same way—you can’t get a loan and build credit unless you have credit.

Michael Broughton ran into the institutional barriers to building credit when he was denied a student loan. A lightbulb turned on, and he built Altro. The free app targets unbanked and underbanked individuals—who are disproportionately members of minority groups—and gives them a path to building credit with smaller, everyday payments like a Spotify subscription instead of traditional forms of credit like a mortgage or high-interest credit cards.

6. Mitchell Jones

LendTable, cash advances for 401(k) matching and stock option funding

Imagine a world where you can pay off your student loans faster while still contributing to retirement savings and wealth-building options. For many Americans, even those with steady employment, a lower middle class income in the $40-60K range means prioritizing the bills of today and putting off saving for life after work.

Mitchell Jones and cofounder Sheridan Claybourne created LendTable to address this exact issue.

Lendtable helps employees take advantage of money that would otherwise be left on the table by supplying them the funds they need to receive their full 401(k) match from their employer. With Lendtable, they no longer need to choose between saving for retirement and covering day-to-day expenses.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.