What You’ll Learn:

- What direct cash flow forecasting is, and when to use it

- What indirect cash flow forecasting is, and when to use it

- Whether a hybrid forecasting model is possible

A cash flow forecast allows you to project what your business’s cash flow might look like in future months. This article explores how different cash flow forecasting methods can help you monitor your expenses and prepare for the future.

Direct cash flow forecasting

A direct cash flow forecast looks at concrete data points to understand a company’s cash flow and make projections about future cash flow. There are two common approaches to this:

- Receipts and disbursements methodology: Reviewing accounts payable and receivable data to see beginning and ending cash balances over a period of time

- The bank data approach: Incorporating bank statement analysis into the previous methodology; some businesses integrate bank feeds directly into forecasting software for real-time updates to enrich their forecasting.

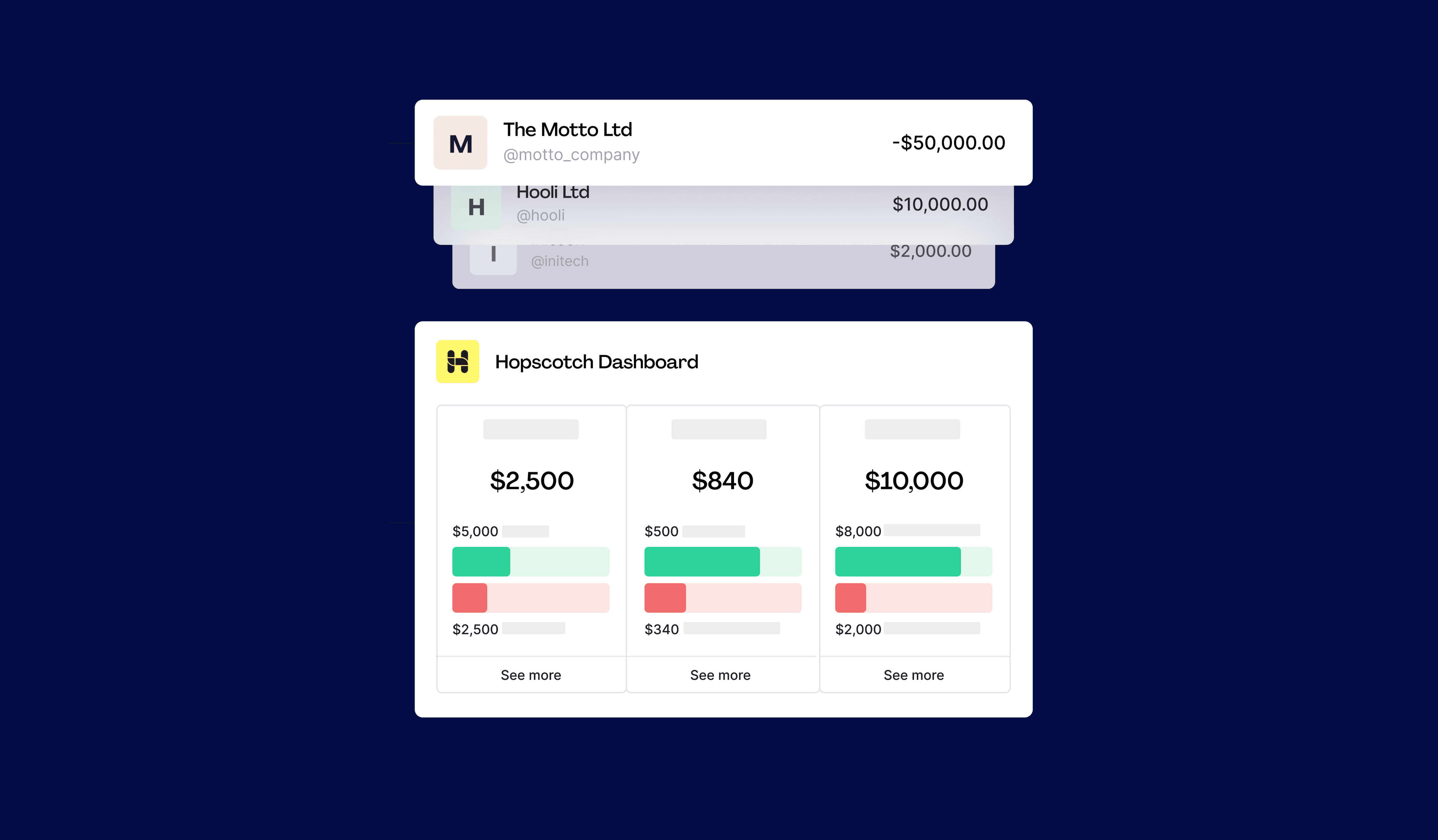

A simple cash flow forecasting statement can help you visualize your money to clearly see what’s going out and what’s coming in.

When to use direct cash flow forecasting

Most businesses that leverage direct cash flow forecasting use it for short-term analyses and predictions (e.g., 30 to 90 days) because it relies on actual cash flow data. The information can be highly useful when looking at day-to-day or even monthly statements. Businesses can use these insights to manage month-to-month cash needs, such as paying vendors or employees.

Cautions with direct cash flow forecasting

One limitation of direct cash flow forecasting is that clients don’t always pay on time. Unpredictable human behavior and fluctuations mean you can’t rely on having money in your account exactly when you expect it.

Additionally, direct forecasting focuses on one information set, typically in a short time frame. This means it doesn’t identify trends well—even ones that might be highly predictable, like expected seasonal patterns.

Indirect cash flow forecasting

Indirect cash flow forecasting is primarily based on accrual accounting and financial statements, such as profit & loss statements and balance sheets. This approach typically derives cash flow estimates from net income, adjusted for non-cash items (depreciation, amortization), changes in working capital, and financing/investing activities. It sometimes adds more information to the forecasting model via:

- Statistical modeling, which adds projected sales and other estimates to the data set

- Business intelligence, which looks at the whole context of a company, including business drivers, market trends, and other upcoming conditions

These models enhance forecasting data and allow for more customized adjustments to consider patterns, trends, and unique circumstances.

When to use indirect cash flow forecasting

Businesses typically use indirect cash flow forecasts for long-term strategic planning (e.g., six months to several years) due to its reliance on financial models rather than actual cash movements. This method captures nuances of timing and circumstance that direct cash flow cannot, and it provides a better understanding of your business’s long-term financial health.

The longer a statistical model is used, the more accurate it can become. Companies with many years of experience and data are more likely to benefit from this forecasting method.

Cautions with indirect cash flow forecasting

With more information involved, indirect forecasting is naturally more complicated than short-term direct forecasting—and it involves more guesswork. Even the most educated and carefully calculated guesswork isn’t foolproof. Market trends and seasonal patterns can change due to unforeseeable circumstances.

Indirect cash flow forecasting also relies on unique access. All accountants typically have access to their company’s invoices and bank statements, but they may not have access to high-level corporate information or strategy meetings. Under a business intelligence model, they need to be granted wider access to make well-informed projections.

Want to get the best invoicing and cash flow tips? Sign up for the Hopscotch newsletter

Can you use direct and indirect cash flow forecasting together?

Yes, a hybrid model is possible and commonly used. It combines the accuracy of direct forecasting with the reach of indirect forecasting.

For example, companies can use direct forecasting to gather current data, such as how much they bring in each month to accounts receivable. They can then project that data into the future to predict performance by modeling how much the company will bring in if it meets its quarterly sales goals.

When to use direct and indirect cash flow forecasting together

Using a hybrid forecasting method may be more helpful than using either one in isolation. It’s particularly insightful for companies with seasonal fluctuations in their accounts receivable. You can track patterns over time so that polarizing sales months (in which AR is either unusually high or unusually low) aren’t used to predict overall success.

A hybrid model may also help if the market is shifting to reflect a period of cooling off or fast growth.

Cautions with a hybrid cash flow forecasting method

While the hybrid approach combines the strengths of each method—and can mitigate some of their individual shortcomings—it’s still a projection that involves complicated data and lots of guesswork. Hybrid models do not eliminate the unpredictability inherent in modeling. Factors like late client payments or emergency expenses will always crop up. Hybrid models also require businesses to manage both short-term liquidity needs and long-term financial planning simultaneously, which can be resource-intensive.

Whether you use direct, indirect, or hybrid forecasting, accurate input data is key to meaningful insights. No cash flow forecasting method is reliable if the input data is incorrect, so it’s essential to review the accuracy of your data before using it in your forecasting model.

There’s no accounting method that can perfectly predict the future—but using accurate data, making room for potential fluctuations, and understanding which method is best for your circumstances can help you forecast cash flow more effectively.

Manage your cash flow with Hopscotch

Invoicing records can be a crucial component of cash flow forecasting. Keeping track of them all in one place means you have all the data you need right at your fingertips. Plus, when you invoice with Hopscotch, you can use Flow to improve your short-term cash flow management. Take control of your cash flow and get paid faster with Flow.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.