What You’ll Learn:

- The risks of late payments and how gaps in cash flow impact small businesses

- Best practices for preventing late payments and protecting client relationships

- A step-by-step guide for communicating at every point in the payment process

Small businesses need strong relationships to survive. This is even more true for service-based businesses like agencies, where the work often happens in direct collaboration or partnership with clients. Building a great reputation, landing big projects, and expanding your book of business hinges on how smoothly you nurture and manage those key relationships from onboarding to invoicing.

But let’s face it—conversations about money can be awkward! What’s the best way to bring up an overdue invoice without sounding accusatory or desperate? What if you need to get paid early? The stakes can feel incredibly high in these situations. One wrong move and you risk souring a sweet client relationship, closing the door to future work, and spoiling important revenue-generating opportunities for your business.

Here’s an easy, step-by-step strategy that walks through different late payment scenarios and offers guidelines for how to collect unpaid invoices without damaging client relationships.

When not paying an invoice becomes a problem

How do you know when an overdue invoice is officially a problem that requires your attention? Particularly for new agencies without as much experience managing late payments, it might feel tempting to kick the can down the road. You might even indulge in some wishful thinking. Why not give them another week to reply to that reminder email? Maybe it will all work itself out! But delaying difficult conversations can lead small businesses into dangerous territory.

Ultimately, the threshold for escalation will likely depend on the payment terms of the invoice, your history with the client, and on the overall financial health of your business.

Payment terms

Let’s say your client is 10 days overdue on a net-30 invoice, but they paid a 30% deposit at the start of the project. The remainder of the invoice is only a couple weeks late, and you have some cash on-hand to vouch for how likely they are to render full payment.

History with the client

It just so happens you’ve worked with this client before and they’ve never failed to pay in full for your services. You’d also like to work with them again, and avoid any tension that might prevent them from giving you repeat business.

Those green flags combined with your goals for the relationship probably warrant extending a grace period for payment in this particular instance. But the other factor you’ll need to consider in late payment scenarios is cash flow.

Overall financial health of your business

Poor cash flow is the #1 killer of small businesses! If a payment delay from your client is creating issues in other parts of your business (preventing you from making payroll, limiting your ability to pay bills to vendors, or even causing you to dip into your emergency savings to make payments) that’s a red flag. But before you pull out all the stops chasing that payment down, consider some of the other options available to you.

An urgent need for cash flow can create real problems for small businesses. Traditional invoice factoring requires tons of paperwork, long turnaround times, and can rock the boat with clients. Hopscotch Flow offers instant payments with none of the downsides for small businesses. Just create and send an invoice to your client, then use Flow to get paid on-demand. You’ll get 90% of your invoice upfront, and be able to instantly infuse that liquid capital back into your business.

Create a free account and see if your invoice qualifies in just 2 clicks.

Ideal unpaid invoice followup timeline

If you want to avoid payment delays from clients altogether, make sure your invoicing terms are clear at the beginning of any new client relationship. Then build in consistent reminders and clear instructions for payment throughout the customer experience.

1. Client onboarding. Clearly share your payment terms (Does your agency require a deposit before work begins? What kind of payment methods does your business accept?) as well as any penalties for late fees. This can serve as a strong incentive for making payments on-time.

2. Sending the invoice. When you initially send an invoice, make sure the net payment terms are clearly indicated and instructions for rendering payment are easy to understand. Include another reminder about any penalties or late fees for overdue payments. Most importantly, make it easy for clients to render payment. The less hassle involved, the more likely they are to go ahead and check that task off their to-do list!

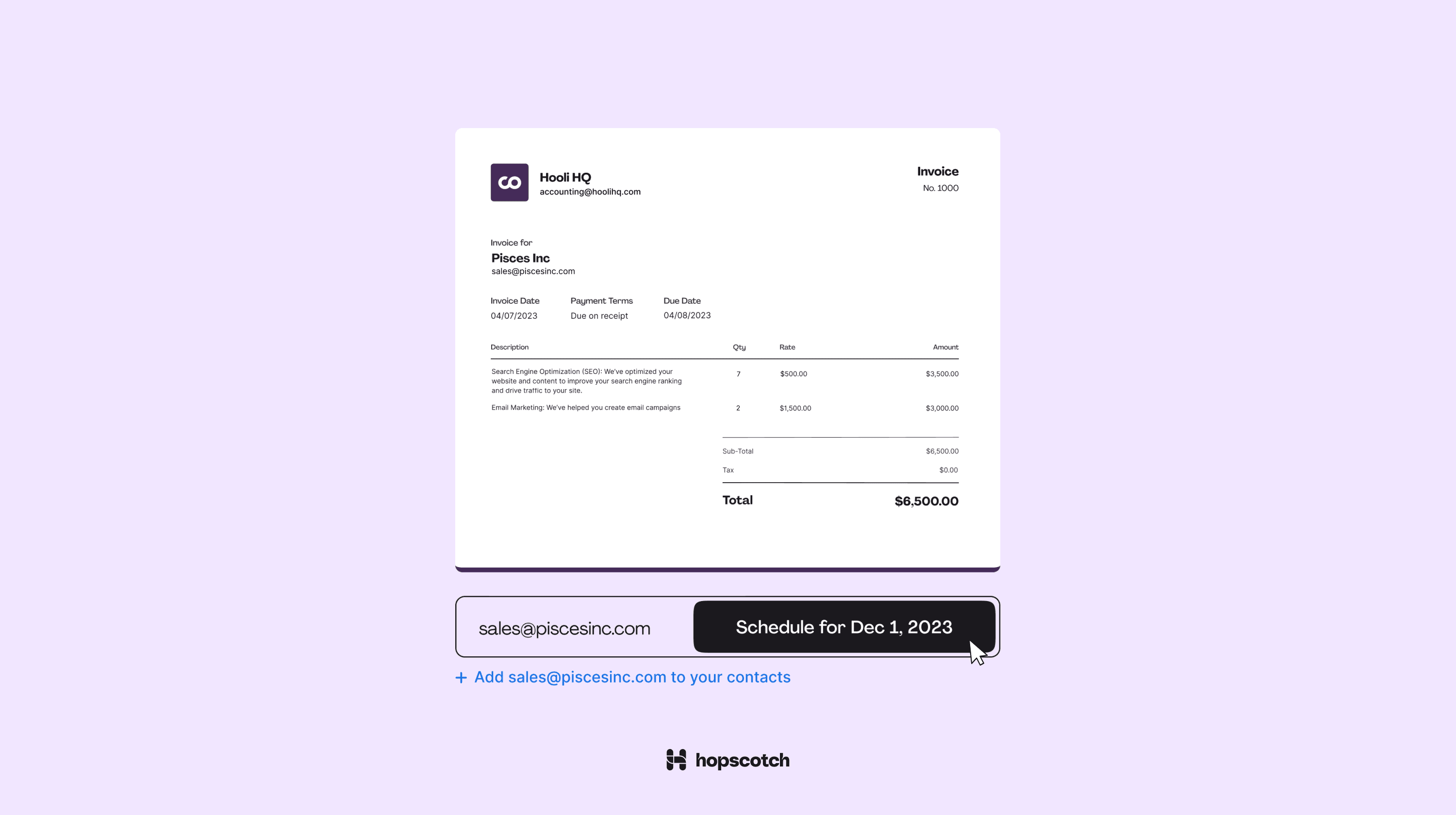

Pro Tip: When you lock in a new client project and are ready to kick off work, schedule your invoice to send in advance with Hopscotch. That way you can guarantee an on-time delivery of your payment notification even if you get busy later in the month and it slips your mind.

Make your business invincible, one invoice at a time

3. Before the invoice is due. Once your client has received the invoice, the ball is in their court. Notifying them about an upcoming due date for their outstanding invoice can be a helpful way to make sure they remember to pay on time. You might also want to include any incentives for early payment, like a 5% discount on the overall invoice amount, or a credit toward future services with your business. And if you need to get paid early (before a client pays you) consider using Hopscotch Flow to accelerate funds from unpaid invoices instantly.

4. The day the invoice is due. It’s always a good idea to send an invoice reminder the day payment is due. This provides a clear opportunity for on-time payment and alerts your clients about the risks for paying late.

5. When the invoice is overdue. What if someone still does not pay an invoice? Once the due date on your invoice has come and gone, it’s usually best to trigger a series of reminder emails and/or texts to urge late-paying clients to render payment.

New agencies that fail to set up a comprehensive payment process are more likely to encounter gaps in cash flow and waste time dealing with confused or unhappy clients.

Methods of unpaid invoice follow-up

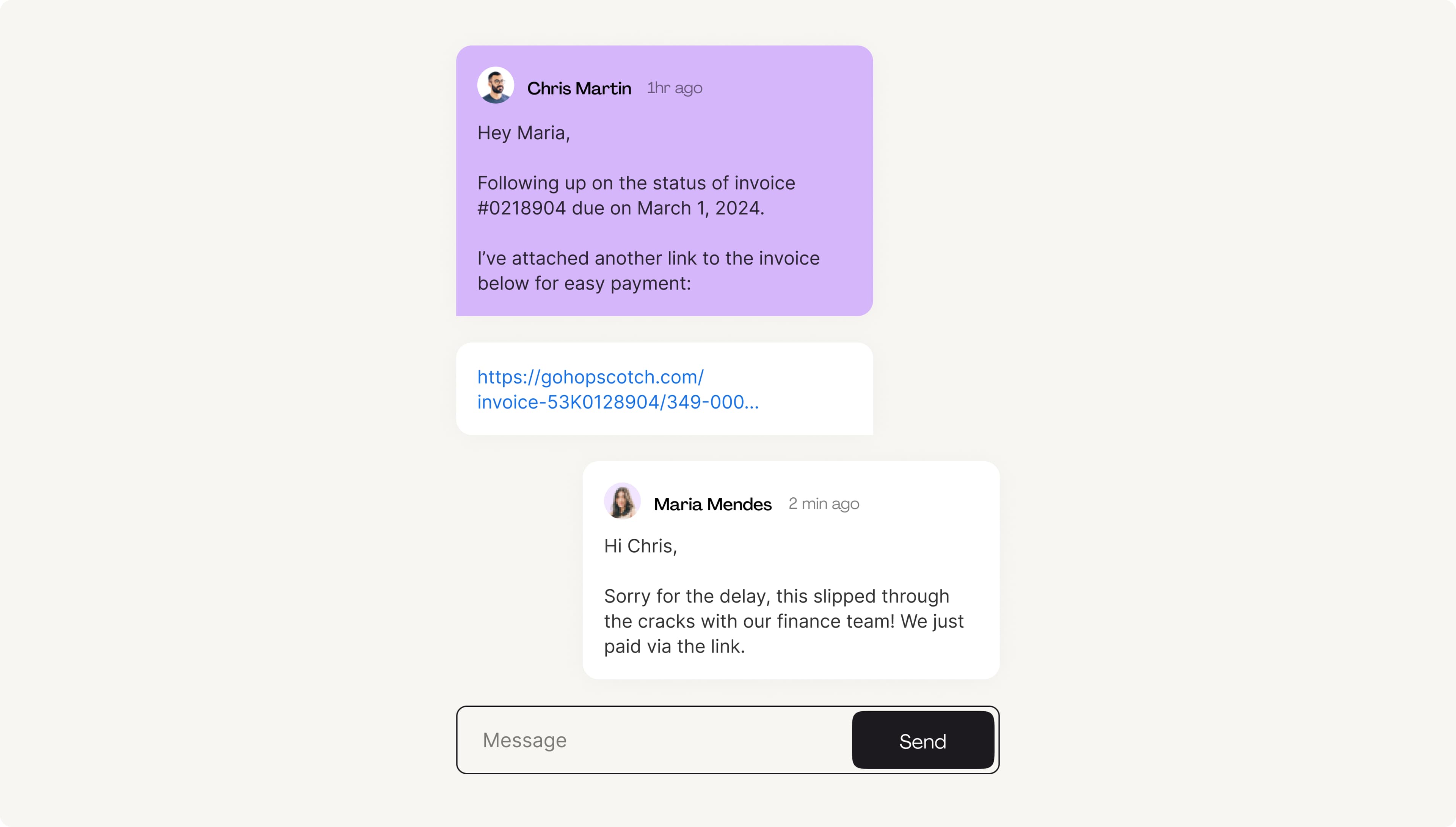

There are several channels you can leverage to communicate with your client about past due invoices. Small businesses may prefer to automate the first part of the outreach process with email or SMS reminders. (Some invoicing platforms like Hopscotch offer built-in reminder messages that trigger at predetermined intervals, so you never have to worry about a late payment slipping through the cracks.)

If you’re looking to minimize friction, automated emails or SMS can be an easy initial touchpoint. They give your customer a gentle nudge without feeling overly personalized. They also reduce manual legwork for busy agency owners. Just set up your preferred reminder cadence in advance and let the system run on its own!

When creating these types of automated messages, keep the tone professional and friendly. Focus on relaying just the facts (We’re sending a reminder to let you know that invoice #2764 has not been paid. If you already paid this invoice or have any questions, let us know!) and make sure to provide a user-friendly option to send payment.

When to use your last resorts

How long can you give someone to pay an invoice? How many “gentle reminder” messages about an overdue payment should you send into the void before taking things to the next level? Again, the answer ultimately depends on the financial health of your business and the likelihood that your client will eventually pay up.

If you have a client that’s dealing with cash flow issues of their own but has been openly communicating about those challenges, it might be worthwhile to set them up on a payment plan. By agreeing to get your funds in installments and offering some flexibility, you could preserve the relationship and secure future work for your business. If you have a client that’s not responsive for weeks at a time and they owe you a significant sum of money, you might want to consider getting lawyers involved and transfer the payment process to collections. If that’s too much of a headache, a better option might be to just cut your losses and move on.

___

Ready to simplify your invoicing process and experience the power of instant payments? Start your free trial of Hopscotch Pro today and get discounted rates on Flow and other premium features.

FAQs

- How long can you give someone to pay an invoice? Invoices should include net-terms that specifically outline the amount of time until payment is due. Net-30, net-60, and net-90 days are the most common time frames for rendering payment. If a business needs to get paid before an invoice is due, invoice factoring services like Hopscotch Flow can be useful in covering cash flow gaps.

- What happens if an invoice is not paid within 30 days? Net-30 terms are common on many B2B invoices. If payment is not rendered within the expected time frame stipulated on the invoice, businesses can and should follow up with their clients. If there is no indication that payment will be sent in a reasonable amount of time, businesses can choose to take legal action.

- Is not paying an invoice theft? Not paying an invoice after services have been rendered is not lawful.

- Can a client refuse to pay an invoice? Clients may refuse to pay an invoice if they claim services were not rendered as promised by the business in question.

- How quickly do you need to send an invoice for your services? Many businesses send invoices after services have been delivered, but some chooose to collect a portion of payment upfront to mitigate risk of nonpayment and protect against gaps in cash flow.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.