What You’ll Learn

- How to politely follow up on an unpaid invoice without harming relationships

- Step-by-step methods to ensure overdue invoices are resolved efficiently

- Tips to streamline your process with Hopscotch

Unpaid invoices are a challenge for any business. Whether you’re a small business owner or part of a larger organization, addressing overdue payments professionally and effectively is essential.

In this guide, we’ll explore how to follow up on overdue invoices while maintaining strong client relationships.

Why following up quickly on overdue invoices is crucial

Impact on cash flow

Overdue invoices can strain your business’s cash flow, disrupting essential operations like payroll, purchasing supplies, or funding growth opportunities.

When cash flow is inconsistent, it creates uncertainty that can affect your ability to plan for growth or handle unexpected expenses. Addressing unpaid invoices promptly minimizes financial stress, enabling you to keep your operations running smoothly and focus on long-term business goals.

Preserving relationships

Polite and prompt communication about overdue invoices demonstrates your professionalism and commitment to maintaining positive relationships. Clients often appreciate gentle reminders, showing you value their business while respecting their circumstances.

By addressing the issue tactfully, you’re more likely to maintain trust, avoid misunderstandings, and ensure continued collaboration.

Setting a standard

Establishing a clear follow-up process ensures clients understand that timely payments are non-negotiable. A structured approach not only resolves current payment issues but also sets a precedent for how future transactions will be handled.

Consistent follow-ups signal to clients that your business values efficiency and reliability, which can deter future delays and foster a culture of accountability.

Step-by-step guide to following up on overdue invoices

Step 1: Verify the situation

Before reaching out, double-check your records to confirm payment terms and the due date. Ensure there are no errors in the invoice or misunderstandings about payment expectations.

It’s also a good idea to confirm that the client has received the invoice and any supporting documents. With Hopscotch, you can use invoice read receipts to know when a client views a payment notification.

Step 2: Initiate a friendly reminder

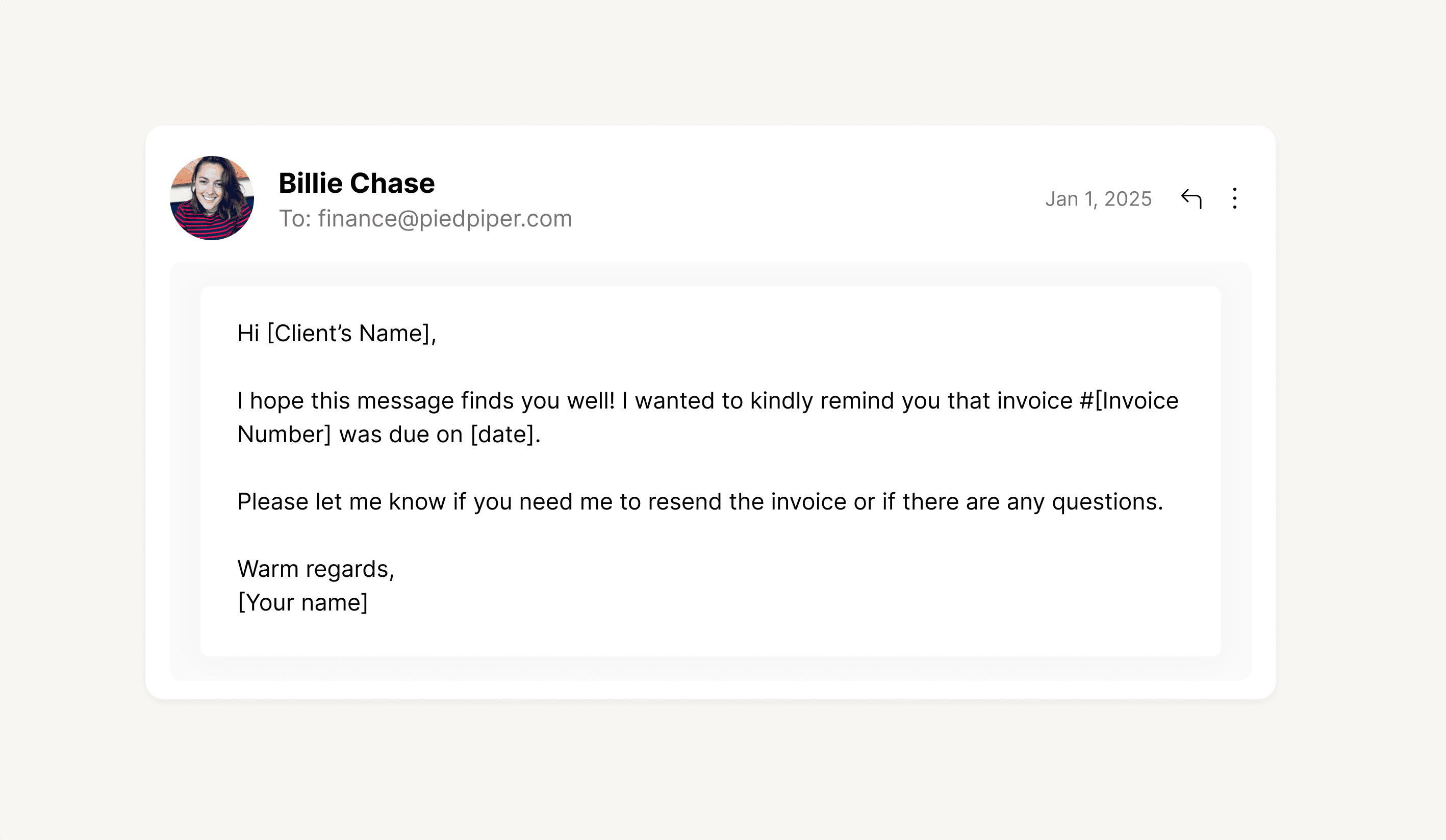

Start with a polite reminder 1–3 days after the payment due date. If you’re wondering how to politely follow up on an unpaid invoice, use non-confrontational language, such as:

“Hi [Client’s Name], I hope this message finds you well. I wanted to kindly remind you that invoice #[Invoice Number] was due on [date]. Please let me know if you need me to resend the invoice or if there are any questions.”

Step 3: Offer multiple payment options

Make it as convenient as possible for your clients to pay. Options like credit cards, bank transfers, or platforms like Hoscotch with fee-free payment options can reduce friction and speed up the payment process. Your customers don’t even need an account to pay you via Hopscotch.

Step 4: Leverage technology

Automate your invoicing process with tools that send reminders before and after due dates. If you’re curious about how often you should follow up on overdue invoices, these tools can help maintain consistent communication without overwhelming your clients. Hopscotch’s invoicing features simplify tracking overdue payments, saving you time and effort.

Step 5: Schedule personal outreach

For payments still outstanding after initial reminders, take a more direct approach. If you’re thinking about how to remind someone of an overdue invoice, call the client to discuss it. Emphasize the importance of resolving it promptly while remaining professional and

Creative follow-up methods

Following up on overdue invoices doesn’t have to be monotonous or strained. Sometimes a creative approach can make all the difference.

If you’re exploring how to politely follow up on an unpaid invoice or wondering how often you should follow up on overdue invoices, these methods can help you stand out while maintaining professionalism.

Add a personal touch

For key clients, consider sending a handwritten note or a small token of appreciation with a payment reminder. This thoughtful gesture reinforces the value of your relationship while gently addressing the overdue payment.

Involve senior team members

If initial efforts fail, having a higher-up reach out can underscore the seriousness of the situation. This method works particularly well for larger accounts or longstanding clients.

Set up a payment plan

If a client is experiencing financial difficulties, offering a structured plan demonstrates flexibility and a willingness to collaborate. This can salvage the relationship and secure payment over time.

Use subtle escalation

When all else fails, consider implementing late fees or interest charges, provided these terms were outlined in your contract. This step reinforces the importance of timely payments while compensating your business for the delay.

What not to do when following up on overdue invoices

When figuring out how to remind someone of an overdue invoice, knowing what not to do is just as important as mastering effective follow-up techniques. Avoiding these missteps can protect your client relationships and improve your chances of getting paid promptly.

Avoid aggression

Using harsh language or being overly persistent can damage your reputation and client relationships. Aim to communicate assertively but respectfully.

Don’t skip documentation

Keep detailed records of all follow-up communications, including emails, calls, and any agreements made. This ensures clarity and provides a paper trail if legal action becomes necessary.

Don’t delay communication

The longer you wait to address an overdue invoice, the harder it becomes to collect. Prompt follow-ups set a professional tone and reduce the risk of non-payment.

Streamline your invoicing with Hopscotch

Managing overdue invoices and interest fees doesn’t have to be a headache.

With Hopscotch, you can streamline the entire process—automating reminders, offering flexible fee-free payment options, and saving valuable time. Say goodbye to the stress of chasing payments and hello to smoother cash flow and a stronger focus on growing your business.

Need a faster cash flow solution? Try Flow, Hopscotch’s line of credit alternative that lets you instantly withdraw up to 80% of your unpaid receivables.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.