What You’ll Learn:

- The data you need to collect for a cash flow forecast

- The actions you need to take with that data to gain financial insights

A cash flow forecast allows you to look ahead at your business finances and potential spending outcomes. If you understand how to forecast cash flow, you can plan for regular spending patterns—while staying flexible enough with your finances to respond to unexpected outcomes or changes.

Follow these best practices for a cash flow forecast to start getting insight into your company’s financial future.

1. Choose a goal for your forecast

Before you gather data for your forecast, understand what you want to learn from it. A clear goal at this stage will inform the rest of the process, allowing you to input the right data points and adjust relevant variables.

Common cash flow forecasting goals can include answering questions like:

- If we don’t bring on any new clients, how many months of operating expenses do we have saved?

- Will we have enough cash for payroll if we spend more on other outflows this month?

- How can we allocate our existing cash during our upcoming slow season?

- Can we afford an increased rent or lease payment with current cash inflows?

Don’t be intimidated by this step. When you first start looking at cash flow, your forecast goal can be as simple as visualizing your projected monthly income and expenses. As you become more comfortable with the process, you can ask more specific questions and add more complicated data.

2. Set a time frame to evaluate

Cash flow forecasting is a time-bound process. Cash flow forecasting typically relies on current and historical data (depending on the forecasting method you choose) though predictive analytics and leading indicators can also enhance accuracy.

For example, if it’s currently December 1 and you need to have a certain amount of cash on hand at the end of Q1 next year, a short-term forecast with a time frame of 3 to 4 months will answer your questions.

In other situations, a single month or more than one business quarter might be the time frame you need to evaluate. Whatever the case, set your framework before you input your data.

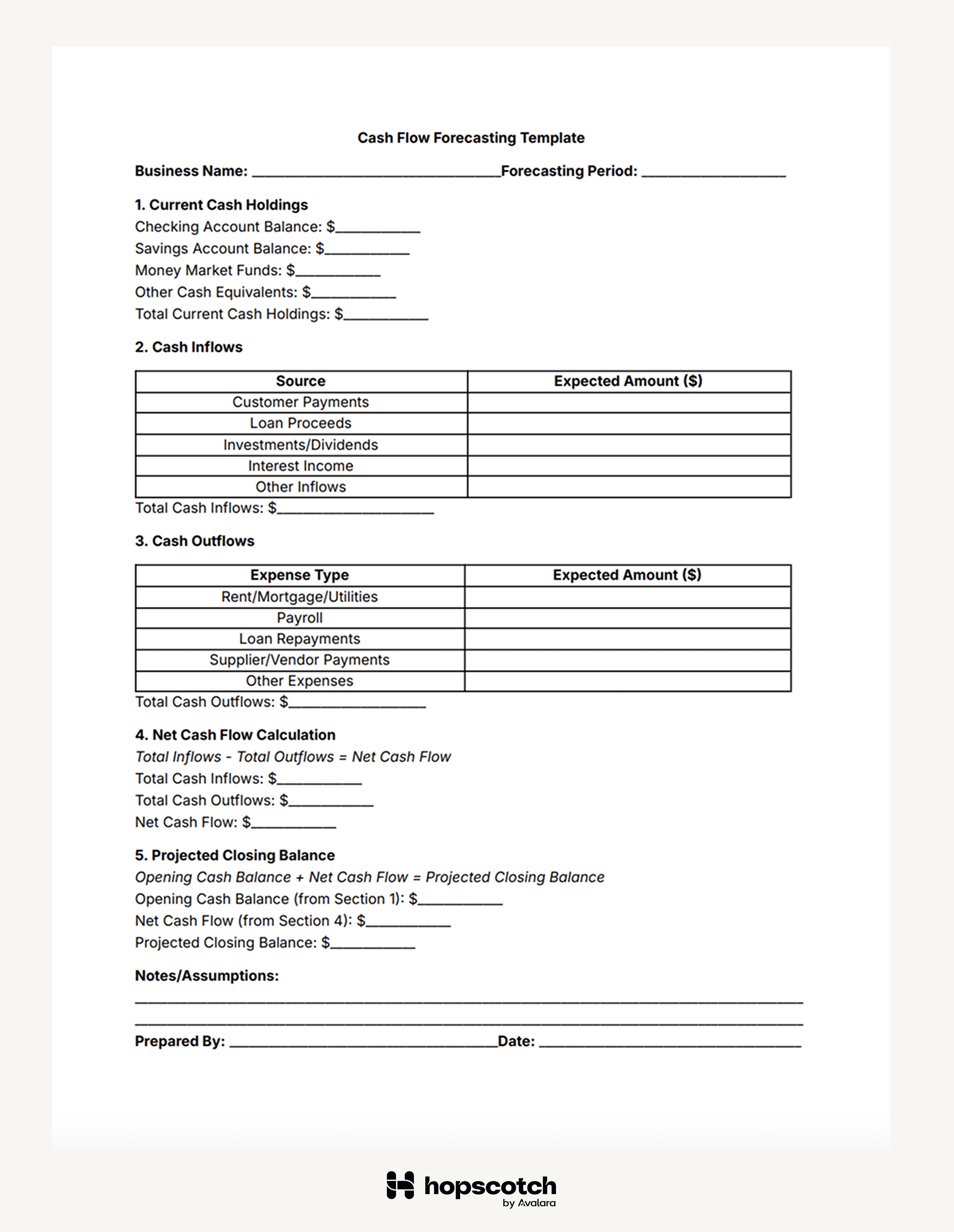

3. Get a template or calculator

If you’ve never done a forecast like this before, getting started can be intimidating. But even pros use templates and calculators to run their forecasts! Our ultra-simple cash flow forecasting template has all the information you need to plug in your data and start getting answers to your questions.

A template or calculator can provide you a simple formula for calculating cash flow. You can always tweak a template to suit your needs as you learn more and adjust your forecasting process.

4. Input your financial data

Forecasts rely on accurate financial data to give you actionable insights. Start by noting your current cash balance. As you gather other numbers, think about all your cash flow points—both incoming and outgoing.

For income streams (inflow), consider:

- Pending invoices

- Projected sales

- Other inflows, like loans or investments

For expense categories (outflow), look at:

- Overhead like rent and utilities

- Payroll

- Vendor payments

Subtracting outflows from inflows gives you the net cash flow for the period. You can use this number along with your starting balance to project your closing cash balance.

5. Play around with variables to answer different questions

With your basic data input into a forecast, changing different variables allows you to compare different potential scenarios for your future cash balance and gather more unique insights.

For example, you might consider the impact of delayed client payments. If a client doesn’t pay an invoice on time, your inflow changes. When looking at the numbers for on-time payments versus late payments, you can visualize the difference and adjust plans for your cash accordingly.

Cash flow projections can look at a variety of factors, like upcoming sales, business expenses, or fluctuations in accounts receivable. Looking at multiple potential outcomes makes it easier to respond to the situations when they actually occur.

6. Analyze your results and make informed decisions

With future insights in hand, you can make informed decisions. Plan business strategies with the results of your forecast in mind. If your cash flow falls short, you have time to arrange a contingency. You may want to cut costs to make payroll or take out a loan to meet other goals.

Incorporating alternative options for invoicing may provide you additional flexibility. Invoice financing, factoring, or tools like Hopscotch Flow give you direct access to your accounts receivable cash.

7. Update your forecast regularly

Cash flow forecasts aren’t a magic crystal ball. You aren’t seeing the future—just predicting likely outcomes. While a forecast is a helpful business planning tool, some factors are always outside your control. Market trends, client behavior, and greater economic forces will fluctuate.

To make your forecast as accurate as possible, keep all your information up to date. As you get new data, input it into your forecast. If you have new questions or priorities, or notice shifting trends, adjust variables to look at new outcomes. Staying attentive to the details and remaining flexible will get you the most out of cash flow forecasting.

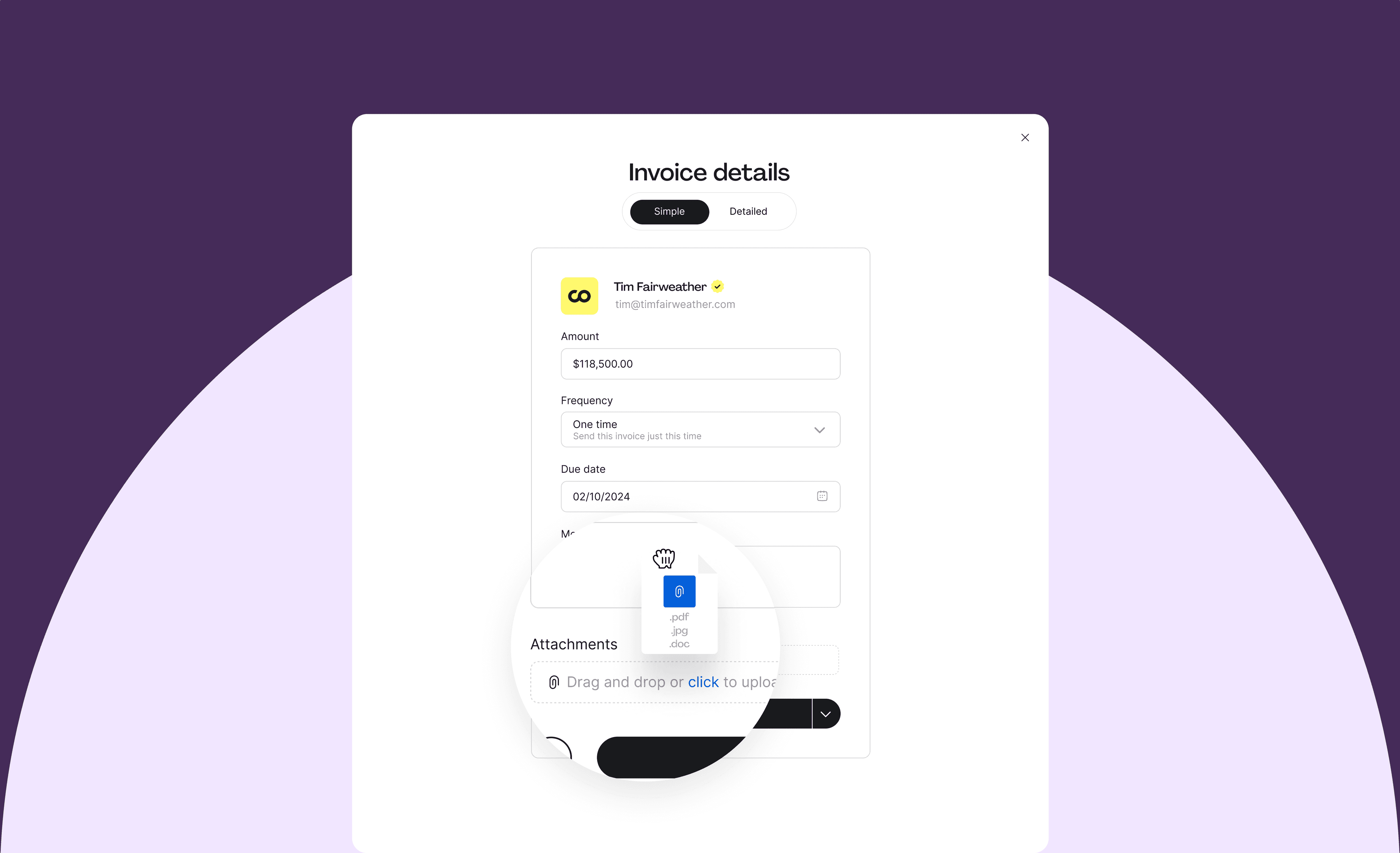

Use Hopscotch Flow to manage your invoices

Hopscotch keeps all your invoices in one place for easy data management. While there are many ways to manage invoices and cash flow, tools like Hopscotch Flow offer solutions that may simplify and improve the process.

Invoice payments go straight to your account without having to wait for long net payment terms or late client payments. Start invoicing with Hopscotch and try Flow alongside forecasting for better cash flow management.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.