What You’ll Learn

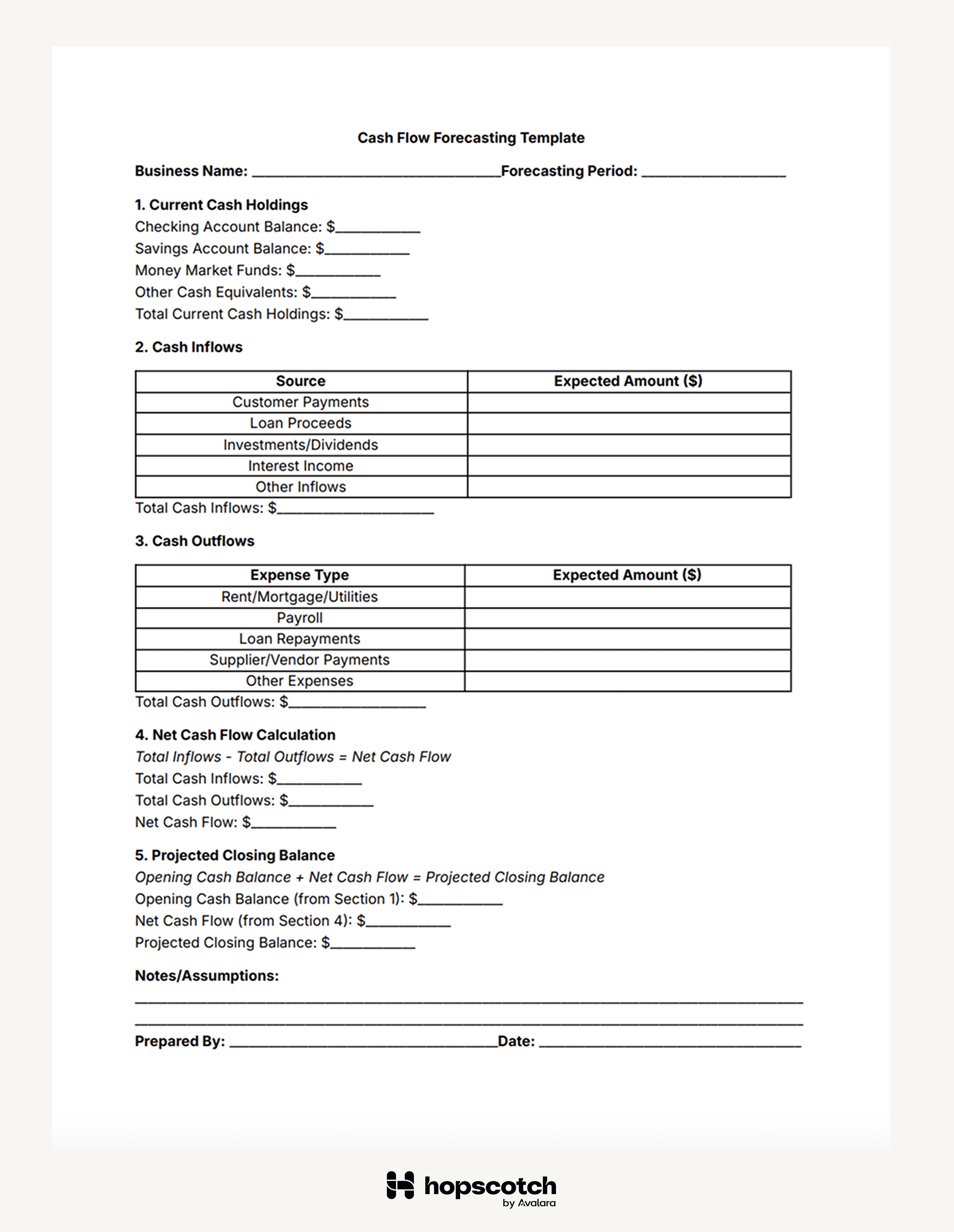

- What a cash flow forecasting template looks like

- The data points you need to plug numbers into a forecasting template

- Ways you can customize a forecasting template for your business

A cash flow forecasting template is an easy way to start visualizing your money. Learn what data points you need to gather for an accurate forecast, and try plugging them into our super-simple template.

What to include in a cash flow forecast

A cash flow forecast requires several financial data points. To put together your forecast, you should understand these data points for the forecasting period:

- Current cash holdings. Cash holdings are any assets you can readily spend (cash and cash equivalents) such as funds in checking/savings accounts and highly liquid investments like money market funds. Assets that take longer to liquidate, such as real estate or stocks, are not typically included in cash flow forecasts as immediate cash holdings.

- Cash inflows. Cash inflows are any payments coming into your business. Customer payments from invoices and other direct income sources are key cash inflows. While accounts receivable represent expected income, they should only be counted in cash flow projections once payment is received. Investments, interest, and loans can also be sources of cash inflows.

- Cash outflows. Cash outflows are any payments going out of your business. These are typically more varied than inflows. Your business might regularly pay rent, payroll, debts owed, suppliers, or vendors.

- Net cash flow. Net cash flow accounts for both inflows and outflows of cash. At the end of a set period, the difference between inflows and outflows is the net cash flow.

Net Cash Flow = Total Cash Inflows – Total Cash Outflows

- Projected closing balance. When looking at the forecasted schedule (such as a month, quarter, or year of payments), the projected closing balance is the estimated cash on hand at the end of the forecasting period, calculated as the opening cash balance plus net cash flow. This number is an estimate of your cash holdings if all inflows and outflows go as expected.

Cash numbers fluctuate frequently as a business spends money or collects payments. When creating a forecast, set a specific period and collect data as accurately as possible to input into your forecasting template. The more accurate your inputs are, the better the cash flow forecast can help you understand your future financial position.

How to create a cash flow forecast

How to customize this template

A cash flow forecast is most helpful when you have specific goals in mind. What do you want your data to tell you? With the essential numbers ready, you can add more data or observe specific variables to customize your insights.

These customizations don’t have to be complicated to be informative. With a few adjustments to our cash flow forecasting template or your forecasting methods, you can:

- Predict cyclical ups and downs. For short-term trends, analyze cash flow data from the past 3–6 months. For businesses with seasonal fluctuations, reviewing at least 12 months of data will provide more accurate trend insights. These patterns—particularly if from consistent sources like payroll—can help you understand and prepare for future occurrences.

- Project possible increases in accounts receivable. Use your sales goals for the next quarter to map out future accounts receivable data. What will those numbers look like if you meet your goals? How will they change if you fall short? Projections allow you to compare a variety of potential outcomes.

- Make client-specific payment estimates. Regular clients have their own patterns you can learn from. Identify clients who are slow to pay or who present other relationship challenges. Create conservative forecasts when using client data to align forecasts closely with client behavior.

- Evaluate how potential expenses affect cash flow. Before you make a change to your expenses, use a forecast to understand how it will affect your overall cash flow. Use this projection to look at what happens if you hire a new employee or sign a new office lease.

Cash flow forecasts are a great way to ask your data questions. As you change data inputs, you gain new insight into potential future outcomes. This allows you to thoughtfully prepare your finances so that your money best serves you.

Streamline your cash flow processes with Hopscotch

When you invoice with Hopscotch, you can use our Flow tool to improve cash flow management.

Hopscotch Flow allows businesses to optimize cash flow by ensuring faster payments. By reducing unpaid invoice wait times, you can maintain more accurate cash flow projections and avoid liquidity issues.

With Hopscotch Flow, your cash arrives in your accounts exactly when you want it to—no more waiting for unpaid invoices to come due. You get more financial flexibility and more accurate cash flow forecast projections. Get started with Hopscotch today.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.