What You’ll Learn:

- What lending discrimination is and how it affects Black-owned businesses

- How recent data trends in small business loan products impact black-owned businesses

- Which alternative lending products can help cover critical cash flow gaps

Small business owners and entrepreneurs have always relied on lending solutions to launch, grow, and manage their operations. Financial institutions like banks can provide affordable access to working capital, a critical factor when it comes to purchasing equipment, hiring employees, and covering other expenses.

But a history of lending discrimination in banking has restricted opportunities for Black-owned businesses. Lending discrimination happens when lenders make decisions based on factors other than creditworthiness, such as race or ethnic background.

Although some progress has been made (there are laws in place to prevent and punish discriminatory practices), undue financial obstacles still exist today for Black-owned businesses. Let’s take a look at recent financial data and growth trends related to Black-owned businesses, and explore how some lending products are adapting to circumvent racial bias.

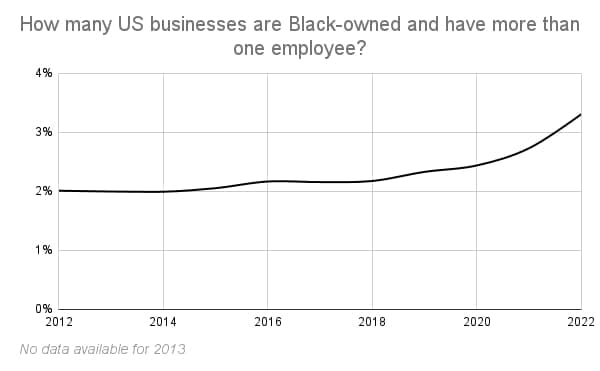

The number of Black-owned firms with more than one employee nearly doubled between 2012 and 2022

US Census Bureau data tracks dozens of traits about businesses and their owners. One of the key distinguishing characteristics is the number of people a business employs—specifically if a business has only one employee (when a self-employed owner works alone) or more than one employee (when a business owner pays at least one other person to work for or with them).

When looking at businesses in that second category—businesses with more than one employee—Black-owned businesses are on a growth trajectory. In 2012, just over 109,000 Black-owned firms existed. By the end of 2022 (the last year with data on record), that number was over 194,000.

Black-owned firms comprised only 3.3% of US businesses with more than one employee in 2022

Despite some recent growth, Black-owned businesses still make up a disproportionately small percentage of overall businesses in the US. According to Census data, 12% of the US population is Black. But only 3.3% of US companies with more than one employee have a Black founder/owner. (In 2012, that number was 2%.)

This slow growth could be at least partially related to limited funding opportunities. To this day, banks consistently deny credit to Black-owned firms more frequently, discourage them from borrowing more often, and offer them smaller loan amounts than their white counterparts—even when these Black founders and entrepreneurs have stronger financial profiles. In one study, Black business owners who concealed their race from lenders obtained 52 percent more in funding than Black business owners who reported their race to lenders.

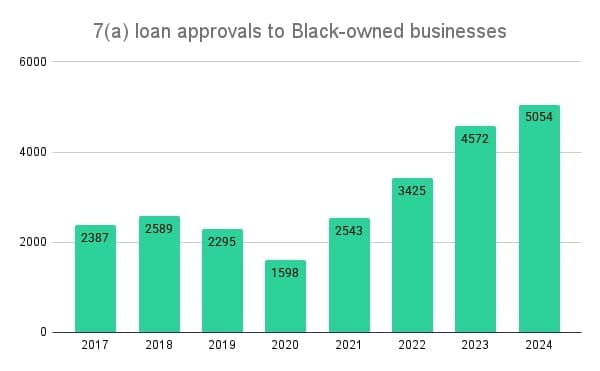

SBA loan approvals to Black-owned businesses doubled between 2017 and 2024

Unfortunately, the Census Bureau doesn’t gather annual data about all loans given to all US businesses. But there is one available proxy: Small Business Administration loans. Traditional lenders like banks administer the funds for these loans, but they are secured through the SBA and meant for businesses who might not qualify for traditional lending sources.

SBA loans come in two main varieties: 7(a) loans and 504 loans. Both these loan products have long repayment terms (typically 10-25 years) which means lower monthly payments for business owners, and lower down payments which makes upfront costs more affordable.

7(a) loans are the most common loan originated through the SBA. Capped at a maximum of $5 million, these loans can be used as working capital, to purchase equipment, refinance business debt, acquire real estate, and more.

Between 2017 and 2024, approval rates to Black-owned businesses for both 7(a) and 504 loans essentially doubled. Between 2017 and 2020, Black-owned businesses were approved for an average of 2,200 7(a) loans each year; between 2021 and 2024, that average rose to nearly 3,900 per year.

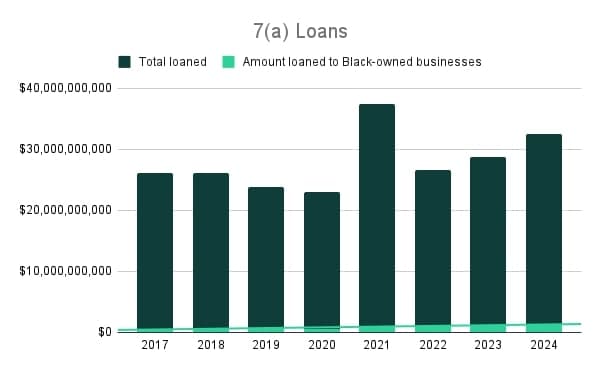

A larger pool of 7(a) loan funds does not always correlate with a proportional increase in loans to Black business owners.

As the number of 7(a) total loans rose across the 8 reported years, the average loan amount to individual Black business owners stayed the same, at about $300K on average. The pandemic-affected years of 2020 and 2021 yielded the highest average loan amounts to Black business owners, nearing $400K in 2021.

But a rising tide doesn’t necessarily float all boats. When comparing the total amount of loan funds awarded to the percentage given to Black-owned businesses, it doesn’t correlate to a marked increase in funding for this particular group.

If the goal is to encourage Black business ownership to be more in line with their overall population, there’s still a long way to go to reach proportional representation. Remember, only 3.3% of US businesses with more than one employee are Black-owned businesses.

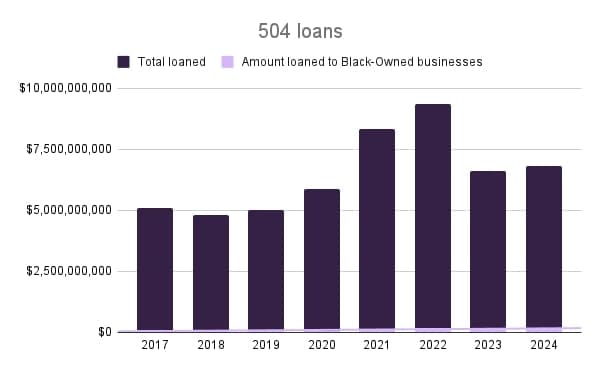

Between 2017 and 2022, Black-owned businesses received less than 2% of 504 loans funds

504 loans have a higher loan amount limit, but a lower approval rating. While thousands of Black borrowers get approved for 7(a) loans each year, only a few hundred (sometimes closer to 100) get 504 loans.

The average 7(a) loan amount is consistently around $300K for Black business owners, but the average 504 loan size went up and down over the 8-year period—the low was $509K in 2021, followed two years later by a high of nearly $890K. Black-owned businesses received less than 2% of all 504 funds awarded in 6 of the 8 years.

Although 504 loans (and SBA-backed loans generally) are only one source of funding, these data can be seen as evidence of a larger problematic trend in lending.

Supplemental cash flow solutions and products

Black-owned businesses face clear and ongoing challenges when it comes to securing funds from traditional banks and small business loans. These products offer significant infusions of working capital that can help businesses finance years of long-term growth.

But many of these businesses also face immediate cash flow challenges. That’s where solutions like Hopscotch Flow can offer support, bridging short-term financial gaps in day-to-day operations.

Get an influx of cash right when you need it, and transform overdue invoices into payroll, inventory, or new equipment. Flow pays out 90% of your outstanding invoices in seconds so you can avoid disruptions to your business.

To use Flow, sign up with Hopscotch today and start invoicing to get pre-approved.

Helpful Resources:

- Annual Survey of Business Owners for 2012 and 2014-2016

- Annual Business Survey for 2017-2022

- SBA 7(a) and 504 Summary Reports for 2017-2024

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.