What You’ll Learn:

- Why healthy cash flow matters more than profitability for business survival

- Common cash flow challenges your clients should be aware of

- What SMBs can do to prepare for liquidity issues

Accountants understand effective cash flow management extends beyond the basics of financial data collection and analysis. When advising small and medium businesses, it’s critical to properly identify and address your clients’ liquidity challenges. Balancing their perceived profitability and actual working capital is key to their survival.

This article examines what every accountant should know about cash flow and how you can help business owners survive liquidity challenges—or better yet, help your clients plan ahead to avoid them.

Why cash flow matters more than profitability

Sometimes, everything appears to be running according to plan with a company’s finances—impressive revenue, healthy profit margins—and yet there’s a major issue looming: cash flow.

Problems with cash flow create a disconnect between profitability and liquidity. This represents one of the most dangerous blind spots for organizations.

In fact, 61% of small businesses face cash flow issues, with 32% unable to pay vendors and lenders or cover payroll as a result.

Many businesses, for example, operate with net-60 or even net-90 payment terms. Those are profits that will eventually come flowing in. Meanwhile, payroll, subscriptions, rent, utilities, and out-of-pocket vendor fees have to be covered months before those invoices are paid.

While profitability indicates business health in theory, proper cash flow management determines operational viability. Your clients may show impressive profit margins but still struggle to deliver products or services when immediate capital is unavailable for fulfilling operational needs.

As their trusted advisor, you can help bridge this critical gap between accounting success and practical business reality.

Common cash flow challenges businesses face

Small and medium-sized businesses (SMBs) often face heavy financial strain from not-yet-paid invoices. Advise your clients to anticipate and prepare to face these common cash flow challenges.

Stymied business operations

Late payments and long payment cycles directly impact daily operations—22% of small business owners struggle to cover operating expenses, and 45% do without their own paychecks to make ends meet.

These struggles create missed opportunities, as businesses:

- Can’t afford to save money by paying their own vendors early to receive discounts

- Have to delay new hires or strategic equipment purchases

- Turn to financing that can lead to even slimmer profit margins in the future

- Get behind on payment cycles and suffer a drop in credit score

Seasonal fluctuations and unexpected expenses

Some industries rely on busy seasons to bring in larger profits, which have to sustain operations for the rest of the year. During slower seasons, businesses can find themselves straining to meet their financial obligations—and unprepared to deal with any extra expenses. If there’s an emergency equipment failure, plumbing or roof repair, or costly tax issue, a business can easily get blindsided by the unexpected costs.

The waiting game for traditional financing

In desperate times, your clients may turn to banks for loan options. Unfortunately, bank loans take time to process, extending up to 30–90 days for Small Business Administration (SBA) loans. Furthermore, banks commonly reject small business loan applications. This leaves businesses stuck between the need for instant capital and the inability to qualify for financing—or get it quickly enough.

How accountants can help clients stay cash flow positive

Accountants play a critical role in helping businesses maintain a healthy cash flow through proactive strategies that prepare them for liquidity issues before those issues hinder business. The following are key ways you can help your clients stay cash flow positive.

Implement regular cash flow reviews

You can assist your clients in developing a system to conduct monthly or biweekly cash flow reviews. Teaching SMBs how to prepare cash flows in accounting and continuously monitor inflows and outflows helps them identify potential shortfalls before they become an emergency.

Accountants can help clients pay close attention to:

- Consecutive negative cash flows

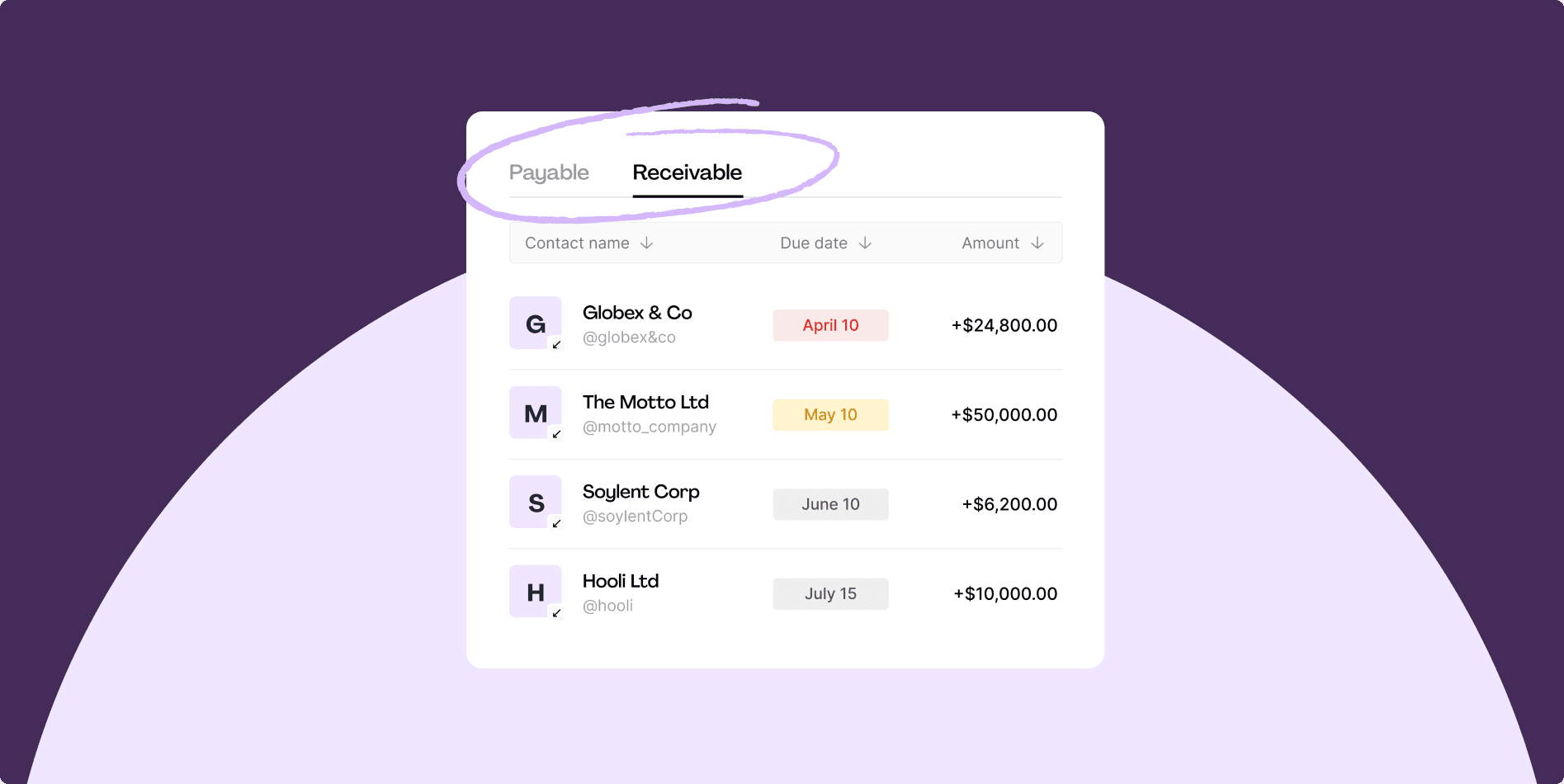

- A trending gap between accounts receivable and accounts payable

- Seasonal patterns in historical cash crunches

- Tax deadlines and their impact on available working capital

Advise on strategic cash reserves

Your guidance on establishing appropriate cash reserves can help clients achieve financial security. While the standard recommendation suggests maintaining 3–6 months of operating expenses, effective reserve planning requires customization based on industry volatility, seasonality, and typical payment cycles.

A comprehensive reserve strategy typically includes three distinct components:

- Operational reserves to cover fixed and variable expenses during revenue fluctuations

- Tax reserves allocated specifically for quarterly estimated payments and annual obligations

- Funds set aside for strategic opportunities, enabling quick response to unexpected growth possibilities or market advantages

Educate clients about their financing options

Financing from banks often fails small businesses right when they need it most. You can help your clients be aware of alternative cash flow solutions.

For example, Hopscotch Flow functions as a revolving line of credit based on a business’s pooled accounts receivable. This model allows businesses to access up to 80% of their outstanding AR on demand, with competitive rates starting at 2.5%.

The automatic repayment structure prevents overborrowing while providing the flexibility needed for operational expenses or growth opportunities. Since approval is based on bank statements and transaction history rather than traditional hard credit checks, Flow offers a low-risk alternative to conventional financing that preserves client relationships.

Anticipate and prepare for tax obligations

Tax season creates predictable yet significant liquidity constraints that require strategic planning. Help clients establish dedicated tax reserves with systematic funding mechanisms calibrated to their specific business profile. These reserves should account for projected revenue growth, industry seasonality, and anticipated deduction opportunities.

For optimal tax-season cash flow management, guide clients on the strategic timing of tax filings based on their specific financial position. Early filing may benefit businesses expecting refunds, while extensions might be appropriate for others.

For clients facing short-term capital constraints, Hopscotch Flow can serve as an effective liquidity management tool. By leveraging their pooled accounts receivable, businesses can maintain operational stability during tax season without compromising their growth initiatives or client relationships.

Resolve cash flow with Hopscotch Flow

Cash flow management is the lifeline of sustainability for SMBs, and accountants are uniquely positioned to guide businesses through liquidity management challenges stemming from delayed payment cycles and seasonally variable cash flows.

With regular reviews, proper planning, and liquidity management options like Hopscotch Flow, businesses can avoid cash flow pitfalls and be more strategic about their growth.

Ready to help businesses take their first step toward better cash flow? Learn how Flow can help your clients so they can get started right away.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.