Invoice factoring sucks for small businesses!

Small businesses need cash flow to stay alive. Traditional invoice factoring companies know this, and they use their products to hold businesses hostage with lots of paperwork, long and ongoing underwriting, and a hard credit check. This puts valuable client relationships at risk and makes working capital harder to access.

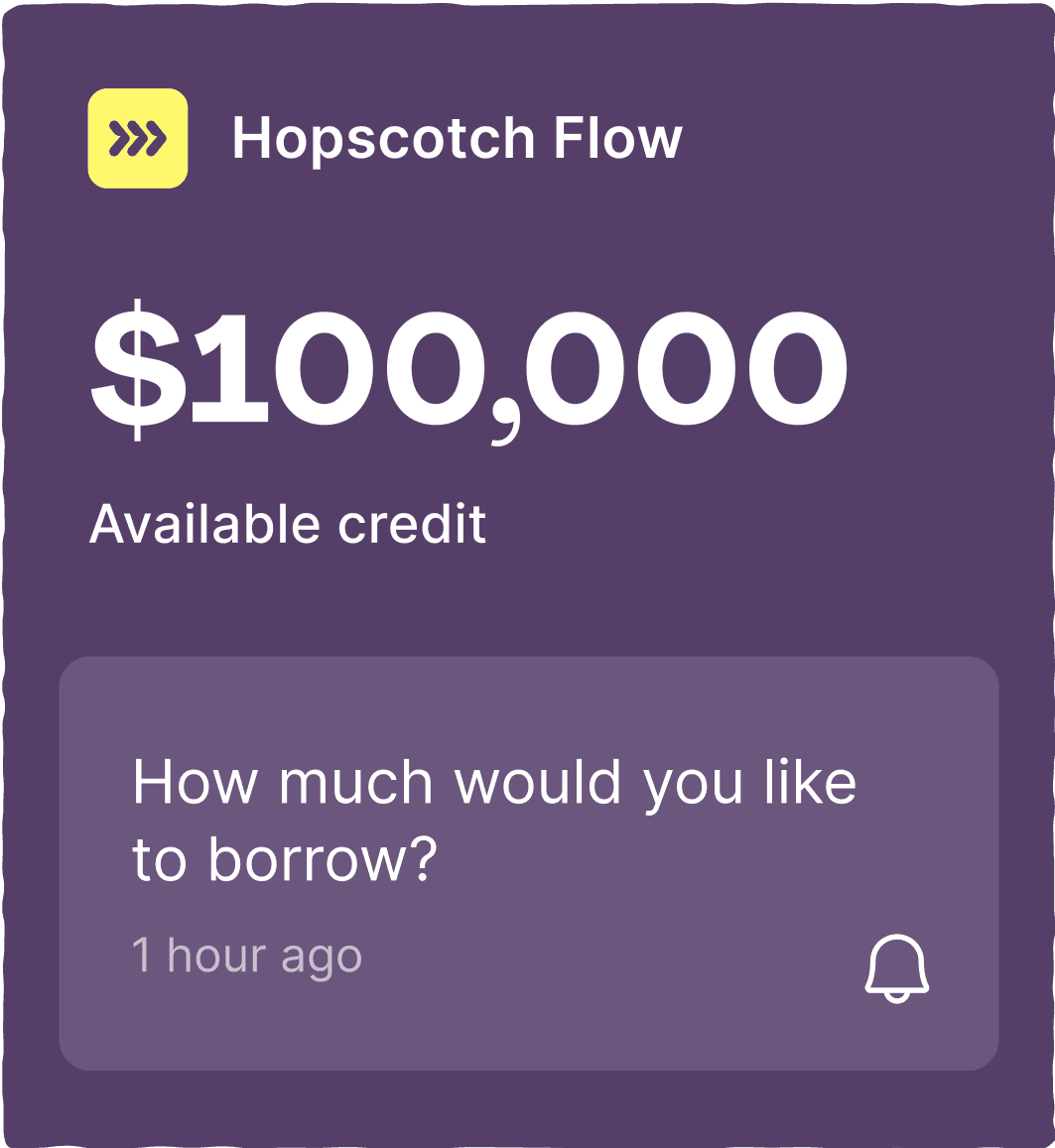

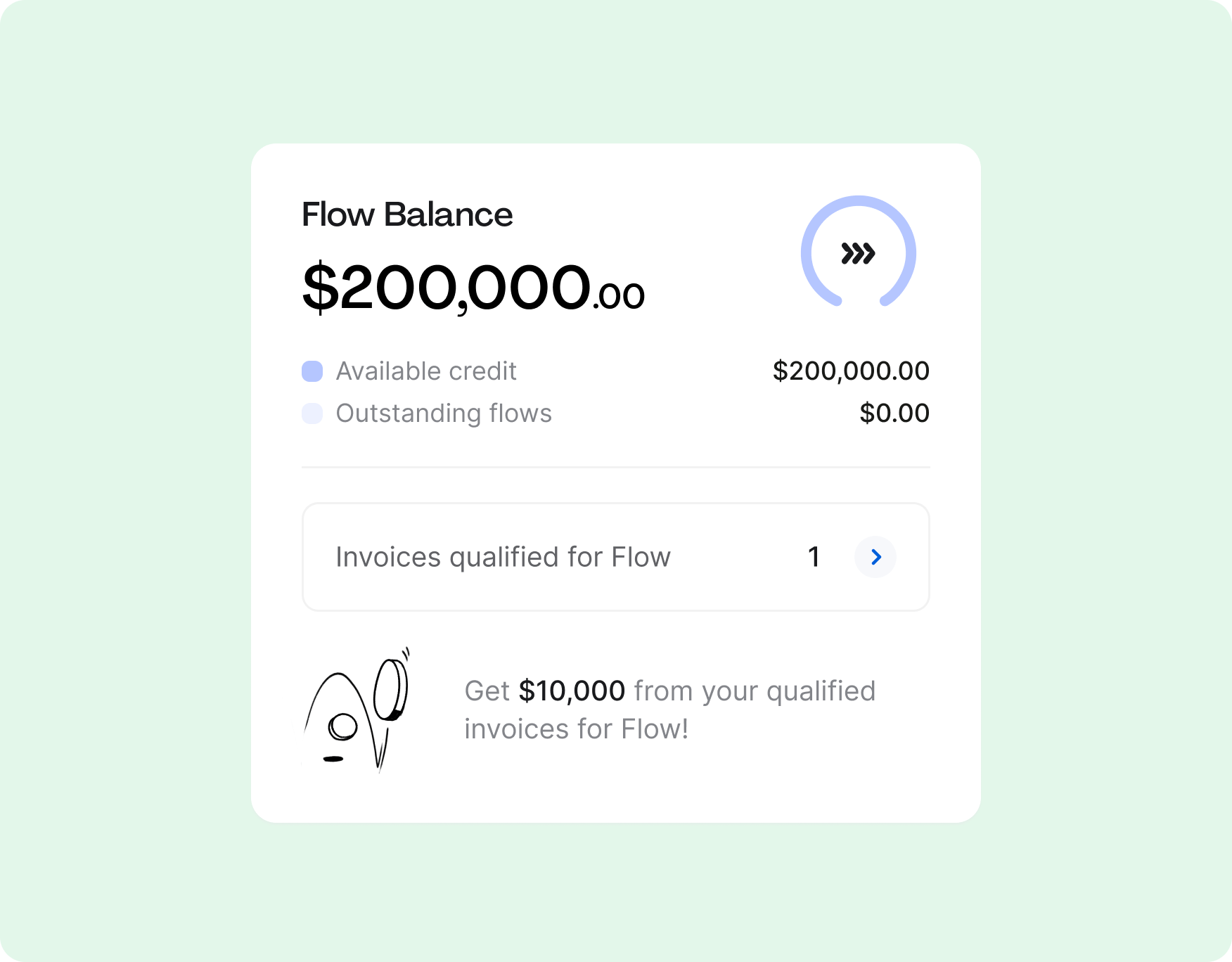

Hopscotch Flow offers instant working capital without the downsides for small businesses. Our partners love recommending Flow because this product uses bank transaction data and invoices to validate the financial health of their clients so they can crush net invoice terms and unlock cash privately, instantly, and effortlessly.

Testimonials

Why partner with Hopscotch?

Apply to be a Referral Partner

Getting started

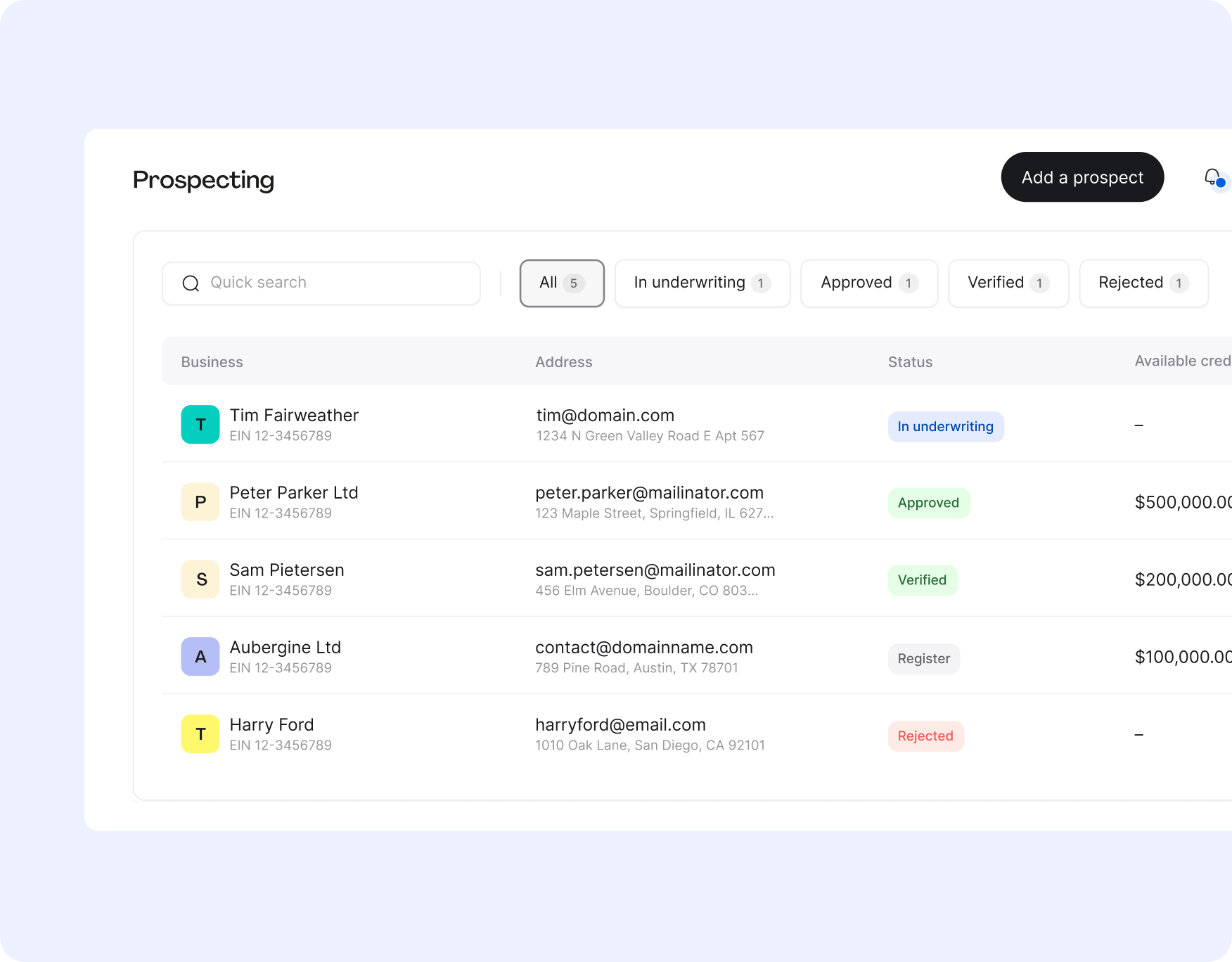

Partners can gather and submit business details on behalf of clients to expedite the pre-approval process. Your clients will be able to see their borrowing limit and rate within the hour. If they aren’t automatically approved, they can request a manual review from our team or take steps to improve the standing of their business before re-submitting.

Before using Flow, businesses need to establish at least 1 month of transaction history in the Hopscotch ecosystem. Sending and receiving payments on the platform helps keep our community safe.

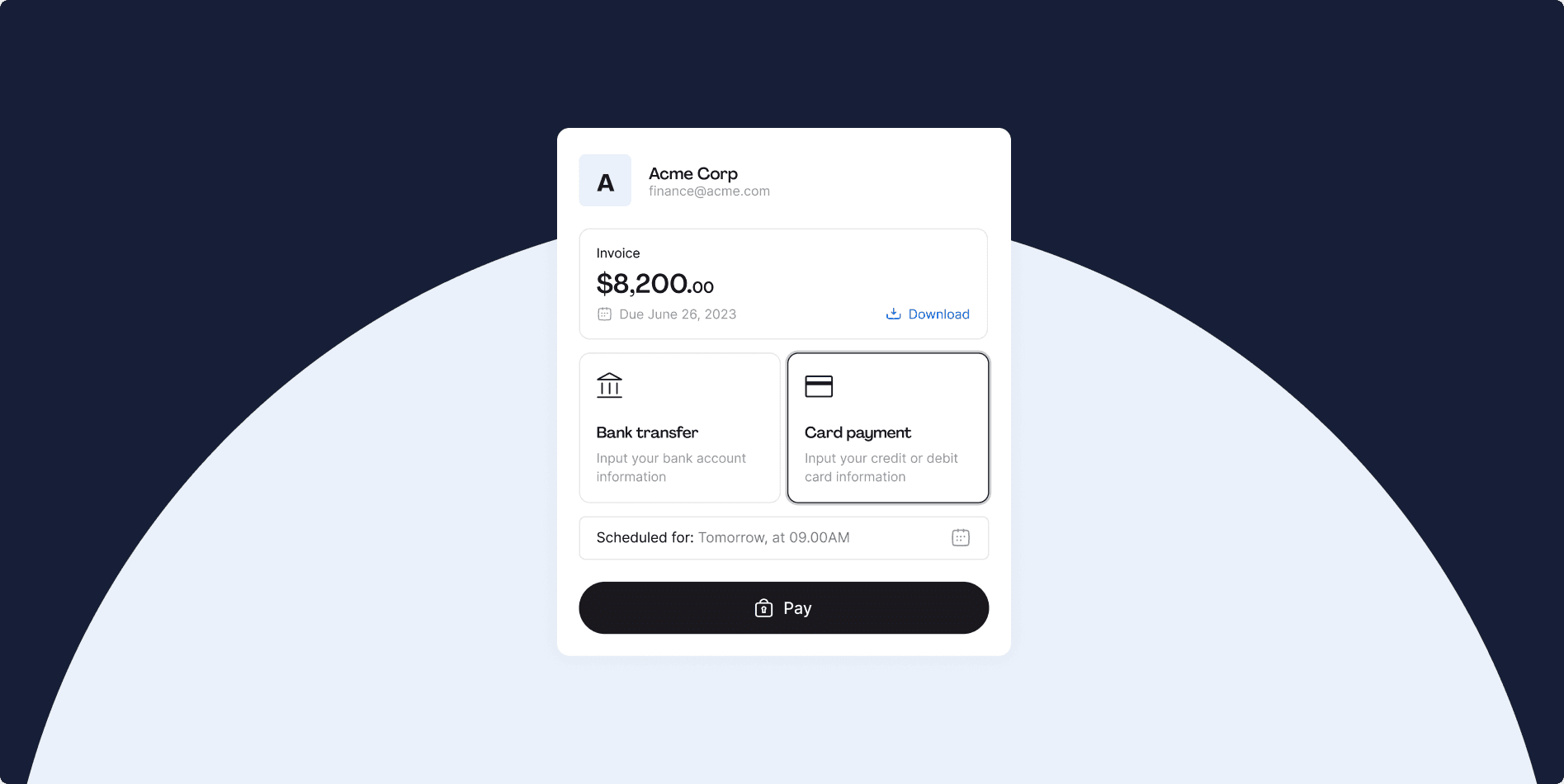

Now your clients can start using Flow to create instant working capital when they need it. Flow is an alternative to invoice factoring that helps hundreds of small businesses cover gaps in cash flow without the predatory fees or bad cycles so often found in other short term lending products.

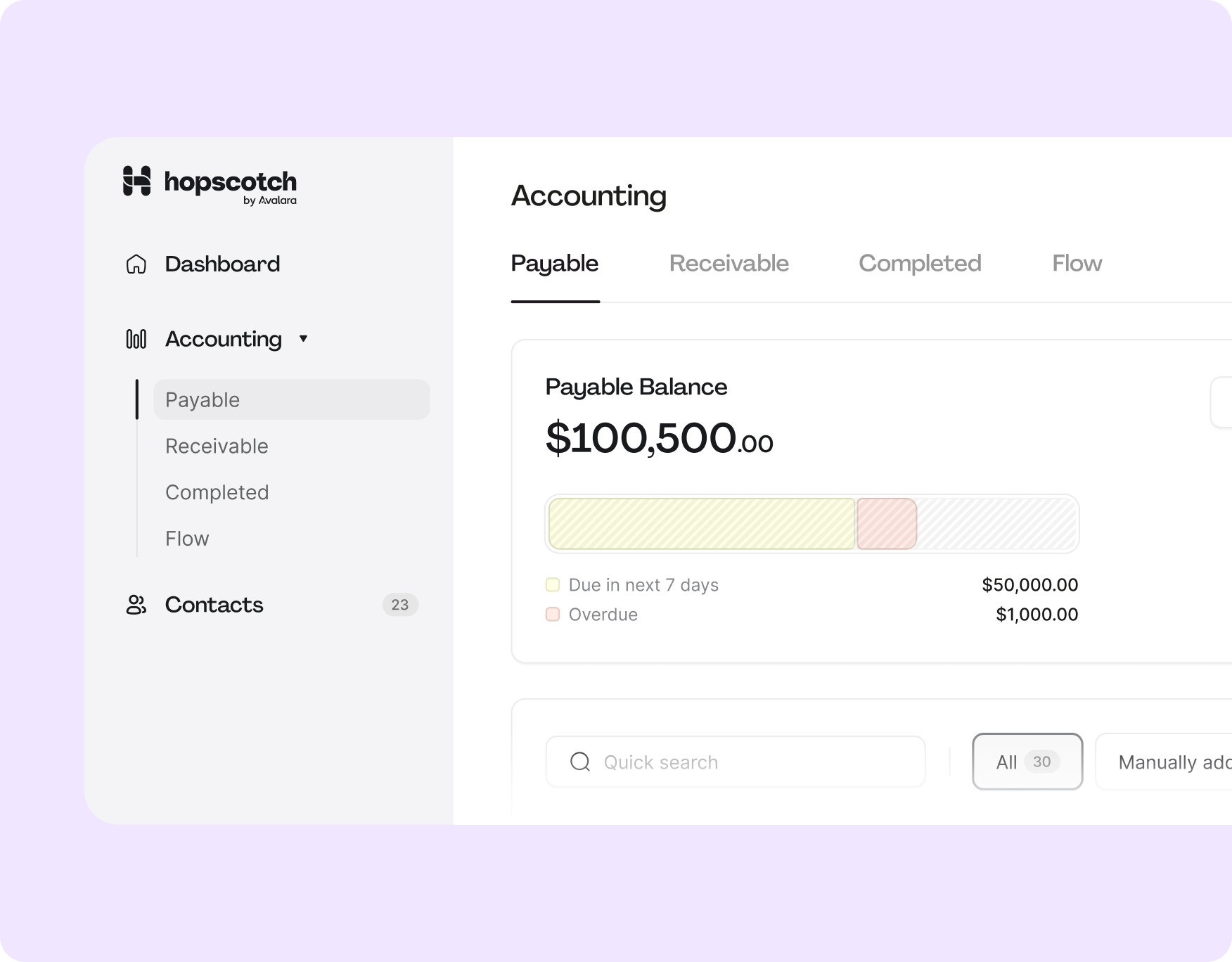

- Expanded suite of features

- Improved support

- Accounting network