What You’ll Learn:

- How B2B ACH payments compare to card payments, wire transfer, and checks

- Why small businesses tend to prefer this type of low-fee or no-fee payment

- Tips for getting set up to send and receive B2B ACH payments

How does your small business make and request payments for services? Invoicing and bill pay can be a source of frustration if you don’t have a system in place to manage what’s coming in and going out of your business. Do you pay your bills via credit card and eat the fees? Do you invoice clients and then wait weeks for a paper check to arrive in the mail?

Business to Business ACH (B2B ACH) payment stands out as a reliable, efficient, and safe method for facilitating transactions between businesses. Here’s what you need to know about B2B ACH payments, including how they work, key benefits, and common questions about how to implement them for your business.

Understanding business to business ACH payments

How you pay and get paid determines the overall cash flow of your business and the fees you pay. In other words, when you pay a bill or send an invoice, the actual method of payment will impact how fast the transaction is completed, the security of the transaction, and the costs you forfeit in the process of paying or getting paid!

Business to Business ACH is a popular way for small businesses to pay and get paid. All types of businesses can use this form of payment, including consultants, contractors, full-time freelancers, and agencies.

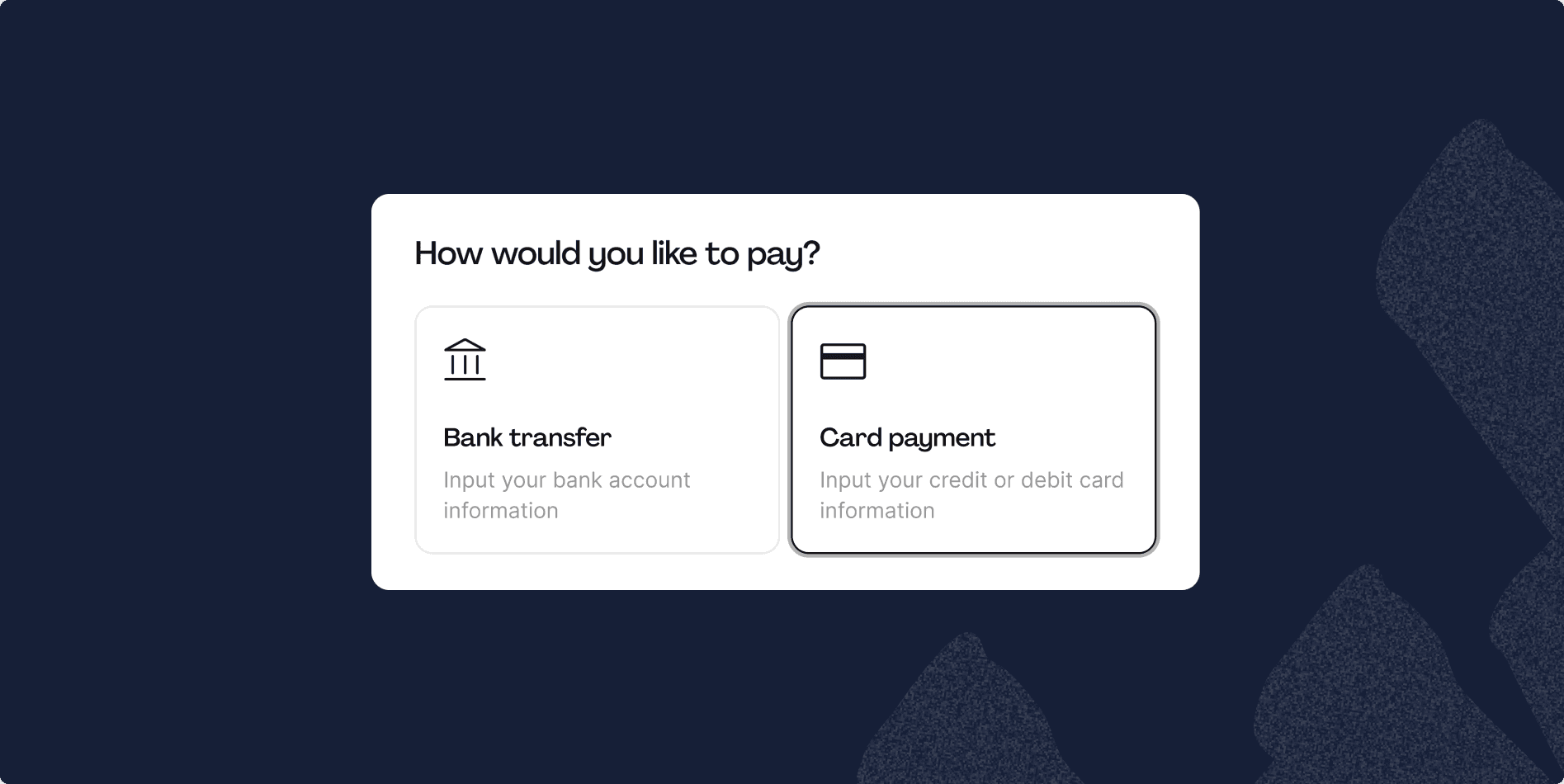

Here’s how it works in a nutshell: B2B ACH refers to the electronic transfer of funds between businesses through the Automated Clearing House (ACH) network. Unlike traditional paper checks (which are slow and susceptible to fraud) or card payments (which can include high processing fees), ACH payments offer a fast and cost-effective way for businesses to exchange funds securely and directly from bank account to bank account.

How B2B ACH works

B2B ACH payments involve the electronic movement of funds from one business bank account to another through the ACH network. This process typically starts with the payor initiating a payment through their bank or a trusted payment processor. The payor provides the necessary payment information, including the recipient’s bank account details and the amount to be transferred. ACH credits transfer funds from the payor to the payee, while ACH debits request the removal of funds from the payor to the payee.

Once initiated, the payment request is transmitted to the ACH network, where it undergoes processing and settlement. The recipient’s bank receives the payment instructions and credits the funds to the designated account. The entire process is automated, reducing the time and effort required for both parties involved.

Make your business invincible, one invoice at a time

Benefits of B2B ACH payments

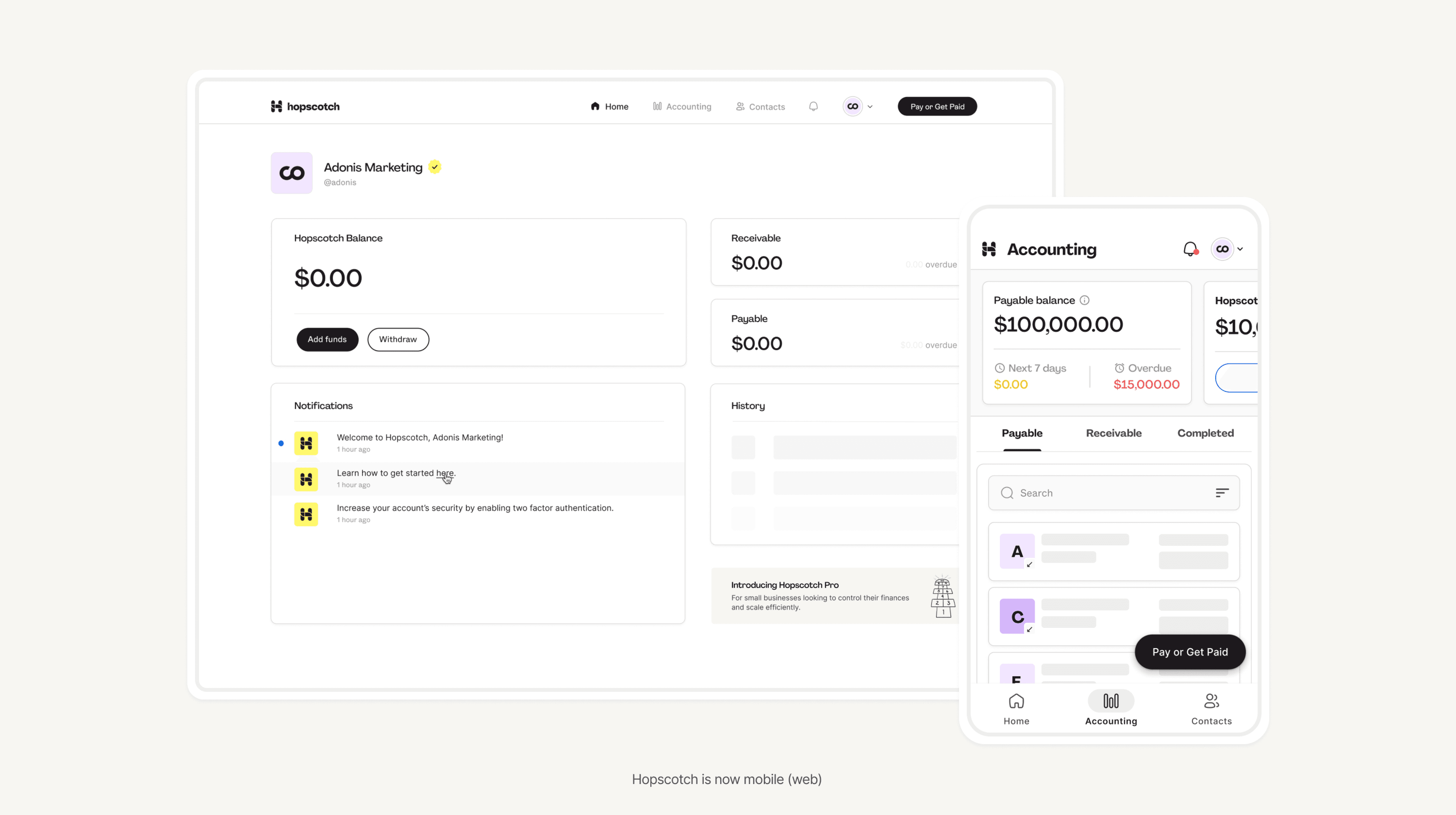

01. Cost-effectiveness: B2B ACH payments are significantly cheaper than traditional payment methods like wire transfers or paper checks, helping businesses save on transaction fees and processing costs. Hopscotch is one of the only payment platforms offering zero-fee ACH payments. This helps small businesses save thousands of dollars every year.

02. Efficiency: With B2B ACH, payments can be processed and settled quickly, reducing the time spent waiting for funds to clear. Waiting for payments to hit your account can create gaps in cash flow and jeopardize your ability to pay back other time-sensitive debts.

03. Security: ACH payments, also known as bank transfers, are highly secure, with built-in encryption and authentication protocols that protect sensitive financial information.

04. Convenience: Businesses can initiate and manage ACH payments digitally in just a few clicks, offering convenience and flexibility in managing cash flow and payments. B2B ACH payments are also easy to automate, which makes them ideal for recurring payments.

Which transaction types are allowed through ACH?

ACH supports various transaction types, including direct deposits, bill payments, person-to-person payments, and B2B payments. This versatility makes ACH an ideal choice for businesses looking to streamline their payment processes, particularly if they’re working with multiple clients on a consistent basis.

How do I pay a vendor through ACH?

Paying a vendor through ACH is a straightforward process that requires very little work for both parties in the transaction. You just need to know the vendor’s bank account details, including their routing number and account number. Then you can initiate a payment through your bank’s online portal or a trusted payment platform like Hopscotch by generating and sending an invoice. Once initiated, the funds will be electronically transferred to the vendor’s account through the ACH network.

What is an ACH form for business?

An ACH form for businesses, also known as an ACH authorization form, is a document that authorizes a business to initiate electronic payments from a customer’s bank account. This form typically includes the customer’s bank account information, authorization to debit the account for payments, and terms and conditions governing the ACH transactions. (When creating and verifying your Hopscotch account, you’ll add your bank details and authorize Hopscotch to send and request payments on behalf of your business via zero-fee ACH, credit/debit card, or your Hopscotch balance.)

Is making an ACH payment safe?

Making an ACH payment is generally safe and secure. ACH transactions are protected by robust security measures, including encryption, authentication, and monitoring systems that safeguard sensitive financial information. Most business-to-business ACH transactions are processed the next business day, which is an added bonus and safety net for businesses in need of quick payment solutions. (This doesn’t include weekends and bank holidays.)

Which is safer: ACH or wire transfer?

Both ACH and wire transfers are secure payment methods, but they differ in terms of processing time and cost. While wire transfers offer immediate settlement, they are often more expensive than ACH payments. ACH payments, on the other hand, are more cost-effective but may take a day or two to clear. Ultimately, the choice between ACH and wire transfer depends on factors such as urgency and cost considerations.

Ready to get paid via B2B ACH with zero fees?

ACH payments offer a secure, efficient, and cost-effective way for businesses to exchange funds electronically with other businesses. By leveraging the capabilities of the ACH network, businesses can streamline their payment processes, improve cash flow management, and enhance overall operational efficiency. Whether you’re paying vendors, processing payroll, or collecting payments from other businesses, B2B ACH provides a reliable solution for your business payment needs.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.