What You’ll Learn:

- The process, cost, and benefits of traditional factoring

- Why businesses use factoring solutions to manage financial operations

- When to suggest alternatives to conventional factoring, like Hopscotch Flow

Unpaid invoices are a common accounting pain point. When cash flows dry up because of long payment cycles, your small business clients might turn to solutions like traditional factoring to generate instant capital. While factoring has lots of benefits, it’s just one of many cash flow solutions you can suggest to help your clients scale.

Why do businesses seek factoring solutions?

Small and medium-sized businesses don’t always have the working capital resources that large or enterprise businesses do. Seasonal dips, emergency expenses, and delayed client payments can all cause significant strain on a company’s budget.

Factoring offers quick access to cash, which reduces risks and offers financial flexibility. Rather than waiting 30, 60, or even 90 days for client payments, businesses can access that cash right away for whatever opportunities might arise.

With short-term financing solutions like factoring, a business can:

- Meet payroll or supplier deadlines

- Pay for emergency or repair costs

- Invest money in growth projects

- Address time-sensitive expenses

It’s important to note that factoring is not a loan and therefore doesn’t typically require the same type of application or underwriting process that comes with borrowing money from a bank. This makes it a viable solution for companies that need cash flow but are unwilling or unable to take on additional debt, such as businesses with limited credit history.

How does traditional factoring work?

Invoice financing is sometimes used interchangeably with invoice factoring, but these are actually distinct financial products. The key difference between factoring and invoice financing is that financing uses unpaid invoices as collateral for a loan.

Invoice factoring, on the other hand, involves businesses selling their unpaid invoices to a third-party factoring company. The company provides that business a percentage of the invoice in cash. The factoring company is then responsible for collecting payment from your clients when the invoices come due. After the invoice is ultimately paid, the factoring company forwards the rest of your invoice amount (minus their service fee).

Factoring is a relatively accessible form of short-term financing, which is one of the reasons it is so popular. However, the accessible service and quick cash come with some drawbacks. If your clients are considering factoring as part of their financial strategy, make sure they’re aware of these details:

- Third-party payment collections. For many companies, one of the least appealing elements of factoring is its impact on client relationships. Once invoices are sold, the factoring company engages directly with those who owe invoice amounts. This can strain relationships or create misconceptions about the financial position of the original business.

- Factoring costs and fees. The costs of factoring can add up quickly, especially for companies that routinely sell their invoices. Companies will have to relinquish a percentage of each invoice they factor. Additionally, they may have to pay some application, credit check, and service fees.

- Long-term contract details. If a client engages in recourse factoring, their contract may stipulate that they must re-purchase their invoices if they go unpaid after the due date. This keeps liability for the invoices on their accounting records and can become a financial burden if clients do not pay.

If your small business clients want to pursue factoring services, make sure they understand the costs and how they may affect their long-term financial goals.

What other short-term financing options are available?

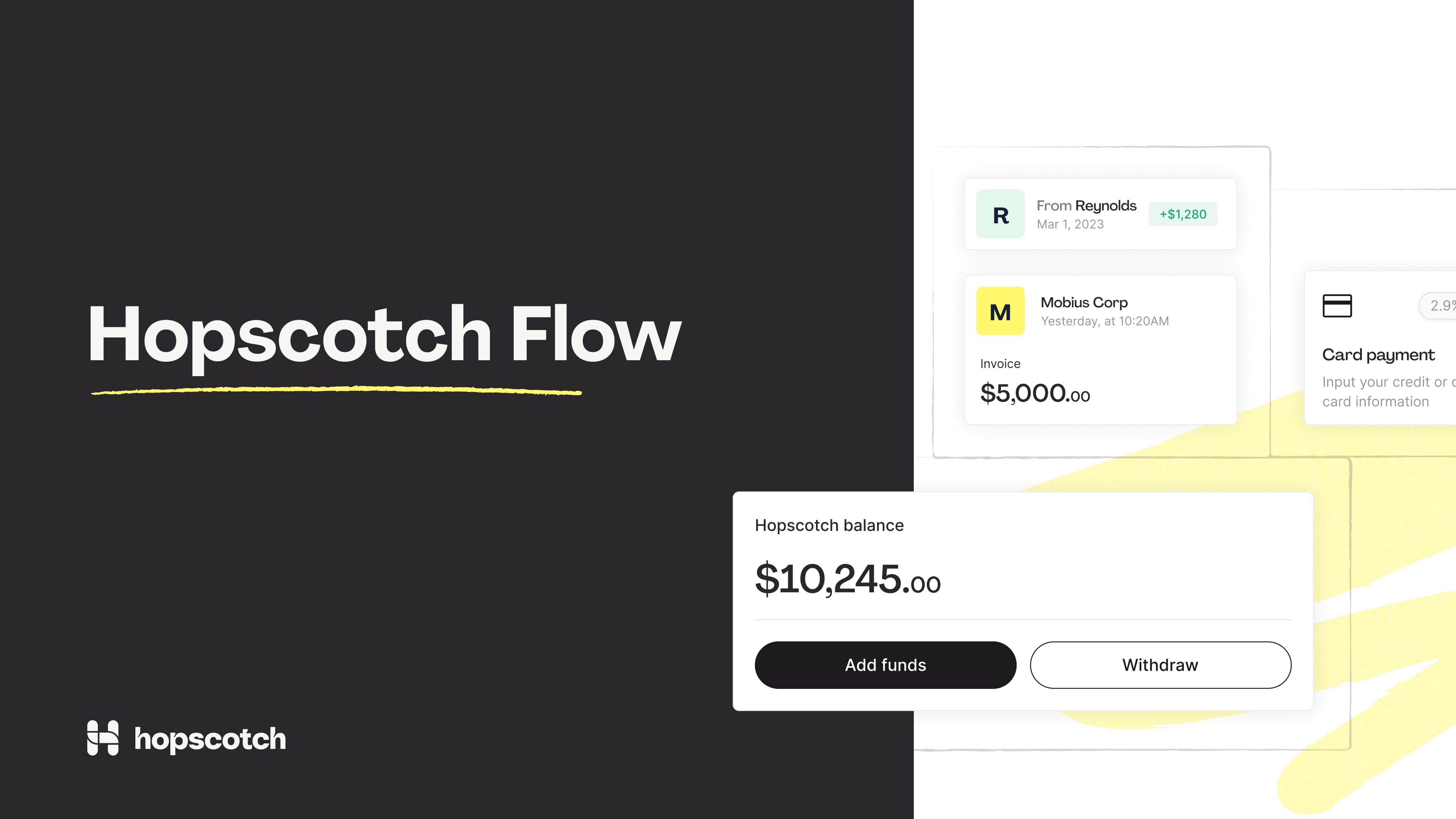

Some alternative short-term financing options allow your clients to access cash flow without selling their invoices. Hopscotch Flow provides the same quick access to cash that invoice factoring or financing would provide—but without selling the invoices or needing to repay a loan.

Flow is integrated into the Hopscotch invoicing system, which makes it easy to use. This product functions more like a revolving line of credit than a traditional invoice factoring solution. When clients pre-apply for Flow, they see their borrowing limit and rate based on their cash flow and total outstanding receivables. Then, once approved, businesses can draw from their Flow line of credit as needed to generate working capital.

Flow is a discreet financial product. There are no third-party collections that interfere with customer relationships. The entire process is contained within the Hopscotch platform.

Guide your clients to smarter financing with Hopscotch Flow

Accountants understand the value of smart financial tools. While factoring offers access to immediate cash, it doesn’t come with the same ongoing accessibility and benefits of Hopscotch Flow.

For easy invoice integration and financial flexibility, your clients can invoice with Hopscotch to Flow payments as needed.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.