What You’ll Learn:

- The cost of factoring and how fees accumulate over time

- How much invoice factoring fees undermine small business cash flow

- Cost-effective alternatives to traditional invoice factoring with fewer fees

Maintaining a steady cash flow is crucial in today’s competitive business environment, particularly for small businesses like agencies, consultants, and contractors facing long net payment terms. Invoice factoring offers a quick solution to gaps in payment by allowing you to sell your invoices for immediate cash, but the factoring rate and additional fees can be pricey.

Here are some of the typical invoice factoring fees you might encounter, their financial impact on your business, and how to avoid paying hidden fees when you need fast access to cash.

What are the most common invoice factoring fees?

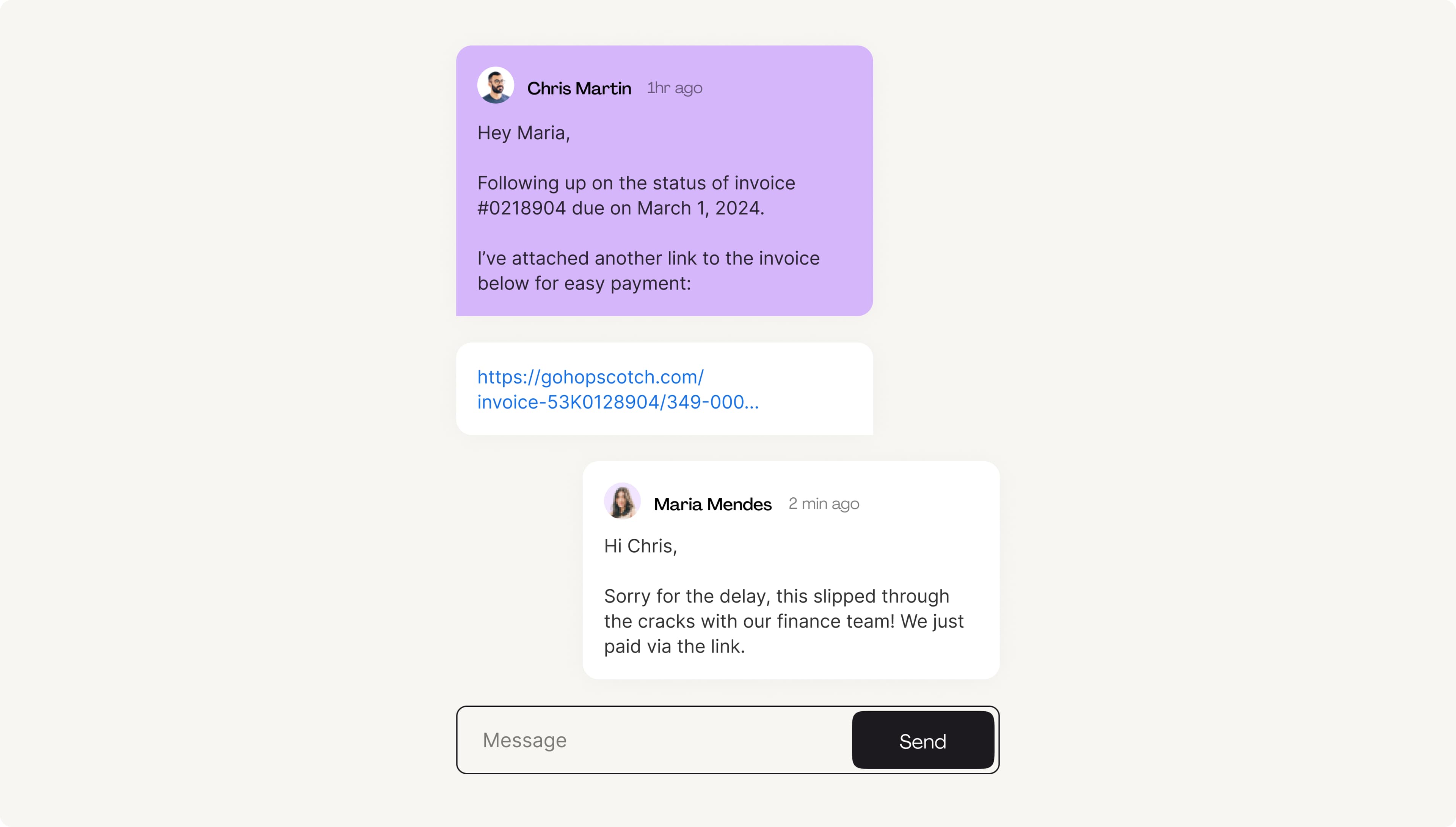

You’re in a bind. You really need your client to pay their invoice asap so you can pay your bills, but their invoice isn’t technically due for a couple weeks. And you don’t want to reach out about early payment and potentially jeopardize that relationship. Invoice factoring might help you get your hands on cash quickly without rocking the boat, but how much does factoring cost?

When you factor an invoice, a range of fees can be applied from the moment you get paid until the moment your client ultimately pays back the invoice. These fees cover various aspects of the service, making the cost of factoring more than just a one-time discounted rate. Here are some of the most common expenses associated with invoice factoring:

- Factoring rate: The price tag for advancing funds from an unpaid invoice, expressed as a percentage of the entire invoice amount.

- Origination fee: A fee for processing the invoice factoring application.

- Credit check fee: A fee for assessing the creditworthiness of your clients.

- ACH fee: A fee for payouts made via electronic funds transfer.

- Service fee: A monthly fee for account maintenance.

- Wire transfer fee: A fee for payouts made via wire transfer, which can be quicker than ACH.

- Early termination fee: A fee if you decide to end a factoring contract early.

You might think the factoring rate is the most important cost associated with factoring an invoice, but many factoring services also charge additional fees that aren’t exactly easy to decipher at the outset of the agreement. And if your client doesn’t end up paying the original invoice amount, you’re still on the hook for all these costs. Fortunately there are other options, such as invoice financing, which uses unpaid invoices as collateral for a loan or line of credit.

Want to learn more about instant payments and cash flow control?

What is an average invoice factoring rate?

The invoice factoring rate is charged as a percentage of the total of each factored invoice. Average factoring rates vary but typically range from 1% to 6%. The rate structure is based on risk variables like the invoice amount and the creditworthiness of the payor, and the fee typically increases the longer an invoice goes unpaid. For example, you might be able to factor a $10K invoice at 3% for the first 30 days, and then 4% for the next 30. These fees can add up:

- Factoring a $10,000 invoice at 5% costs $500.

- Factoring a $3,000 invoice at 3% costs $90.

- Factoring a $5,000 invoice at 2% costs $100.

Again, these rates are in addition to other fees that impact the overall cost of factoring. Invoice factoring fees directly affect the net amount you receive and can significantly impact a business’s financial health if incurred on a regular basis.

How is an invoice factoring rate usually calculated?

Factoring rates are largely determined by the risk associated with purchasing an unpaid receivable. By fronting your business the cash for an outstanding invoice, the factoring company takes on financial risk in exchange for a fee. The factoring rate is designed to protect and compensate the factoring company while also providing an advance of cash flow to businesses in need of working capital. Variables that could impact your rate include things like:

- The creditworthiness of your clients: Factoring companies will run a credit check on your clients and evaluate their payment history to get a sense of how likely they are to pay back the invoice on time. If your client is regarded as a higher risk, it can lead to higher factoring rates.

- Volume of invoices: You may be offered a more favorable rate if you factor a large volume of invoices.

- Industry risks: Certain industries are considered riskier than others due to their payment cycles, economic stability, and client reliability.

- Invoice amounts and terms: Smaller invoices or those with longer payment terms can carry higher rates.

- Your company’s financial health: The overall financial condition of your business also plays a role in rate determination. A reliable financial history might result in lower rates, whereas a company with less consistent finances or other outstanding debts might face higher factoring costs.

- Contract terms: The specifics of your agreement with the factoring company, such as the duration of the contract and the penalties for early termination, can influence rates.

Hopscotch Flow simplifies this process by focusing primarily on the invoice size without needing client credit checks. Plus, you’ll have fewer documents to submit, a far shorter application process, and your clients won’t be notified when you use this service.

Instant cash flow, fewer fees

Choosing the right financial tools is crucial for maintaining a healthy cash flow, particularly for smaller businesses facing the dual challenge of managing immediate expenses and maintaining long-term profitability. Here’s why Hopscotch Flow stands out as a superior alternative to traditional invoice factoring:

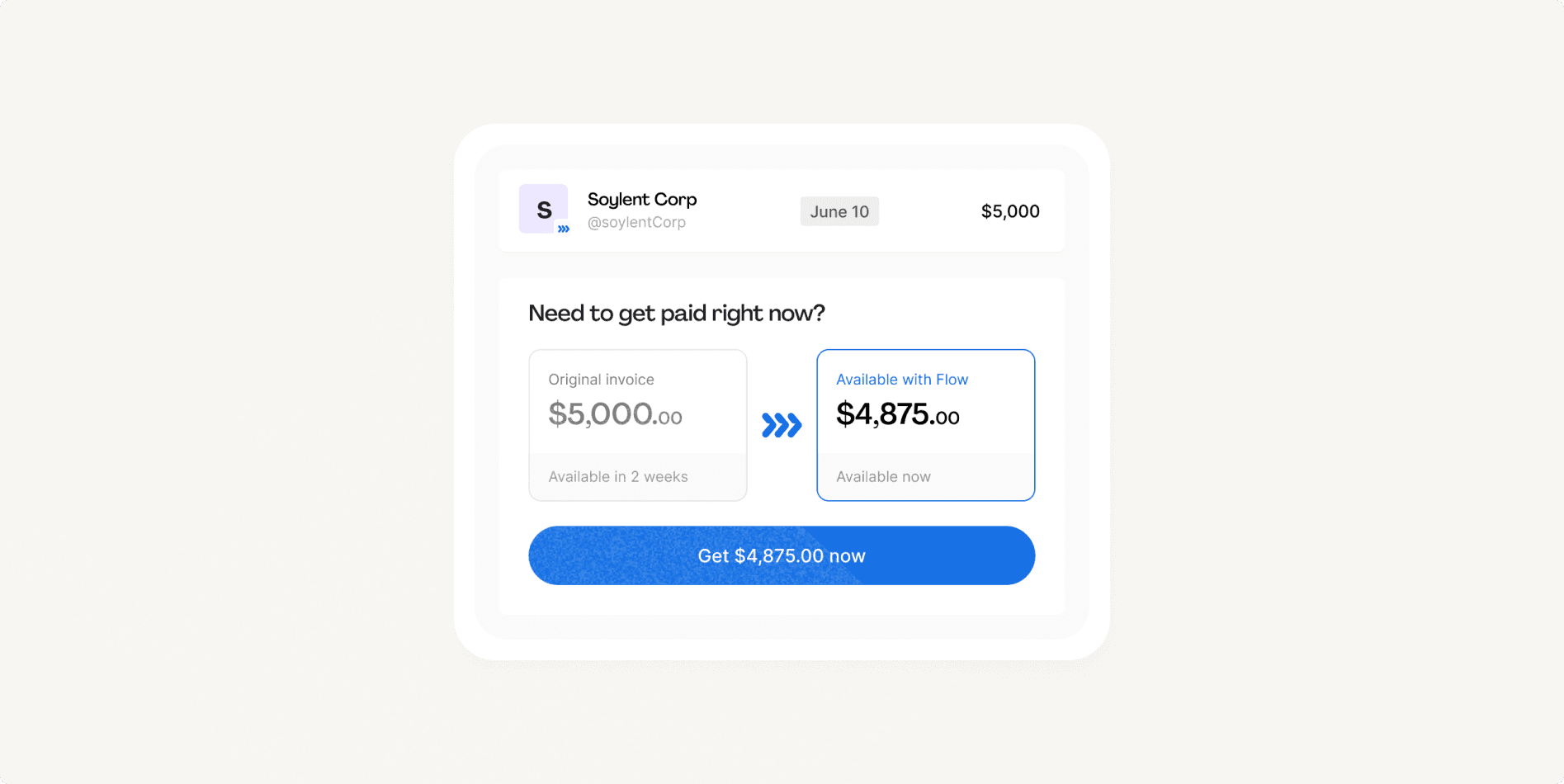

- Immediate access to funds: There are no long wait times with Hopscotch Flow, you can get paid in just 2 clicks. Generate and send an invoice, then click the Flow button!

- 90% upfront: With Hopscotch Flow, you get 90% of your unpaid invoice instantly. Once your client pays back the invoice, you get the remaining 10% minus the factoring rate.

- No hidden fees: Unlike traditional factoring solutions, Hopscotch Flow has no hidden costs. Businesses pay an average of 3% every time they Flow a net-30 invoice.

- Protect client relationships: Your clients will never know when you use Hopscotch Flow, so there’s none of the stigma that traditional invoice factoring carries.

- No credit check required: Hopscotch won’t run a hard credit check on your business or your clients. Just sign up and link your bank account to get started!

- Simple and user-friendly: Hopscotch Flow is easy to use and designed with the user in mind. There’s no paperwork, long wait times, or complicated processes.

Need a quick cash flow solution that doesn’t stain your business? Trade traditional invoice factoring for Hopscotch Flow. Sign up for Hopscotch today and start managing your invoices and cash flow in one place.

Bret Lawrence

Writer

Bret Lawrence is small business writer at Hopscotch, with a special focus on invoicing and cash flow management products and strategies. Her previous roles include senior financial writer at Better Mortgage, where she covered the ins and outs of lending and the home buying process. She is based in New York City.