What You’ll Learn:

- The risks of factoring invoices and why it might be a red flag to your clients

- The best alternatives to traditional invoice factoring when you need to get paid fast

Need to get paid right now? Invoice factoring (selling unpaid receivables in exchange for a quick infusion of cashflow) can be a lifesaver for small businesses. However, there are some downsides to traditional invoice factoring. The process may create unnecessary friction for clients, jeopardize important relationships, and lead to negative payment experiences that ultimately undermine your business. In other words, invoice factoring can definitely affect client relationships—but sometimes it’s worth the risk!

Here’s how to weigh the pros and cons of traditional invoice factoring and mitigate risks to protect client relationships:

Who do my clients pay when I factor their invoices?

One of the primary concerns small business owners have about invoice factoring is confusion over payment arrangements. Clients might be concerned about how to navigate this new process—who exactly are they paying and how? They might have doubts about the legitimacy of the factoring company and whether their transaction is secure, especially if the initial touchpoint introducing the invoice factoring company is fumbled or sloppy.

Clear communication and transparency are crucial in soothing client concerns. Business owners need to ensure that clients are informed about the factoring arrangement and clearly understand how it impacts their payment process. Establishing trust and maintaining open lines of communication can help mitigate any potential confusion or apprehension.

Will someone else come calling and asking my clients for money?

When you create and send an invoice to your clients, you maintain visibility on the transaction from start to finish. When you factor an invoice, you transfer ownership of the receivable. In simple terms, you don’t own the invoice anymore. The factoring company typically takes over the entire payment process, meaning they can and will directly interact with your clients.

Clients might perceive this as intrusive or disruptive—after all, they agreed to have a business relationship with you, not the factoring company. The last thing a business wants is for its clients to feel harassed or pressured by a third party demanding payment.

To prevent such scenarios, businesses should carefully choose a reputable invoicing and cash flow management company that prioritizes professionalism and respects client relationships. It’s essential to work with a factoring partner that understands the importance of preserving client goodwill and employs tactful communication strategies when interacting with clients regarding payments.

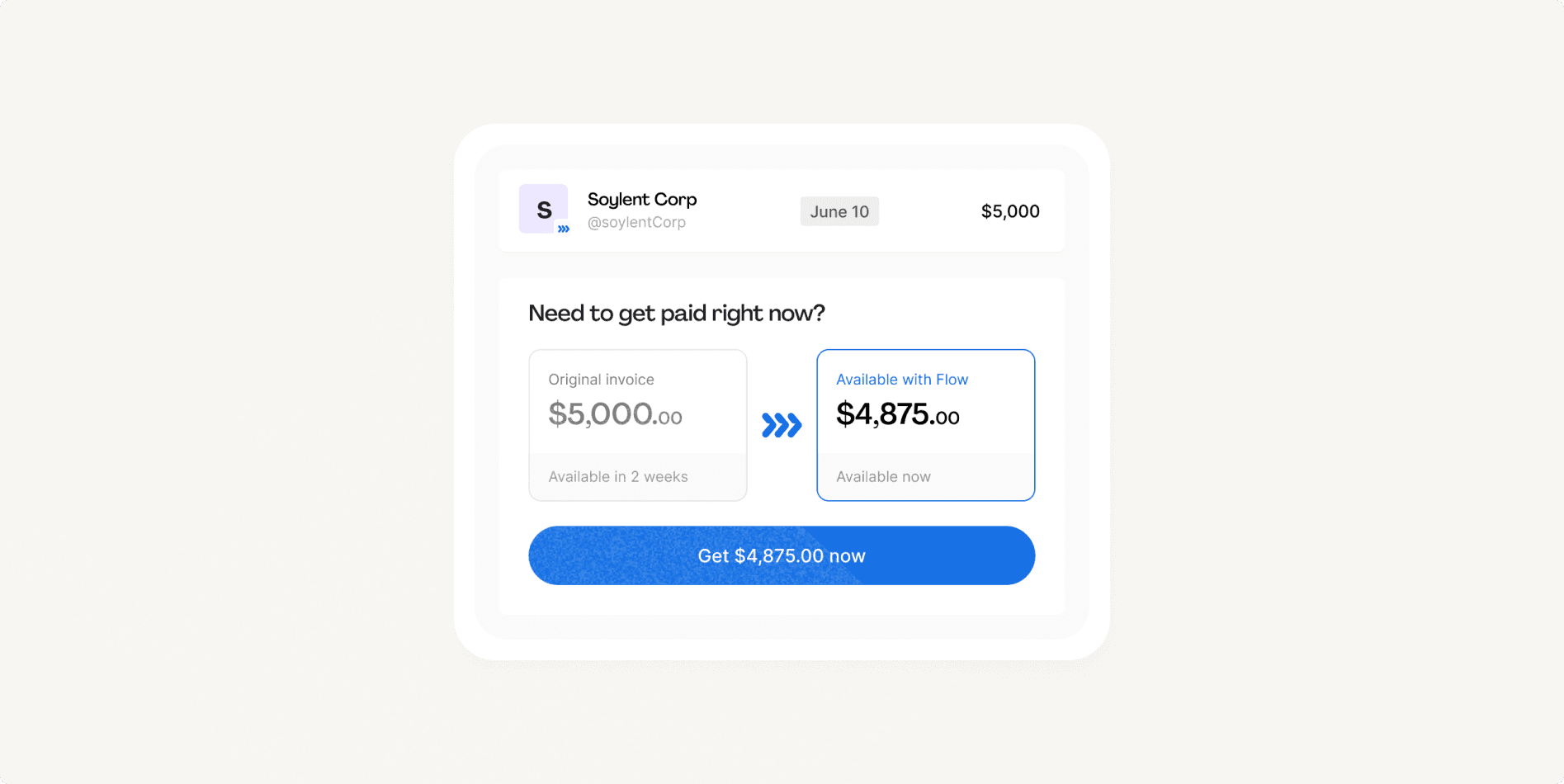

A new and improved take on traditional invoice factoring

Hopscotch Flow is a completely private invoice factoring tool designed for small businesses. Looking to protect client relationships and get lightning fast cash flow? This solution offers the best of both worlds. Advance 90% of your invoice upfront in just a few clicks, no credit check required!

Will my client think I see them as a source of cash if I factor their invoice?

Invoice factoring can sometimes create the perception that your business views its clients solely as a means to access cash quickly. This perception can strain relationships and erode trust if not managed effectively. Clients may feel undervalued or taken for granted if they sense that their business is just a source of revenue to you.

Small business owners rely on solid relationships and networking to survive. If you need to factor an invoice, find ways to demonstrate client appreciation. Remind them that they are more than a data point in a spreadsheet to your business! Counteract any negative perceptions associated with invoice factoring by investing in your relationships — host a small happy hour event for your most valued clients, send a small gift to their office, or find other meaningful ways to prove that the relationship is not just transactional.

Make your business invincible, one invoice at a time

Will my clients wonder about the financial security of my business if I use invoice factoring?

Clients may also question the financial stability and reliability of a business that resorts to invoice factoring. They may worry about the reasons behind the decision to factor invoices and whether it reflects underlying cash flow problems or instability within the business. Concerns about the long-term financial security of the business could lead clients to reconsider their relationship or seek out different partners.

Business owners can proactively address these concerns by communicating openly and honestly with their clients about their financial strategies. Transparency about the motivations behind invoice factoring, coupled with reassurances regarding the business’s overall stability and commitment to delivering value, can help alleviate any doubts of this nature.

Alternatives to traditional invoice factoring for small businesses

Despite its potential benefits, traditional invoice factoring may not be the ideal solution for every business—particularly those that want to maintain strong client relationships. Freelancers, contractors, consultants, and small service-based businesses like agencies often rely heavily on positive client interactions and referrals to sustain and grow their operations.

For these types of businesses, preserving client trust and loyalty typically outweighs the benefits of traditional invoice factoring. If that’s the case for your business, look for alternative financing solutions that offer flexibility and convenience without compromising client relationships.

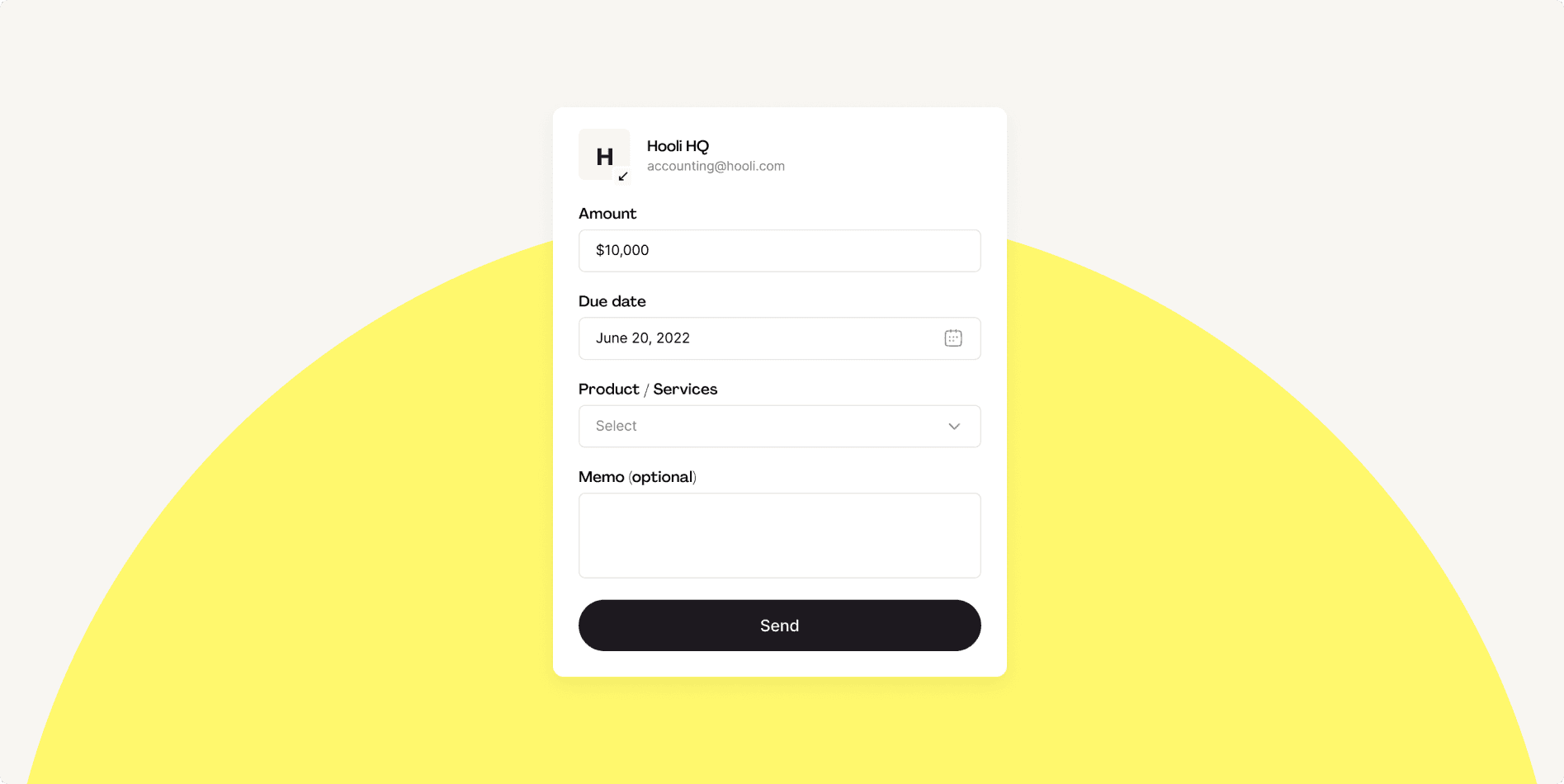

Hopscotch Flow offers instant cash flow and is completely private

Hopscotch Flow offers all the benefits of traditional invoice factoring for businesses looking to optimize their cash flow without jeopardizing client relationships. With Hopscotch Flow, businesses can access the funds they need in just 3 clicks.

Unlike traditional invoice factoring, Hopscotch Flow prioritizes transparency, flexibility, and is designed to be client-centric. With competitive rates and privacy guaranteed, small businesses can use Flow to advance 90% of their invoice upfront. Rather than filling out tons of paperwork and waiting weeks for approval, you can find out immediately if your invoice qualifies for Flow—no credit check required.

Ready to get started? Create your Hopscotch account today and Flow your first invoice in minutes.

Bret Lawrence

Writer

Bret Lawrence is small business writer at Hopscotch, with a special focus on invoicing and cash flow management products and strategies. Her previous roles include senior financial writer at Better Mortgage, where she covered the ins and outs of lending and the home buying process. She is based in New York City.