What You’ll Learn:

- Basic documents for invoice factoring requirements

- Why certain documents matter to factoring partners

- How Hopscotch Flow beats traditional invoice factoring

Essential documents for invoice factoring

When applying for invoice factoring, you’ll need several documents to get started. Here’s a breakdown of the basic invoice factoring requirements:

- Bank statements

- Factoring application

- Invoices you want to factor

- Proof of delivery or service

- Customer credit information

- Accounts receivable aging report

- Articles of incorporation or business registration

Why do factoring companies require a factoring application?

A factoring application serves as the initial step in the process, providing essential information about your business and its financial standing. This document helps the factoring provider assess your eligibility and determine what rates to charge for their services.

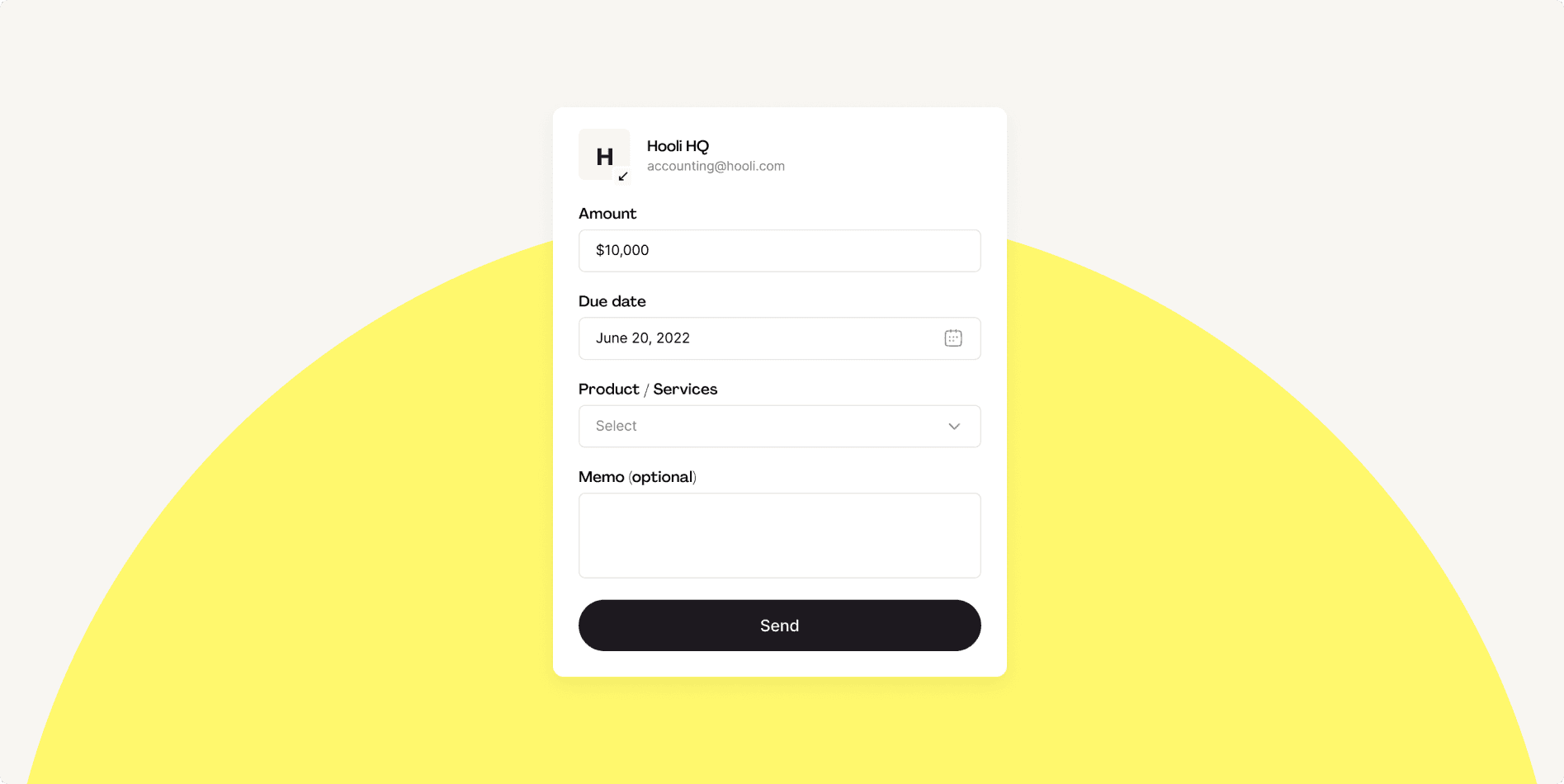

Why do factoring companies require an invoice?

Unpaid invoices are the primary assets you’ll be factoring. These documents demonstrate that you’ve completed a service or delivered goods, and that you have an outstanding receivable the factoring company can purchase from you and collect from your clients. These documents serve as collateral for the factoring agreement.

Why do factoring companies require proof of delivery or service?

To validate the legitimacy of your invoices, factoring companies often require proof of delivery or service. This can include signed delivery receipts, work orders, or other documentation confirming that the goods or services were provided as invoiced.

Why do factoring companies require customer credit information?

Factoring providers may request information about your customers’ creditworthiness. This helps them assess the risk associated with advancing funds against your outstanding invoices. Knowing the creditworthiness of your customers enables factoring companies to make informed decisions about the risk in taking on your receivable and the exact terms they’re willing to extend to your business.

Why do factoring companies require articles of incorporation or business registration?

Proof of your business’s legal status, such as articles of incorporation or business registration documents, validate your company. Factoring providers require this documentation to ensure they’re dealing with a legitimate entity and to verify your authority to enter into financial agreements.

Why do factoring companies require bank statements?

Bank statements provide insight into your business’s financial health via your invoicing and cash flow patterns. Factoring companies review these statements to evaluate your ability to repay advances and manage your finances responsibly. Additionally, bank statements help verify the accuracy of the invoices submitted for factoring.

Make your business invincible, one invoice at a time

Why do factoring companies require an accounts receivable aging report?

An accounts receivable aging report outlines the outstanding invoices owed to your business and their respective ages. This document helps factoring providers evaluate the quality and age of your receivables, which influences the advance rates and fees they offer. It provides visibility into your cash flow and helps identify any potential risks or collection issues.

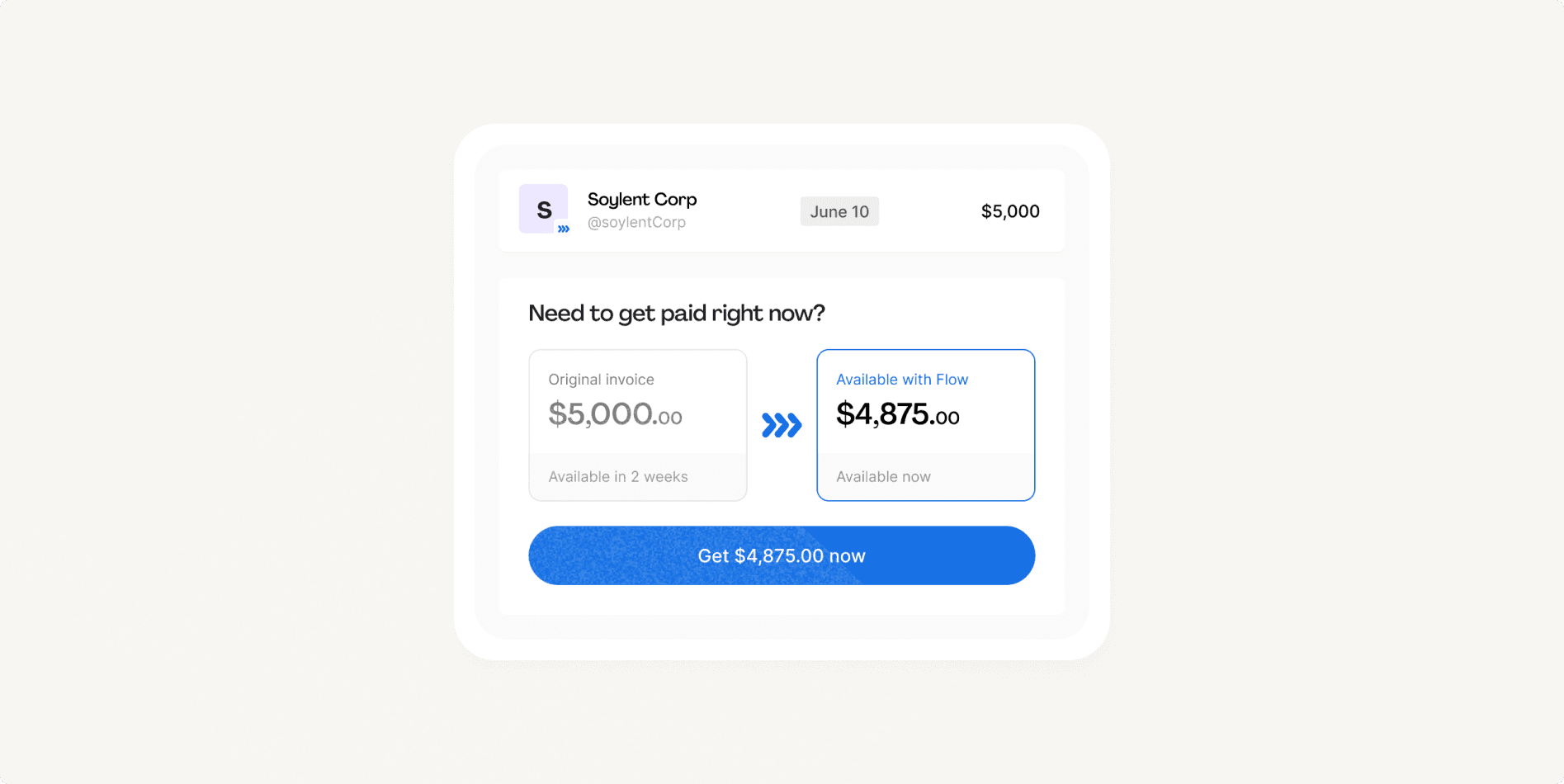

How does Hopscotch Flow compare to traditional invoice factoring?

Hopscotch Flow is a simpler, faster way to leverage unpaid receivables. Rather than requiring tons of paperwork or a long application process, Hopscotch tells businesses immediately whether an invoice qualifies for Flow and advances 90% of the invoice total in just 3 clicks. There is no credit check required when you Flow an invoice, and your clients won’t be notified when you use this service.

Need to get paid right now? Sign up for Hopscotch and start unlocking cash flow from outstanding invoices today.

Bret Lawrence

Writer

Bret Lawrence is small business writer at Hopscotch, with a special focus on invoicing and cash flow management products and strategies. Her previous roles include senior financial writer at Better Mortgage, where she covered the ins and outs of lending and the home buying process. She is based in New York City.