What You’ll Learn:

- What cash flow means for different types of small businesses

- Profit vs. cash flow and methods to measure both for your business

- How to make any small business truly invincible to gaps in cash flow

Effective cash flow management is crucial for small businesses. Maintaining a healthy cash flow ensures that a business can meet its financial obligations, invest in growth opportunities, and weather unexpected setbacks.

In this guide, we’ll explore key questions about cash flow for small business, review ways to measure and predict cash flow accurately, and provide actionable strategies for accelerating cash flow on-demand.

How much cash flow is good for a small business?

There isn’t a one-size-fits-all answer to this question, as the ideal amount of cash flow varies depending on factors such as the size of the business, its industry, and its growth stage. Rather than a specific amount of cash flow, just aim to generate positive cash flow as early as possible.

Positive cash flow is a strong benchmark of any healthy business, indicating that more money is being generated than is being spent. It’s essential to monitor your cash flow regularly and strive for consistency and positive trends over time. Once you have positive cash flow, you can dig into the specific amount deemed “good” for your business. This will depend on your financial goals, expenses, and capital requirements.

How do you summarize cash flow for small businesses?

Creating a cash flow projection involves estimating the inflows and outflows of cash over a specific period, typically monthly or quarterly. Start by listing all your sources of cash inflow, such as sales revenue, investments, and loans. Then, detail your anticipated cash outflows, including operating expenses, loan repayments, taxes, and any planned investments or purchases. By subtracting the total cash outflows from the total cash inflows, you can calculate your projected net cash flow for each period. Utilizing software to track invoices and bill payments can streamline this process, improve accuracy, and provide insights into your business’s financial health.

Businesses that use Flow get paid 41 days faster on average

What is an example of cash flow in a small business?

Let’s use a small marketing agency as an example. The cash flow statement would include cash inflows from recurring client contracts, as well as additional revenue streams such as ad hoc services. On the outflow side, expenses like subcontractors, rent, utilities, employee wages, and taxes would be accounted for. By comparing the total cash inflows to the total cash outflows, the business can determine its net cash flow for a given period.

How can small businesses generate cash flow fast?

Generating cash flow quickly often involves strategies to accelerate revenue collection or reduce expenses. For instance, offering discounts for early payment or incentivizing customers to pay invoices promptly can speed up cash inflows. Additionally, optimizing inventory management to minimize carrying costs and selling slow-moving items can free up cash tied up in inventory. Exploring alternative financing options such as invoice factoring or short-term loans can also provide an infusion of cash when needed.

However, it’s crucial to balance the need for immediate cash flow with the long-term financial health and sustainability of your business. Make sure the on-demand cash flow solution offers more benefits to your business than downsides. With Hopscotch Flow, you can unlock funds from unpaid invoices in just a few clicks. There’s no credit check required, your privacy is guaranteed, and you get 90% of the total invoice amount instantly.

Is cash flow the same as profit?

No, cash flow and profit are not the same, although they are related. Profitability refers to the difference between revenue and expenses over a specific period, as reported on the income statement. In contrast, cash flow focuses on the movement of cash in and out of the business, considering factors such as accounts receivable, accounts payable, and non-cash expenses like depreciation.

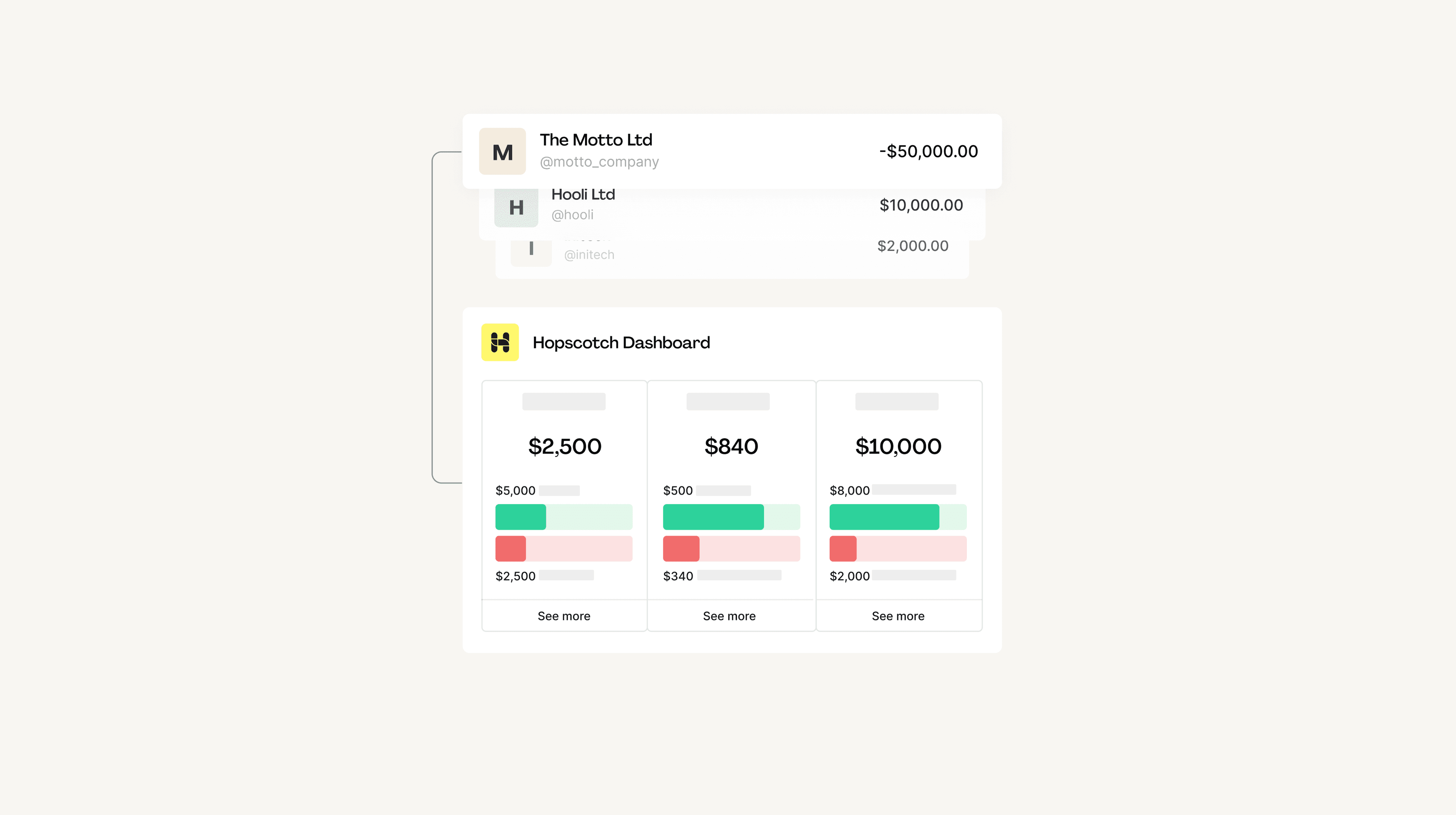

There’s often a delay between when profit is recognized (when goods are marked as sold from an accounting perspective) and when profit is officially collected (when outstanding invoices are actually paid by clients). Let’s say your business secures a client contract worth $50,000 with net-60 invoice payment terms. That sale will appear as income on your balance sheet, but you won’t actually receive the money for another 2 months. Your cash flow statement will show that you don’t have access to that $50,000 and therefore can’t use it to pay any of your immediate expenses.

Cash flow measures money as it moves in and out of a business, whereas profit measures the net income of a business. Both need to work in lockstep for a business to grow successfully. While a profitable business may have positive cash flow, it’s possible for a profitable business to experience negative cash flow if cash outflows exceed cash inflows. Understanding the distinction between cash flow and profit is essential for effective financial management and decision-making.

How do small businesses calculate cash flow?

There are two main methods to calculate cash flow and generate a cash flow statement.

The direct method goes into greater detail and involves listing every single source of inflow and outflow to your business. On one hand, this method is simple because it separates transactions into just 2 categories—positive and negative. On the other hand, it requires tracking cash in an extremely detailed way that isn’t realistic for many businesses.

The indirect method of calculating cash flow is based on accrual accounting, which records revenue before it’s actually realized and expenses when they are incurred. It doesn’t matter exactly when the payment is made, but when the transaction officially takes place. You can read more about these calculation methods here.

On cash flow statements, inflows and expenses fall into one of 3 categories: operating cash flow, investing cash flow, and financing cash flow, each reflecting different aspects of a business’s financial activities. By analyzing these components, businesses can gain insights into their sources and uses of cash and make informed decisions to improve cash flow management.

How do small businesses convert profit into cash flow?

Converting profit into cash flow for small businesses involves managing the timing of cash inflows and outflows to align with operational needs. Strategies such as optimizing accounts receivable by incentivizing prompt payment from customers and negotiating favorable payment terms with suppliers can help accelerate cash inflows and delay cash outflows. Additionally, minimizing non-cash expenses like depreciation and amortization can enhance cash flow generation. Ultimately, prioritizing liquidity and efficiently managing working capital are key to converting profit into cash flow effectively.

Effective cash flow management enables small businesses to sustain operations, seize growth opportunities, and navigate economic challenges. If you’re running a small business, consider investing in a payments software like Hopscotch that will streamline your invoicing process and always make sure you get paid on time. Start your free trial today!

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.