What You’ll Learn

- How to select an all-in-one platform that grows with your business

- Essential features to consider when upgrading your payments process

- The power of centralizing invoicing, bill bay, and cash flow in one dashboard

Accounting teams at growing businesses inevitably reach a day when their current invoicing solution feels inadequate. When it’s time to choose white label invoicing software, look for features that create an optimal payment processing experience for your business and your clients.

What you should get from white label invoicing software

When evaluating what to look for in white label invoicing software, start by considering your daily operational pain points. When billing multiple clients with different payment terms, the right platform should feel like hiring an extra team member—one that works 24/7 handling your invoicing needs.

Your current system might work, but at what cost? If your team spends hours each week creating invoices, sending reminders, and reconciling payments, you’re leaving money on the table.

Here are some things to look for when choosing white label invoicing software:

1. User-friendly interface

Even non-technical team members should find the invoicing platform intuitive and easy to navigate. The ideal software will minimize the learning curve, allowing your team to dive into invoicing tasks with ease, reducing onboarding time and enhancing efficiency from day one.

2. Onboarding and setup

Choose invoicing software that offers guided onboarding for new users and straightforward integration, allowing your team to get up and running with minimal downtime. An efficient setup process lets you focus on core tasks without getting bogged down by extensive software training.

3. Flexibility in invoice design

Brand identity is crucial, especially for small businesses providing design or other creative services. (Today, hundreds of agencies use Hopscotch to pay and get paid.) The right invoicing software should offer various customization options. Platforms with robust branding controls allow you to add logos, colors, and design invoice templates that reflect your brand.

4. Control over payment experience

Your white label invoicing software should offer flexibility in designing payment screens and notifications to match your unique branding needs. Look for platforms that allow you to personalize the payment journey and customize payment gateways. This flexibility creates a seamless payment experience for your clients by ensuring each invoice matches the look and feel of your business. This reduces friction and increases confidence in the security of your payments experience.

5. Early payment options

For B2B businesses managing variable cash flow, early payment options can make a significant difference. Solutions like Hopscotch Flow empower you to offer early payment incentives to clients, which can stabilize cash flow without drastically impacting your margins. This feature is particularly helpful during slower months, giving you an avenue to consistent revenue to cover expenses.

6. Recurring invoices

Automating recurring invoices can save substantial time for service-based businesses with long-term clients or subscription-based billing. A white label invoicing solution with recurring billing features simplifies the process, reducing manual work and ensuring timely invoicing for ongoing services.

7. Compliance with regulations

Your invoicing platform should comply with relevant global regulations to protect your business and client data. Look for software that meets industry standards and certifications, such as financial data encryption.

8. Integrations with accounting software

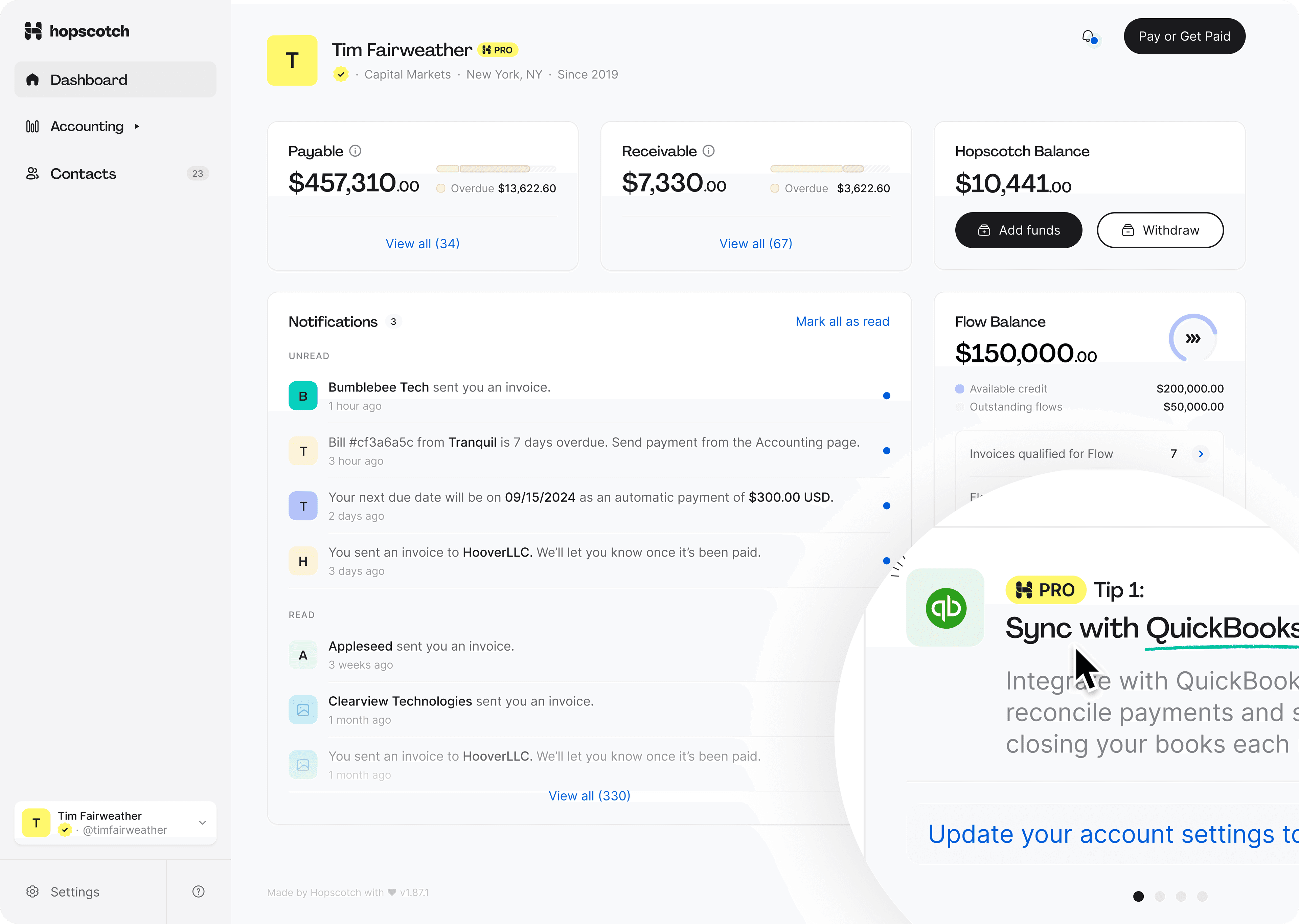

Choosing invoicing software that integrates with popular accounting tools, such as QuickBooks, can streamline your financial management. Seamless integration allows you to sync data easily, reducing the risk of manual errors and enhancing your team’s efficiency.

9. Cost-effectiveness

Whether your business needs a free or budget-friendly option, selecting a cost-effective solution is essential. The best invoicing software offers high-quality features at a reasonable price, supporting your growth without overextending your budget.

What your clients want from white label invoicing software

Your clients—whether they’re Fortune 500 companies or growing startups—expect a professional, friction-free payment experience. After delivering outstanding services, the last thing you want is payment delays because your invoicing system is confusing or limited in payment options.

1. Multiple payment gateways

Think about your clients’ accounts payable teams. They’re processing invoices from numerous vendors, and anything that simplifies their workflow makes your team easier to work with. A platform offering multiple payment methods, clear payment terms, and automated reminders can make the difference between getting paid on time and waiting weeks past due dates.

2. Mobile accessibility

Mobile accessibility isn’t just a nice-to-have feature anymore. When your client’s CEO wants to review and approve an invoice while traveling, or their finance team needs to process payments remotely, your invoicing platform should work flawlessly across all devices.

3. Automated reminders

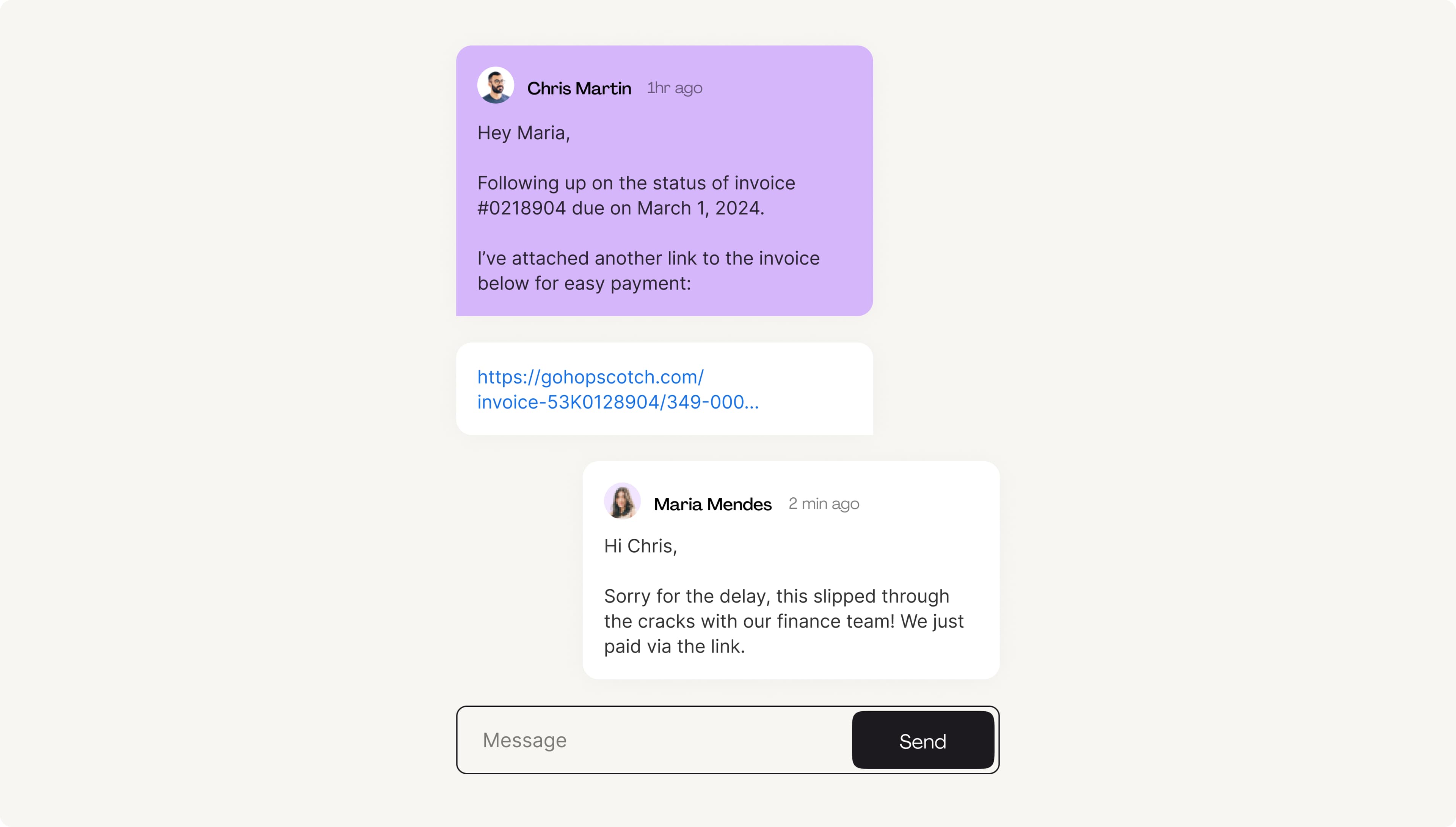

The best white label solutions are designed to serve the unique dynamics of provider-client relationships. They offer features that maintain professionalism while streamlining payments. Automated payment reminders are a must. Customize your automated messages to strike the right tone with your clients, ensuring consistent communication without straining client relationships during collection periods.

4. Data security

When choosing a white label invoicing platform, ensure it uses robust encryption protocols and secure payment processing methods to safeguard your business’s financial information, as well as your clients’ data. This layer of protection not only guards against unauthorized access but also builds trust, signaling to clients that your brand is serious about maintaining high security standards.

5. User-friendly interface

The invoicing platform should feel as intuitive as opening an email or any familiar online tool. A clean, user-friendly interface reduces training time for your team and minimizes the likelihood of errors, which can be costly and time-consuming to correct. This level of usability also ensures your finance team can operate efficiently, freeing them from the technical headaches often associated with complex invoicing systems.

For established businesses still securing their market position, choosing the right invoicing platform isn’t just about managing current needs—it’s about supporting future growth. The right solution helps stabilize cash flow, reduces administrative overhead, and provides the professional image that keeps you competitive with other service-based businesses.

How white label invoicing software can support growth and profitability

Choosing a white label invoicing platform isn’t only about managing invoices; it’s a strategic investment for any small service-based business interested in growth and profitability.

As your business scales, handling finances effectively becomes crucial for maximizing revenue and sustaining steady cash flow. The right software can help you navigate high-growth periods smoothly, support increased transaction volume, and keep your team focused on your most vital tasks.

White label invoicing software can also enhance profitability by reducing invoicing and payment bottlenecks. Features like time-tracking integrations and detailed reporting provide insights into where project time is being spent, allowing you to monitor budget overruns and adjust invoicing as needed.

Hopscotch: white label invoicing software that works for you and your clients

When your business streamlines its invoicing process, you will see improvements in client satisfaction. By removing friction points, clients can approve invoices more quickly, and you can receive payments faster. With Hopscotch’s reporting features, your finance team gains the ability to analyze trends and patterns, such as identifying slow-paying clients and peak cash flow times. Smarter financial planning can begin with better invoicing.

Discover how Hopscotch not only simplifies your billing process but also empowers your growth trajectory. Sign up today.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.