What You’ll Learn

- How to navigate the legalities of charging interest or late fees on overdue invoices

- The state-by-state variability in maximum allowable charges

- Whether charging late fees and interest truly encourages timely payments

Most business owners have faced the frustration of unpaid invoices. Late payments can hurt cash flow and disrupt operations, leading many businesses to implement overdue invoice charges like late fees or interest.

But can you legally charge interest on overdue invoices? And if so, is there a limit to what you can charge? This article breaks down the legal, financial, and relational aspects of managing overdue payments with late fees and interest.

How do late fees and interest work?

Late fees and interest are tools businesses use to address overdue invoices, but they work in distinct ways.

Late fees vs. interest: What’s the difference?

- Late fees are flat charges applied once an invoice becomes overdue. For example, if a client misses a 30-day payment deadline, a business might charge a $25 penalty.

- Interest is a percentage-based charge applied to the overdue balance. For instance, with a 1.5% monthly interest rate, a $1,000 unpaid invoice accrues $15 monthly interest until payment is made.

How to implement late fees and interest

To enforce these charges effectively and legally, your business must:

- Set clear terms upfront. Ensure your contracts or service agreements clearly outline the conditions for late fees and interest.

- Follow legal limits. Calculate charges consistently and ensure they comply with local regulations to avoid disputes.

- Communicate proactively. Notify clients about these terms before invoicing and remind them when payments are overdue.

Putting it into practice

Imagine a client owes $1,000; the invoice is now 60 days past due. If you charge 1% monthly interest, the overdue balance will accrue $20 in interest for those two months. If your agreement also allows a $25 late fee, the total amount owed becomes $1,045.

Clearly communicating and properly implementing these charges help businesses recover overdue payments while maintaining professional relationships.

Can any company charge late fees or interest?

Not every business can impose late fees or interest on overdue invoices without proper precautions. The ability to demand these overdue invoice charges depends on having a clear, legally enforceable agreement in place. You may wonder, “How much can I charge for late fees?”

In most jurisdictions, the late fees or interest terms must be explicitly stated in the original contract or invoice. Attempting to impose vague or retroactive charges often fails to hold up legally and could lead to disputes.

Businesses should follow a few best practices to ensure compliance and avoid misunderstandings.

- First, consult a legal expert to verify that your terms align with local and federal laws.

- Use clear and specific language in your agreements to prevent ambiguity.

- Be proactive and inform clients about potential charges when discussing payment terms to ensure they fully understand the consequences of overdue payments.

Taking these steps safeguards your business and fosters trust and transparency with clients.

Navigating state-specific laws

The rules around maximum invoice late fees by state are highly varied. For example, in California, businesses are generally limited to charging late fees that do not exceed 10% of the invoice amount unless otherwise agreed upon in a contract.

In Florida, the law caps monthly interest on overdue invoices at 1.5% unless a written agreement explicitly outlines a higher rate. These variations highlight the importance of tailoring your invoicing practices to your state’s legal requirements.

To stay on the right side of the law, familiarize yourself with your state’s usury laws, which govern maximum allowable interest rates. Digital tools and legal resources are also available to help verify the specific rules in your region.

For the most accurate and reliable guidance, consider consulting official state government websites or seeking advice from a legal professional. Taking these steps can help you avoid penalties or disputes while safeguarding your ability to recover overdue invoice charges.

Are late fees and interest effective?

Late fees and interest can be effective tools for encouraging timely payments, but their impact often depends on how and when they are applied.

Businesses that communicate their policies upfront can reduce the risk of making clients feel caught off guard by additional charges. However, the effectiveness of these fees diminishes if clients believe they are overly punitive. Excessively high fees, for example, may backfire by discouraging clients from paying altogether, as they may feel overwhelmed by the growing balance.

It is also important to consider how late fees and interest might affect client relationships. Applying these charges too aggressively can jeopardize trust and goodwill, especially if clients feel unfairly penalized. Striking a balance between firmness and flexibility is key to maintaining healthy relationships while addressing overdue invoices.

For businesses looking to ensure payment while preserving client rapport, softer alternatives may be worth exploring.

- Friendly reminders, sent as follow-ups before fees are applied, can prompt action without escalating the situation.

- Offering early payment discounts, such as a small percentage off for payments made before the due date, provides a positive incentive for clients.

- Providing the option to set up a payment plan for clients struggling with cash flow can make it easier for them to settle their debts while demonstrating your willingness to work with them.

By combining clear communication, strategic use of fees, and alternative approaches, businesses can improve their chances of getting paid while maintaining positive client relationships.

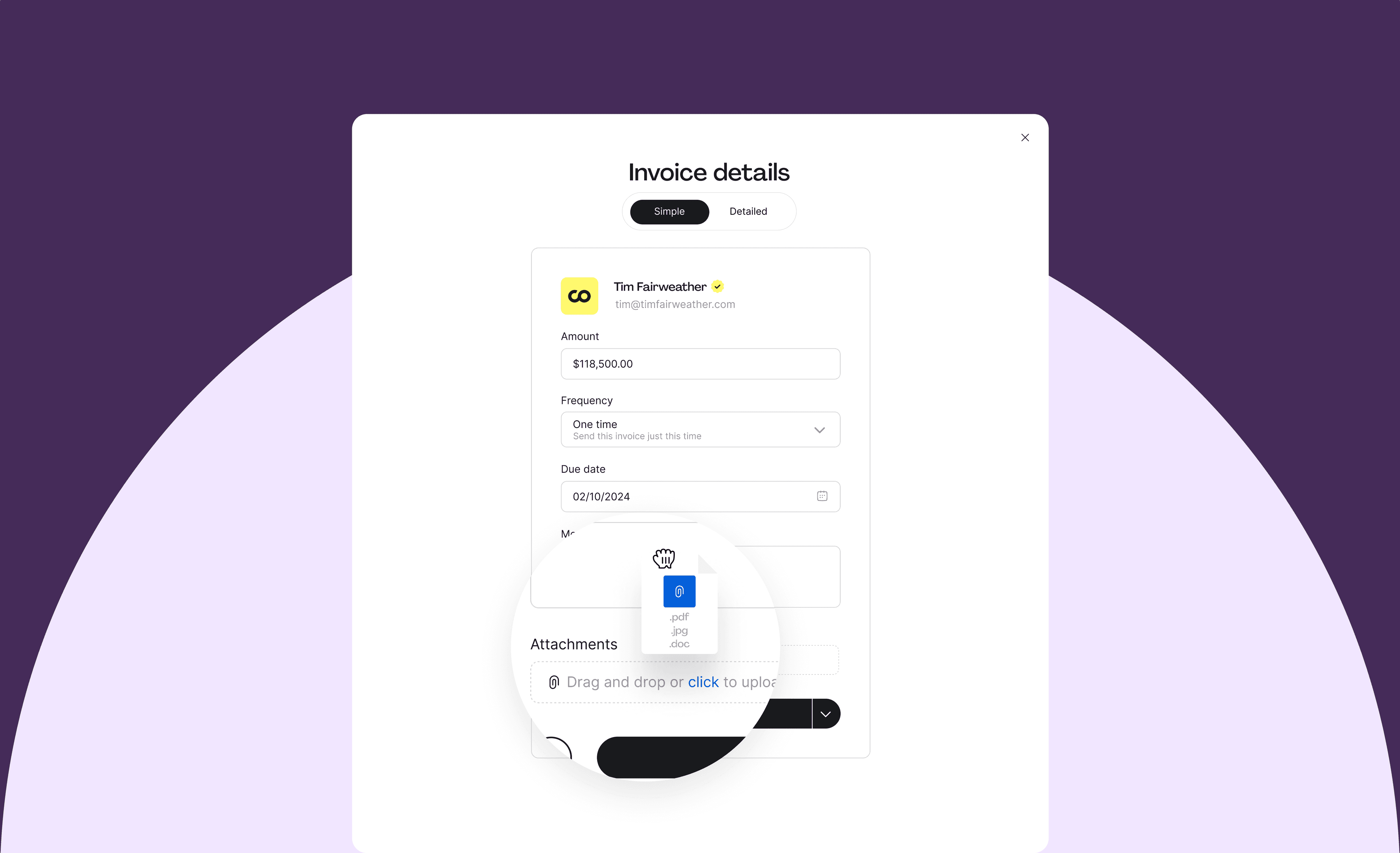

Make invoicing easier and more effective with Hopscotch

Late fees and interest can be effective tools when used correctly. However, managing overdue invoice charges doesn’t have to cause financial strain on your business. With Hopscotch Flow, you can get paid faster and reduce cash flow headaches.

Try Hopscotch today and take control of your invoicing process!

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.