What You’ll Learn:

- How self-employed freelancers, consultants, and contractors should invoice

- Tips for easily creating and sending professional looking invoices

- Invoicing strategies for getting paid on time and impressing clients

Self-employed freelancers, consultants, and contractors have a lot on their plates. These multi-hyphenate professionals are constantly hustling and working hard to impress clients with high-quality services and outcomes. It’s no wonder that invoicing is an afterthought for many of these solopreneurs. But overlooking the payment experience can present major challenges—from gaps in cash flow to negative customer experiences.

Why invoicing matters for the self-employed

When it comes to getting paid, small businesses need strong processes in place. Why? Because messy invoicing causes problems! Here are some telltale signs that your invoicing process is letting your business down:

- Invoices are randomly generated or poorly designed.

- Payment notifications and reminders are sporadic.

- Invoice sharing is sloppy, attached to an email.

- Invoices are missing important instructions.

These kinds of missteps can create a bad impression. Not only that, poor invoicing practices can create confusion for clients and ultimately delay payments. Small businesses are especially vulnerable to gaps in cash flow—it’s the #1 reason they fail! So providing a simple, easy-to-use payment experience that works for both you and your clients is crucial for the self-employed workforce.

How to make a freelancer or consultant invoice

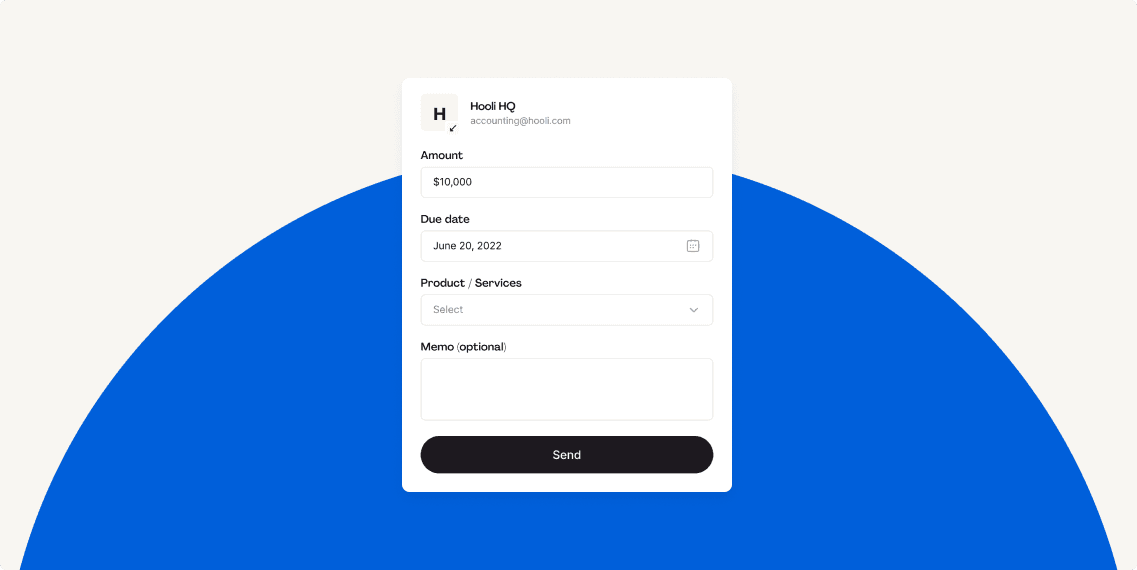

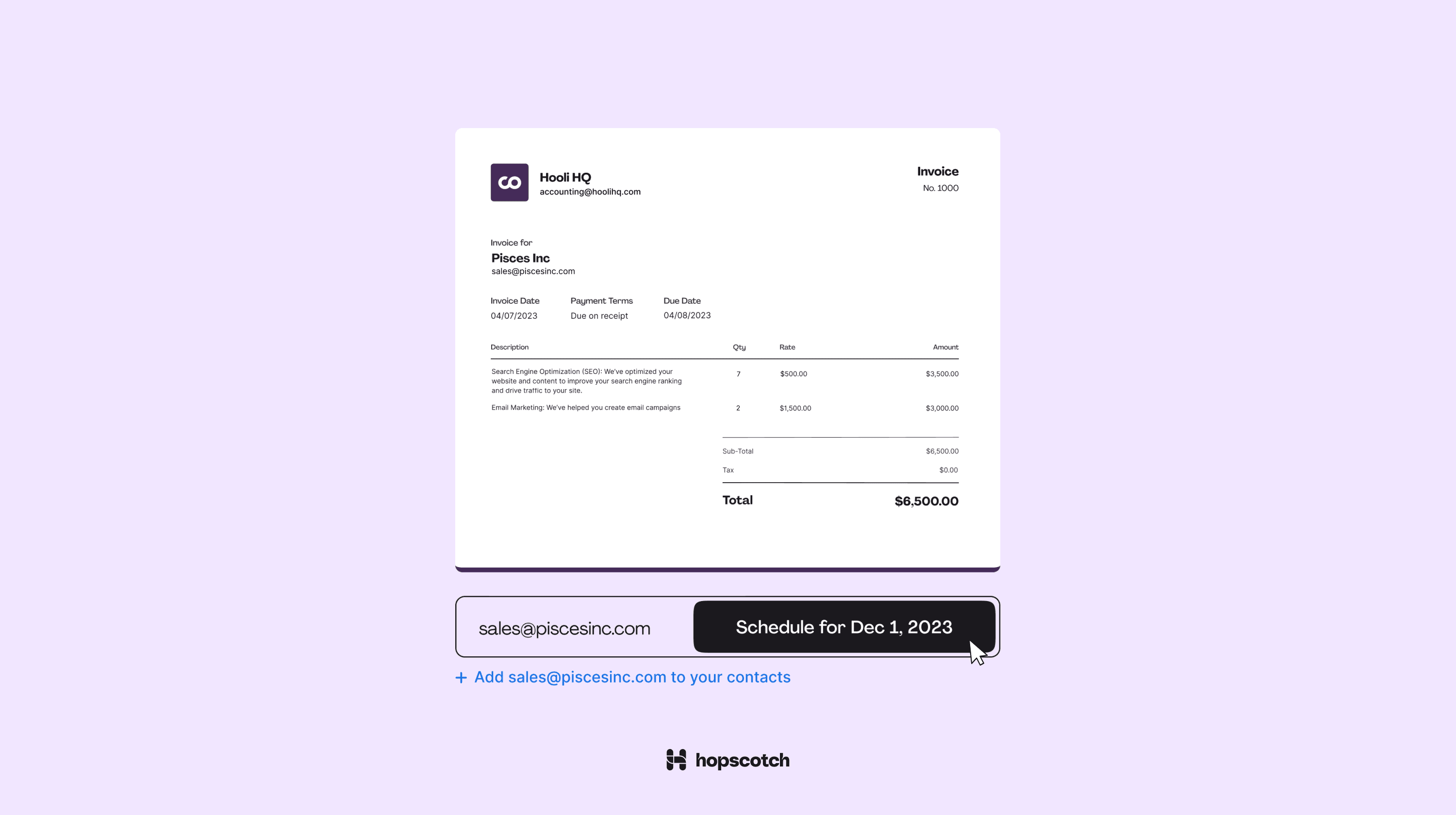

So you’re ready to improve your invoicing process and send your client an invoice…but where do you start? You need to be sure to include all the must-have invoice information like the due date, a description of services rendered, and the invoice number.

In terms of the design, invoices need to look and feel just as professional as all the content that came before. Otherwise, you risk undermining all that effort with a sub-par payment touchpoint. There are tons of templates available online, but make sure you can adapt the templates to your brand. Drop in colors, logos, fonts, and icons to help your customer recognize your business and validate the authenticity of the invoice.

Invoicing best practices for the self-employed

Once you choose a template that works for your business, the next step is developing an easy way to consistently generate and send those invoices. The workflow should be simple and accessible for you or the designated point person on your team. Getting bogged down in financial admin every month is a no-no for self-employed individuals, who need to be ruthless about their time management. You don’t want to waste precious billable hours on tasks that can be automated with the right tools. Your time and skills are better spent generating revenue for your business. So create an efficient process and stick to it.

When should I send an invoice?

It might make sense to send invoices at the end of the month in a batch, or throughout the month as you complete work. You’ll also need to stay organized about what’s coming and going from your business.

How many payment methods should I offer my clients?

Making it easy for clients to render payment is a must. One way to do that is by offering a variety of popular and convenient payment methods including credit/debit card and ACH or bank transfer. You’ll also need to stay organized about what’s coming and going from your business. Think about the number of clients you interact with on a quarterly and yearly basis. Monitoring the payment status of all those outstanding invoices will ensure that receivables arrive on-time and you have enough cash on-hand to pay bills to any vendors or subcontractors.

How to follow-up on invoice payments?

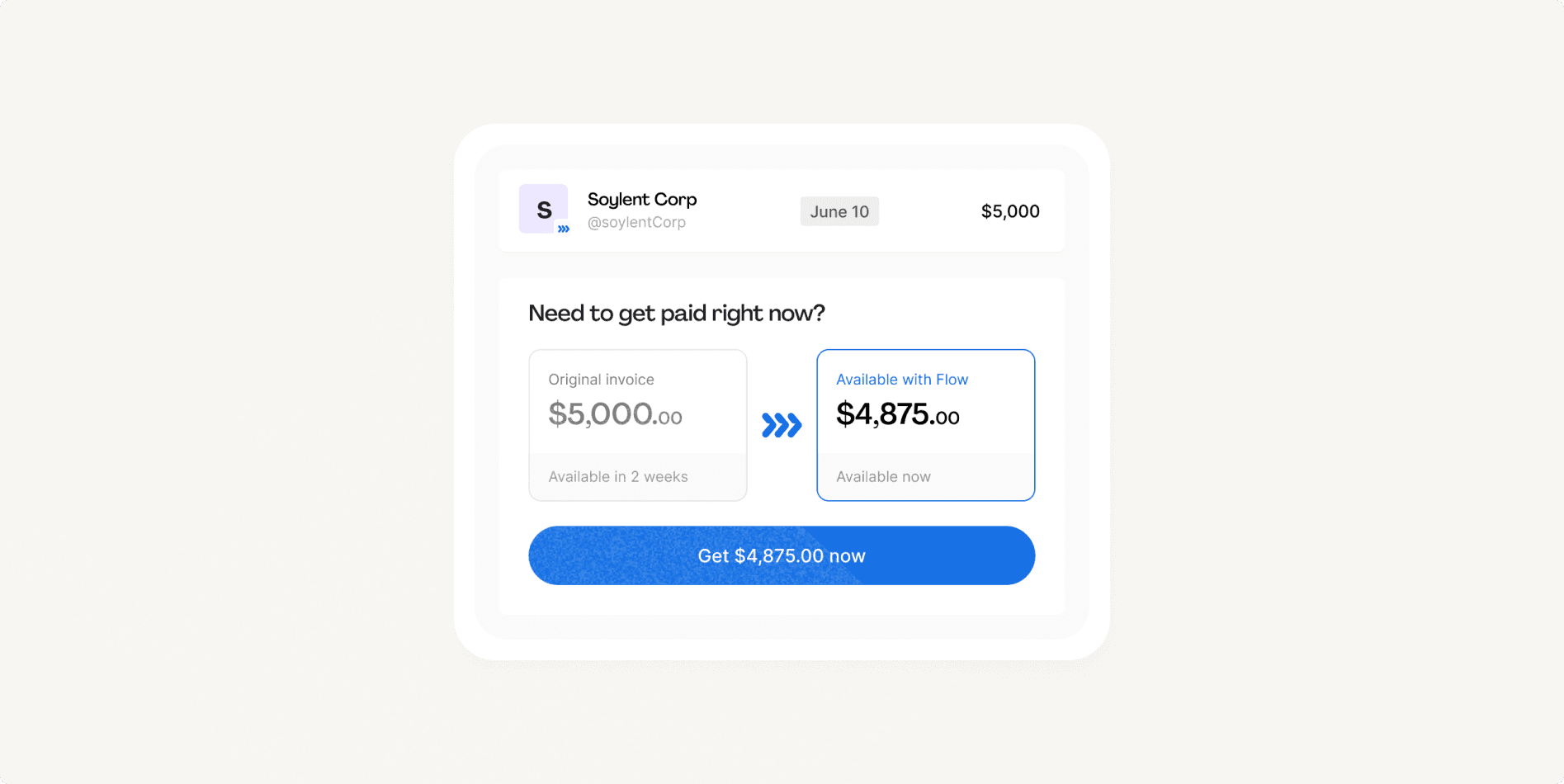

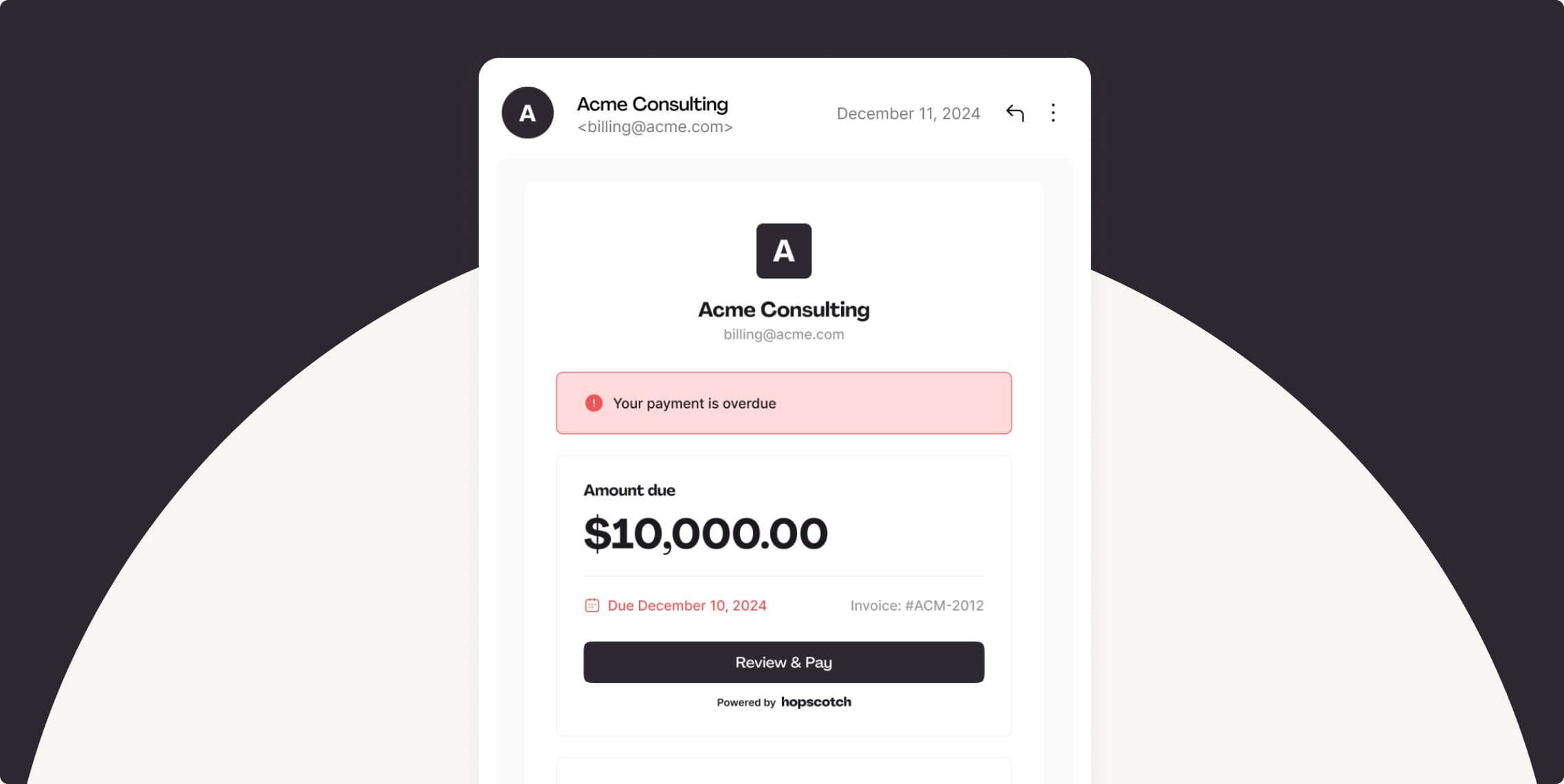

Staying on top of payment status and accurately tracking what’s due or overdue is critical for self-employed workers looking to maintain visibility on their cash flow. In order to keep your finger on the pulse of payments, you probably want to develop an automated series of reminder emails and messages. Having this sequence trigger automatically will ensure you don’t let something fall through the cracks.

How do I send secure invoices?

Finding an invoice template that works for you is just the first part of setting up your payment process. You also need to consider the best channels to send and receive payments. Attaching an invoice with sensitive financial information in an email, for example, is not the most secure way to operate your business. Platforms like Hopscotch offer secure transactions thanks to end-to-end encryption on all payments.

Building an invoicing system from scratch that accomplishes all this would be time-consuming, which is why many self-employed people prefer to find a product that manages all their payment needs.

Hopscotch is the all-in-one invoicing and bill pay solution for small businesses. Offering a side-by-side ledger of accounts payable and receivable, Hopscotch helps you save time with useful features like auto-reminders and save money with fee-free payment options.

Invoice templates vs. invoicing software

At the end of the day, deciding whether to build your own piecemeal process around invoice templates or to go with a full-service invoicing software solution will depend on the needs of your business. Here are some pros and cons to consider:

Pros of invoicing software

- All-in-one solution. The self-employed workforce is busy. Finding a pre-built invoicing solution with high-quality templates and payment workflows might offer tons of convenience and simplify your monthly financial admin considerably.

- Save time and money. Invoicing software is designed to be easy-to-use and competitive, which means there are likely benefits for your business. For example, in addition to simple or detailed invoice templates Hopscotch offers tons of other features like fee-free payment options which can save small businesses thousands of dollars every year.

- Secure payments. Transacting over a secure payment network will likely give your clients peace of mind about the safety of their financial data.

- Support team. If you hit a snag or need assistance, your team of one may benefit greatly from having access to a support team.

- Design quality. Creating an invoice template from scratch is time-consuming and likely won’t add any discernible value to your business. Using a template you can generate, customize, and send through Hopscotch is a great way to manage the payment experience for your clients from start to finish.

Cons of invoicing software

- Upfront costs. There are typically some costs involved with creating an account and using invoicing software, whether they be one-time membership or transaction fees. Do research before you decide which platform to partner with for your payments experience and find the ones that offer the most competitive rates.

Make your business invincible, one invoice at a time

What should a self employed invoice include?

Here are the basic elements required for any invoice:

- Your company’s name, address, and contact info.

- Your client’s company name, address, and contact info.

- Invoice number to track this payment in your records.

- Date invoice is sent

- Date invoice is due:

- Line item and description of services or goods provided.

- Total amount owed

- Invoice note including any additional information relevant to the invoice.

- Payment terms and any late fees or early payment incentives

This isn’t an exhaustive list. You can choose to add more detail depending on the needs of your business and the preferences of your clients. But not including any of these data points might put your invoice at risk of not being paid on-time.

Do I need to add tax to my freelance invoice?

Determining whether you need to include taxes in your freelance invoice depends on your location and the type of services you provide. Sales tax regulations are set by state and local governments, which mean they vary significantly by region. If you operate remotely and serve clients in various states, you may want to verify whether your specific service is subject to taxation and the rates that apply. Some states may mandate tax collection only from businesses licensed within that state or from businesses that hit a particular annual revenue threshold. Your income tax rate depends on how you do business — freelancers pay a different rate than small businesses registered as LLCs, S-Corps, etc. As a freelancer, you may want to take your tax rate and your take-home pay into consideration when pricing your services.

Ready to use an easy self-employed invoice template?

Poor invoicing can lead to cash flow gaps and low client retention. To enhance your invoicing practices, consider using an all-in-one solution like Hopscotch, which not only offers customizable templates but also provides fee-free payment options, secure transactions, and instant cash flow.

Hopscotch is the all-in-one payment solution for small businesses that want to simplify and automate their invoicing process. Create and send custom invoices in seconds. Use simple or detailed templates and add brand colors, fonts, and logos. Want to give it a try? Start your free trial today!

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.