What You’ll Learn:

- How invoice factoring works

- How invoice factoring compares to a loan

- What makes Hopscotch Flow better than other lending solutions

You’ve delivered the goods or services your clients ordered, on schedule and as specified. But when it’s time for you to get paid, you play the waiting game. Some clients can take weeks or even months to pay their bills. Waiting for net terms to pass can feel like watching paint dry—it’s slow and frustrating. And delays can cause cash flow problems, leaving you struggling to cover expenses, pay employees, and grow your business.

Invoice factoring is a standard solution for advancing capital and covering gaps in cash flow. But is invoice factoring a loan? Understanding the difference between traditional and alternative funding products can help you make a more informed decision for your business.

Is Invoice Factoring a Loan?

No, invoice factoring is not a loan. It’s technically a transaction. You as a business owner sell your unpaid invoices to a factoring service, and they advance you the invoice amount (less the fees they charge for their factoring services) before the net payment terms of the original invoice—usually 30 or 60 days.

From that point onward, the factoring company owns your company’s receivable and will collect on the invoice amount when it’s eventually paid by your client. Invoice factoring doesn’t put your company in debt or risk its assets. Invoice factoring allows you to receive funds immediately without borrowing money you’ll eventually need to repay.

Want to learn more about instant payments and cash flow control?

Invoice Factoring vs. Business Loans

Invoice factoring and business loans aren’t the same, but each has perks and drawbacks. Knowing the key differences can make choosing the appropriate one for your business easier. Here are a few commonly asked questions about the two options:

Do you need to apply for invoice factoring or business loans?

Yes, but the application process is different for each option. The application for a business loan is usually extensive, requiring detailed financial statements, business plans, and personal guarantees. In contrast, invoice factoring requires fewer documents and is more straightforward. You simply sell your unpaid invoices to the factoring company, and they advance you the cash.

Is there a credit check?

In most cases, lenders will thoroughly check your credit and scrutinize your personal and business credit scores before offering a loan. This process can be a barrier for companies with less-than-perfect credit. Invoice factoring primarily hinges on the creditworthiness of your clients, not your business.

Do you have to pay the money back?

One of the most significant differences between loans and invoice factoring is repayment. With a business loan, you must repay the borrowed amount with interest, which can strain your cash flow. Factoring rates are typically lower and more predictable, with Hopscotch Flow offering some of the most competitive rates and terms for small businesses to get paid instantly. And since you’re selling your invoices, there’s no loan to repay—just a small fee deducted from the invoice amount.

Will it go on your credit report?

Business loans show up on your credit report. They impact your credit score and can limit your ability to secure future financing. Invoice factoring doesn’t involve taking on debt, so it doesn’t appear as a liability on your balance sheets. This means your credit report and credit score won’t be impacted. But if you’re hoping to qualify for invoice factoring, the credit score of your clients will likely be reviewed by the factoring company.

How much money is available through each option?

With invoice factoring, the amount of money you can access is limited to the value of your unpaid invoices. If your invoices total $40,000, that’s the maximum you’ll get, minus any fees. For larger financing needs, consider a business loan. However, remember that a loan increases your debt and may come with higher interest rates.

Ultimately, deciding between invoice factoring and a business loan depends on your needs and financial situation. When compared to traditional loans, which can use your assets as collateral and strain your cash flow, invoice factoring might be less risky.

Want invoice factoring without the downsides? Get paid instantly with Hopscotch Flow

Hopscotch Flow is superior to business loans and traditional invoice factoring, which can be expensive, slow, and inconvenient. With Hopscotch Flow, you get the best of both worlds: a quick infusion of cash without the inconvenience of traditional factoring or risk of debt.

Small businesses can get paid instantly without the hassle of credit checks while protecting their valuable client relationships. Business loans put companies in debt and may affect credit scores—you won’t have to worry about that with Hopscotch Flow.

Hopscotch Flow goes even further by offering immediate eligibility checks and instant access to cash without notifying your clients. That way, your cash flow activities remain private, and your business reputation stays intact.

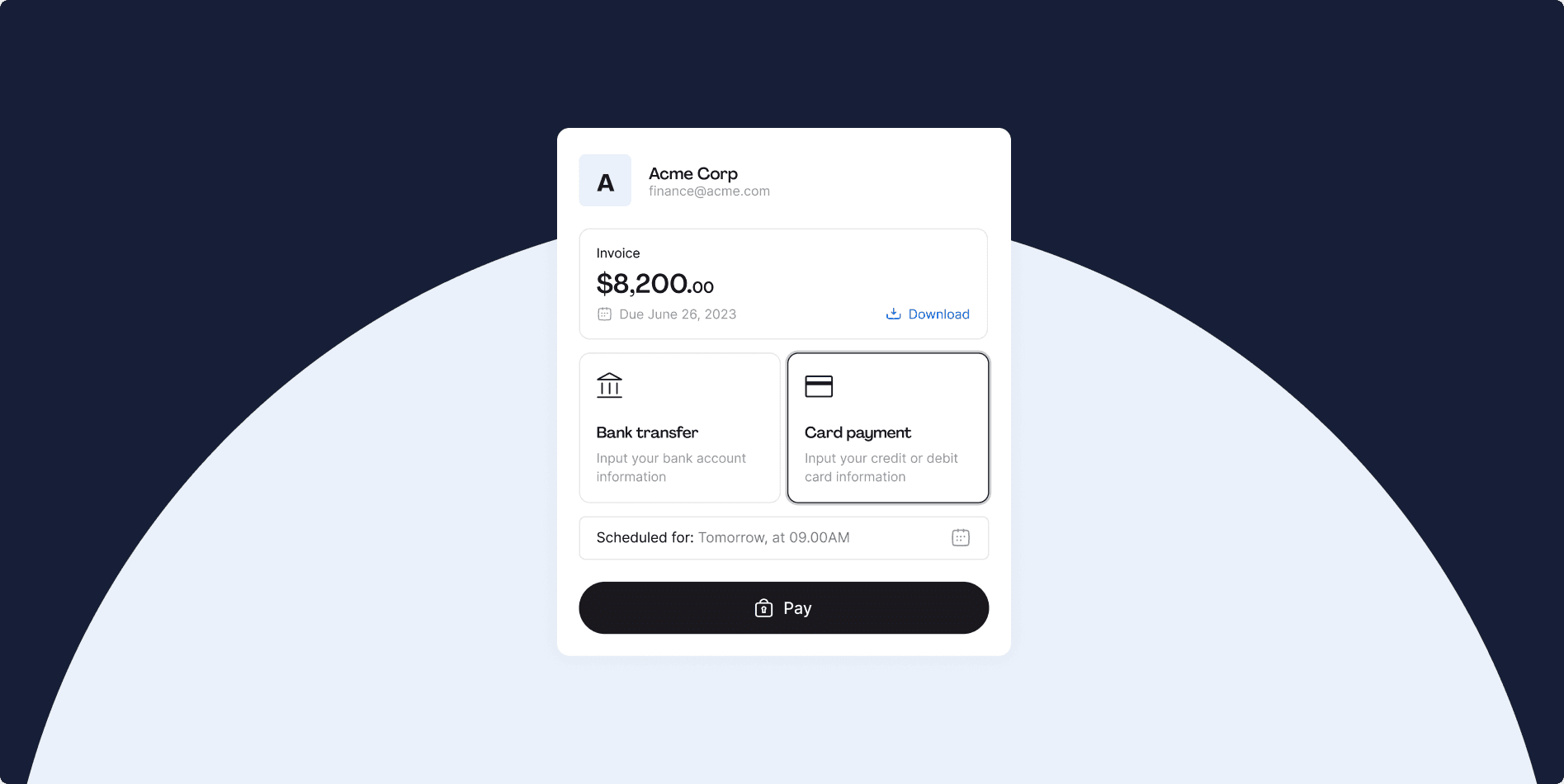

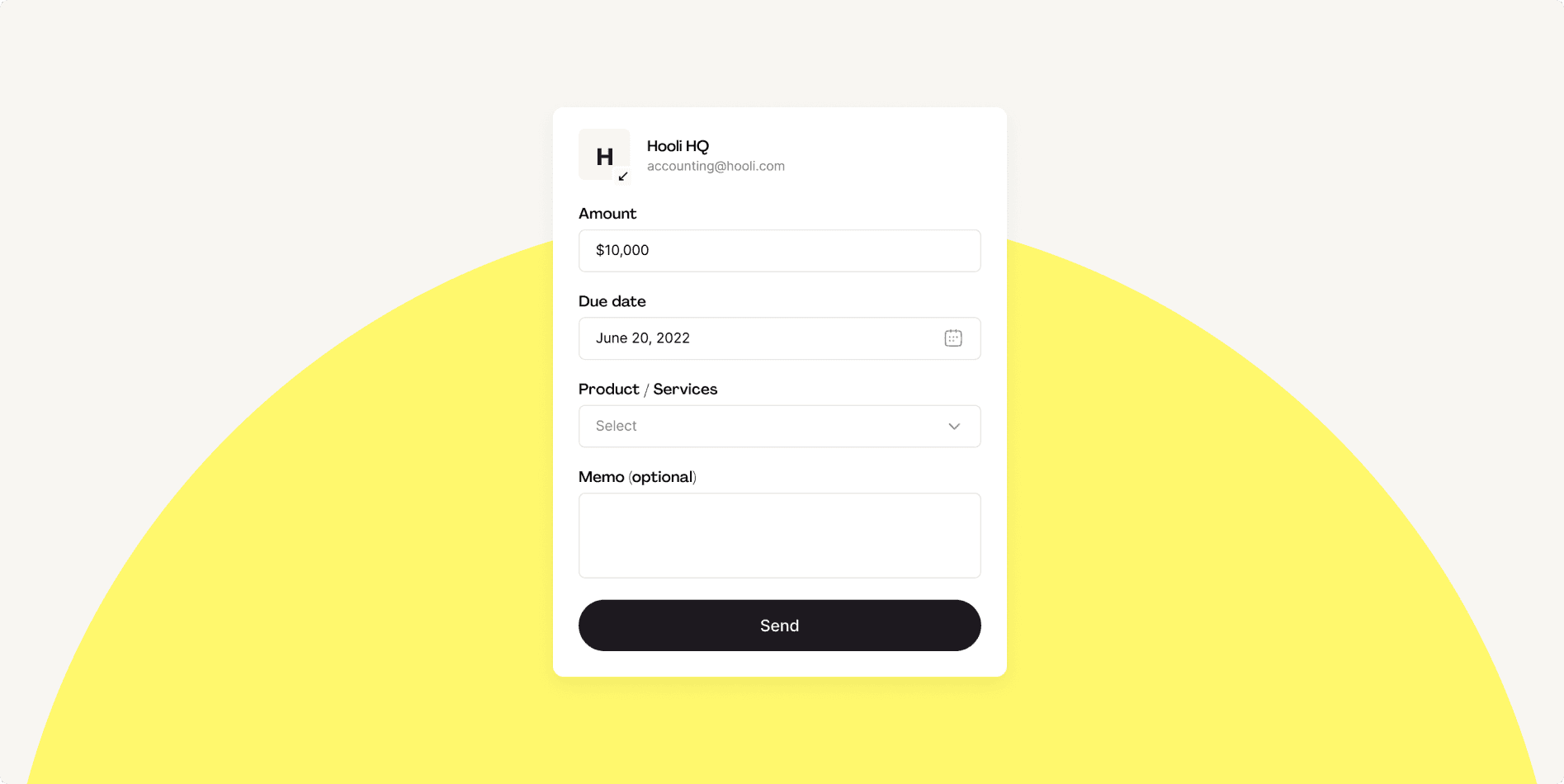

Additionally, Hopscotch Flow allows you to create professional invoices with customizable templates to better manage your finances. With funds instantly added to your Hopscotch Balance upon acceptance of payment terms, Hopscotch Flow helps you avoid cash flow gaps and get paid on time.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.