What you’ll learn:

- What your clients might think about invoice factoring

- Ways to the mitigate the privacy risks of invoice factoring

- Specific confidentiality concerns your business should be aware of

Invoice factoring is a financing option that allows businesses to leverage their accounts receivable to get immediate cash in-hand. It’s a popular solution for companies facing cash flow challenges, providing quick access to funds without requiring the business to take on additional debt (like they would with a traditional business loan.)

While there are clear benefits to factoring invoices, there are also some downsides. In this article, we will explore the level of confidentiality in invoice factoring, the potential impact on customer relationships, and the risks business owners should be aware of before opting for this funding solution.

Is invoice factoring confidential?

When you factor an invoice, you’re essentially selling that receivable to a third party in exchange for upfront payment. Once the factoring company owns your invoice, they’re typically responsible for collecting payment. This can potentially expose the factoring arrangement to your customers. The lack of guaranteed confidentiality concerns some businesses, who worry about creating negative impressions among their client base.

That said, certain types of invoice factoring offer levels of confidentiality. Confidential invoice factoring, also known as invoice discounting, allows businesses to retain control over the collection process while still accessing funds against their invoices. In this arrangement, the factoring company’s involvement may not be disclosed to customers, preserving the confidentiality of the transaction.

Ultimately, whether invoice factoring is confidential depends on the specific terms of the agreement between the business selling the receivable and the factoring company. It’s essential for businesses to discuss confidentiality concerns and carefully review the terms of the agreement before committing.

Want to learn more about instant payments and cash flow control?

Why invoice factoring might be worth it to some businesses

Quick cash flow

Invoice factoring provides businesses with immediate cash, improving their liquidity and allowing them to meet short-term financial obligations or pursue growth opportunities.

No additional debt

Unlike traditional loans, invoice factoring does not create debt on the balance sheet. It’s a financing method that leverages existing assets (accounts receivable) without borrowing additional funds.

Quick and easy access to funds

The application process for invoice factoring is typically faster and less stringent than traditional financing options like loans, making it an attractive solution for businesses in need of immediate capital.

Scalable funding solution

Invoice factoring is scalable, meaning businesses can factor as many or as few invoices as needed based on their cash flow requirements.

Why some businesses might prefer alternative lending solutions

High cost

Invoice factoring comes with fees (some predatory) including a discount fee or factor fee charged by the factoring company. While it provides quick access to funds, businesses need to consider the cost implications.

Potential damage to customer relationships

In traditional factoring agreements where the factoring company communicates directly with the payor during payment collection, there’s a risk of negative experiences for your customers.

Poor customer experience

In many factoring arrangements, businesses relinquish control over the collection process. This can impact their ability to manage the payment experience for customers and potentially damage critical relationships.

Selective financing

Factoring companies may choose to finance only certain invoices, leaving businesses with potentially unmet cash flow needs for invoices that do not meet the factoring company’s criteria.

Impact on customer relationships

One of the most significant concerns for businesses considering invoice factoring is the potential impact on customer relationships. When a factoring company communicates directly with customers to collect payments, it may create confusion or concern among customers about the financial stability of the business. Additionally, customers may perceive the involvement of a third party as a sign of poor financial standing, leading to strained relationships or even loss of business.

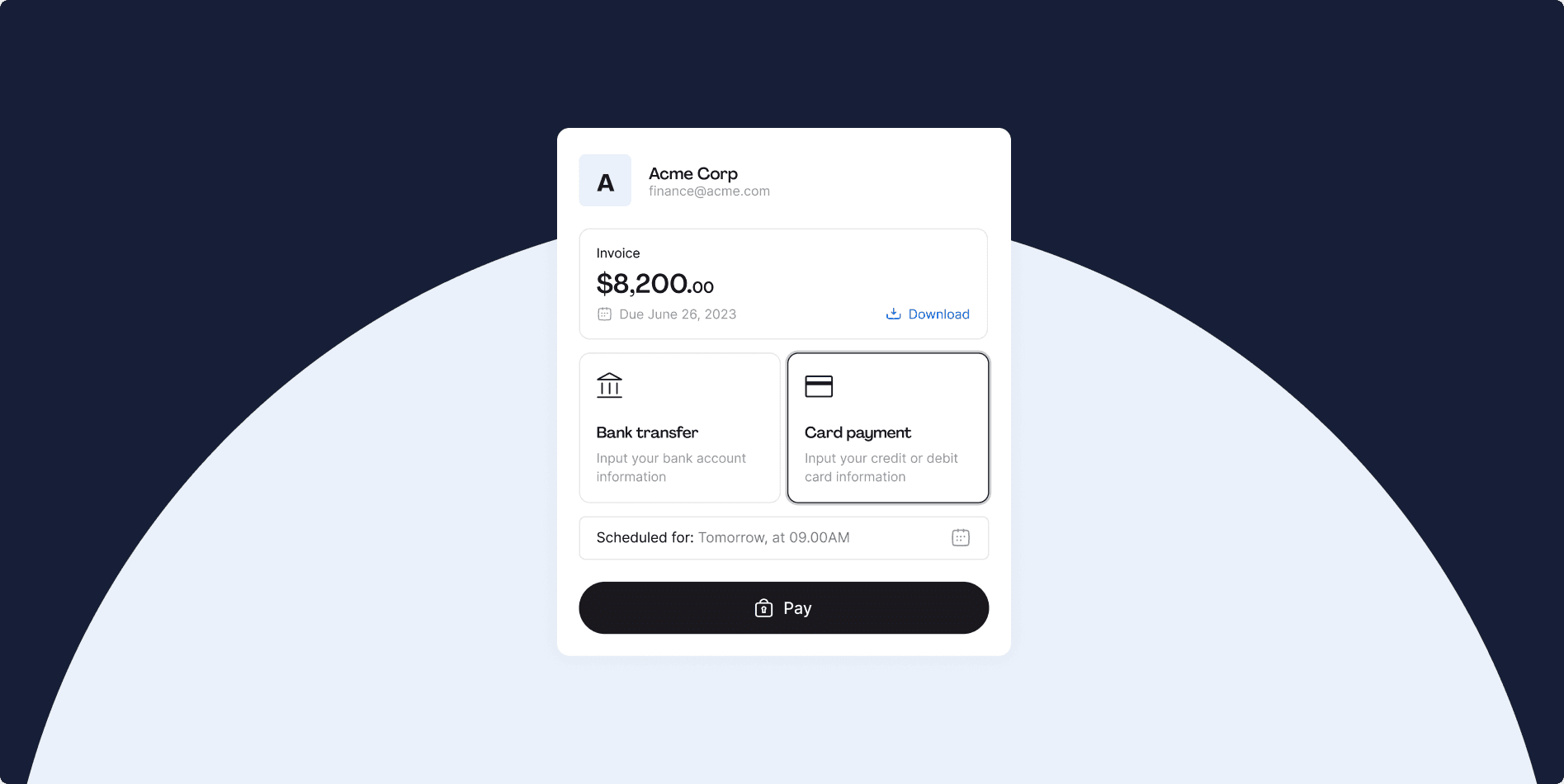

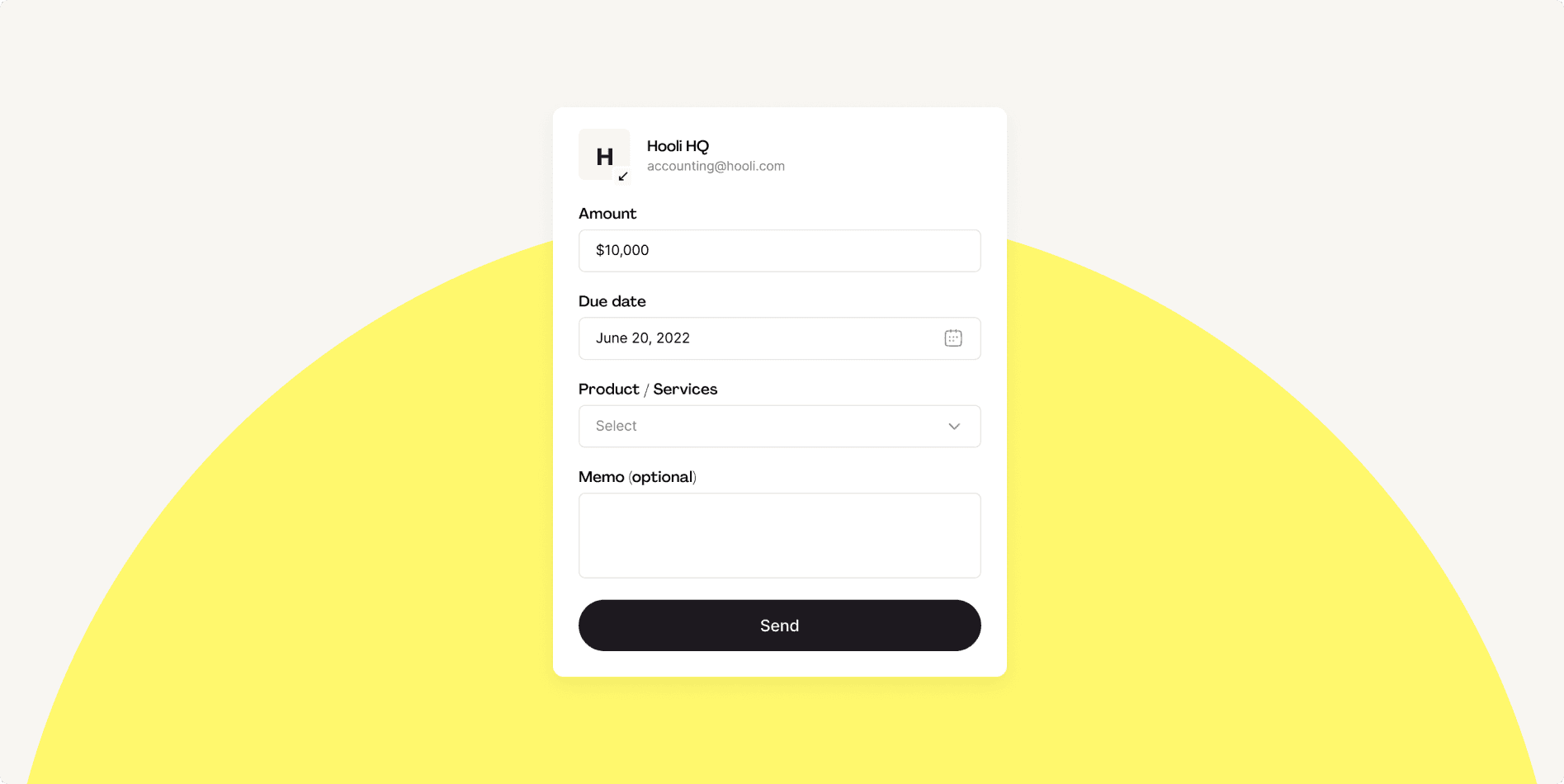

To mitigate risks like these, businesses can opt for confidential instant funding solutions like Hopscotch Flow, which is completely private and delivers a seamless payment experience to all customers.

5 confidentiality risks in invoice factoring

While invoice factoring offers several benefits, it’s essential for business owners to be aware of the risks involved:

- Third-party communication: Your best clients are familiar with your payment process. Any deviation from the norm might be a red flag, creating confusion or concern. In traditional factoring arrangements, the factoring company communicates directly with your clients to collect payments. An unannounced third party suddenly wading into the transaction can lead to mistrust or apprehension about the future of their relationship with your business.

- Perception of financial instability: Clients may interpret the use of invoice factoring as a signal of financial instability or cash flow problems within your business. They might question your overall ability to manage your finances effectively or worry about the business’s long-term viability. This perception can erode trust and confidence, potentially leading clients to seek alternative suppliers or partners.

- Loss of control: When a factoring company becomes involved in the collection process, you essentially forfeit control over how payments are handled. You also lose visibility on the communications your clients receive. Clients may feel alienated or disrespected if they perceive a lack of personalized attention or if their concerns are not addressed promptly and effectively.

- Security concerns: Clients may have concerns about the confidentiality of their financial information when a third party is involved in the payment process. They might worry that sensitive information could be mishandled or improperly disclosed, potentially jeopardizing their own business interests or exposing them to security risks. This concern about confidentiality can strain valuable client relationships.

- Payment disputes: In some cases, clients may dispute invoices that have been factored, either due to legitimate concerns about the quality of goods or services provided or as a result of misunderstandings or billing errors. Resolving payment disputes can be more complicated when a third party is involved, leading to delays in payment and frustration on both sides.

Want to get paid instantly and protect client privacy?

While traditional invoice factoring can provide businesses with much-needed cash flow and flexibility, it’s essential to carefully consider the associated risks. Lack of confidentiality can lead to negative consequences for your business. By using Hopscotch Flow to get paid instantly, you don’t have to worry about jeopardizing key relationships. Create an account today and get paid in two clicks.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.