What You’ll Learn:

- The three parties involved in invoice factoring

- The two types of invoice factoring

- The basic steps of accounts receivable factoring

Invoice factoring is a powerful tool for small businesses. Among a host of other factoring benefits, it allows you to take control of your cash flow. You get quick access to the money your customers owe you with minimal disruption to your clients.

How does invoice factoring work? We’ll take you through the important details in this guide.

Who is involved in accounts receivable factoring?

Traditional accounts receivable processes involve two parties: the business and their customer. Accounts receivable processes that use factoring add a third party: a factoring company. What does that look like?

Take a look at the parties and their relationship to each other:

The business. In these cases, the business is the seller. They sell unpaid invoices from their customers to the factoring company, then no longer carry the responsibility for those payments and do not receive any money from the customer directly when the invoice is paid. In exchange, they receive a portion of the invoice’s balance upfront, paid by the factoring company.

Businesses typically enter into this relationship to gain immediate access to cash. This helps them put capital to work as soon as possible for future gains.

Learn how invoice factoring differs from a loan.

The factor. A factoring company acts as an intermediary between the business and their customer. In relation to the business who owns the unpaid invoice (the receivable), they are the buyer. They purchase outstanding invoices and take over responsibility for managing the paperwork and collections. In relation to the customer, they are now the collector. They pursue and accept payments.

Like other financing models such as AR financing, factoring companies offer the benefit of upfront payments to businesses in exchange for money. They receive factoring fees from the original business in exchange for taking over the admin tasks associated with collecting payments.

The customer. The customer’s role doesn’t change in these scenarios. They are still the debtor, and must make the payments they owe on outstanding invoices. However, the party they now owe the money to has changed. Rather than paying the business with which they initially entered into the relationship, they now pay the factoring company.

Customers do not choose to transfer their debt—they simply pay what they owe for purchasing goods or services.

Learn more about how factoring affects your customers.

What are the types of invoice factoring?

Different types of invoice factoring come with different levels of responsibility for the business that sells the invoices. Here’s how the types of invoice factoring differ:

Recourse factoring. With recourse factoring, the agreement to sell invoices comes with a recourse for factoring companies to relieve themselves of unpaid invoices. The original business must buy back the unpaid invoices if a customer fails to pay.

This approach typically involves fewer fees from factoring companies, but it also involves more risk for the original business.

Non-recourse factoring. In non-recourse factoring, the factoring company assumes all risks that come with the purchased invoices. If a customer fails to pay, the business that sold the invoices has no responsibility to resolve the situation.

When sold this way, a business typically receives a lower percentage of the original invoice amount from the factoring company. However, it may be a safer financial decision, especially for businesses concerned about customer credit risks.

What are the basic steps of accounts receivable factoring?

What does the process look like once a business decides to sell invoices to a factoring company? It typically follows these steps:

- Business submits invoices for approval. The factoring company reviews the terms of the invoice and evaluates its financial risk. They typically run a credit check on the customer and look at the business’s financial history.

- Factor approves and advances funds. If approved, the factor advances a percentage of the invoice value to the business. The exact percentage varies by company, but it’s usually at least 70% of the original invoice amount.

- Factor manages collections. Once the factoring company purchases the invoice, they take on the responsibility of collecting payment from the end customer. Any collections or communication come from them. Learn how to account for factored receivables on your end.

- Factor pays out the remaining balance. Once the customer pays the invoice in full, the factor releases the remaining balance (minus its factoring fees) to the business. Fees are typically based on a percentage of the invoice, rather than a flat amount.

How long does it take to factor an invoice? The timeline varies depending on the invoice’s original payment terms. A factoring company usually takes a few days to review and approve invoices. You’ll receive your first payment from them at that point. Then, invoices proceed on the regular cycle for collections—such as 30 days for a standard net-30 invoice.

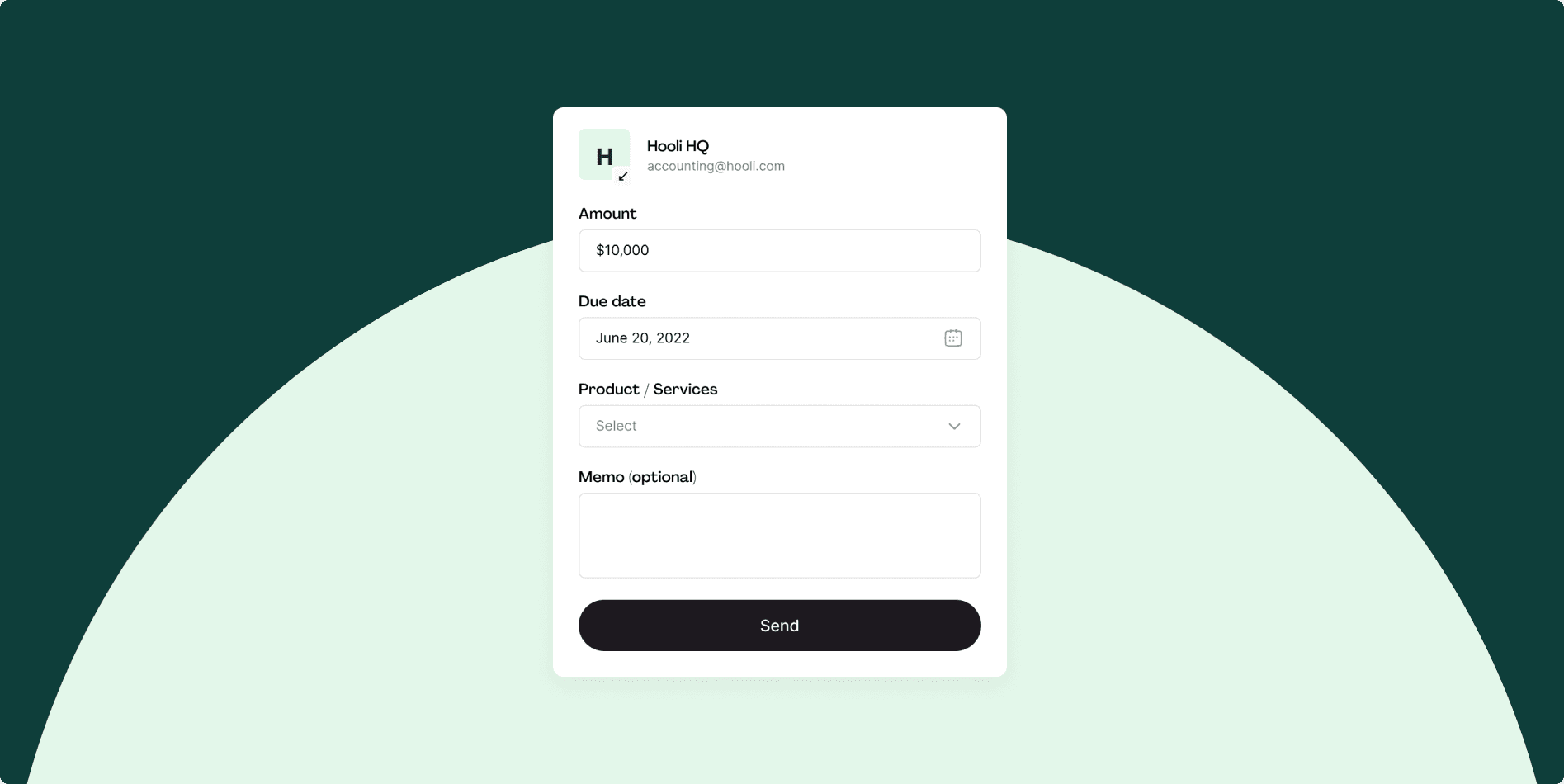

Factoring made faster with Flow

Hopscotch makes accessing working capital affordable and convenient. Instead of advancing funds on individual invoices, Flow gives you a borrowing limit based on your total outstanding accounts receivable. You can draw up to 80% of that balance straight to your account whenever you need it. On the customer side, nothing changes. They won’t see any third-party involvement or hard credit checks from Hopscotch.

Do you need good credit for invoice factoring? Traditional invoice factoring looks at the customer’s credit. With Hopscotch Flow, there’s no hard credit check required. Your business can get pre-approved to advance funds from your unpaid receivables, with automatic prepayments to prevent late fees and reduce overborrowing.

If you want to improve your cash flow without the drawbacks of traditional factoring, create a Hopscotch account in just a few minutes and get started with Flow today.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.