What You’ll Learn:

- The difference between invoice factoring and bank loans

- How to determine which product is best for your business

Many types of businesses use financing products to manage dips in their cash flow cycle. Two of the most popular solutions are invoice factoring and bank loans. These funding solutions have a few things in common, but overall there are some key differences to consider like fee structures and costs, funding timelines, and approval ratings. Learn the pros and cons of each option before deciding how to proceed.

Understanding the basics: factoring vs. bank loans

Balancing the inflow and outflow of cash from any business can be difficult. Sometimes you have expenses (inventory, supplies, payroll, etc.) that come due before you receive earnings to cover those costs. Rather than stalling out your business and waiting for cash from outstanding invoices to hit your bank account, it might make more sense to use lending products to cover the gaps in cash flow and keep moving forward.

With a bank loan, you’re basically asking the bank to lend you a specific amount of money. You promise to pay back that amount plus some extra (via interest) over a set period of time. Invoice factoring is more like a transaction than a loan. You sell your accounts receivable (your unpaid invoices) to a third party at a slightly discounted rate. Boom! Instant cash infusion, minus the service costs.

Do banks offer invoice factoring?

Invoice factoring is considered a form of alternative lending. Banks typically offer traditional lending products like personal and business loans. That means if you’re looking to factor your invoices, you’ll be working with specialized financial institutions or dedicated factoring companies rather than banks. These third parties will purchase your unpaid invoices and give you quick access to cash without the hassle of a lengthy loan approval process.

Average cost of factoring invoices and loans

The cost of factoring invoices depends on a number of different variables, like how many invoices you’re looking to sell, how reliable your customers are, and the fine print of your agreement with the factoring company. Typically, you’re looking at factoring fees of around 1% to 5% of the total invoice value per month. If the factored invoice gets paid back on the time, your total costs will likely be lower. But there are other fees that can rack up (like late fees) and balloon the cost of factoring. This might seem risky and potentially expensive, but remember you’re paying a premium for that immediate access to cash flow and easier approval process. It’s also a bit cheaper than the average small business bank loan, which currently clock in somewhere between 6% and 12% APR.

Factoring is also not classified as debt on your balance sheets, unlike a loan. Loans require collateral to secure the financing, which is an asset that can be seized in the event that you default on repaying the money you borrowed from the bank. Therefore, loans show up as debt on the financial statements of your business.

Want to learn more about instant payments and cash flow control?

Qualifying for invoice factoring vs bank loan

Qualifying for invoice factoring is way simpler than securing a bank loan, because banks tend to be more picky about who they choose to lend money to. With a bank loan, you’ll need to go through a long application process and it can take weeks to get your hands on the money you need to borrow to keep your business running. Factoring companies are more interested in your customers’ creditworthiness rather than your business’s track record. As long as your customers are solid, (even if your own credit history is a bit shaky) you can still typically tap into factoring to pump up cash flow. That’s a win for startups and businesses in a crunch.

Types of businesses utilizing invoice factoring

Factoring isn’t just for large businesses in certain industries. It can also be a useful financial resource for small contractors, consultants, and other types of service-based businesses. If you get paid via invoices with net-terms like 30, 60, or 90, you might be a good fit for invoice factoring. Businesses in industries from manufacturing and staffing to design and healthcare rely on factoring to keep their cash flow healthy when payments get delayed.

Speed of invoice factoring

This is where invoice factoring really shines: speed. Unlike the sluggish pace of bank loans with long wait times and strict approval requirements, factoring gets you cash quickly and is often easier to qualify for than a typical bank loan. Once the factoring company reviews your invoice and you sign their terms agreement, you could have cash in your hands within 24 to 72 hours. That’s lightning-fast liquidity to cover your bills or jump on those growth opportunities.

Example of how invoice factoring works

Let’s paint a picture here. Say you’re a small manufacturer who just delivered a hefty order to a retailer with a 60-day payment term. But guess what? You’ve got bills to pay now—you need to cover the raw materials you used to make your product and fund payroll for your employees. Instead of twiddling your thumbs waiting for the retailer’s payment to trickle in, you decide to factor that invoice and get paid immediately. The factoring company buys your $50,000 invoice at a 5% discount, handing you $45,000 on the spot. When your client (the retailer) eventually pays that invoice sometime in the next 60 days, the factoring company will send you the rest of your receivable minus their fees.

Why invoice factoring might be better than bank loans for fast cash

In conclusion, invoice factoring and bank loans might both grease the wheels of business financing, but they’re definitely not cut from the same cloth. Factoring is all about quick cash, simple qualifications, and keeping your business humming without jumping through hoops. Using your accounts receivable (those unpaid invoices) as collateral to score fast cash can be extremely beneficial to some businesses, but there are a few downsides—fees can creep if your invoice isn’t paid back on time, and you might put client relationships at risk if you’re working with an unreliable factoring company.

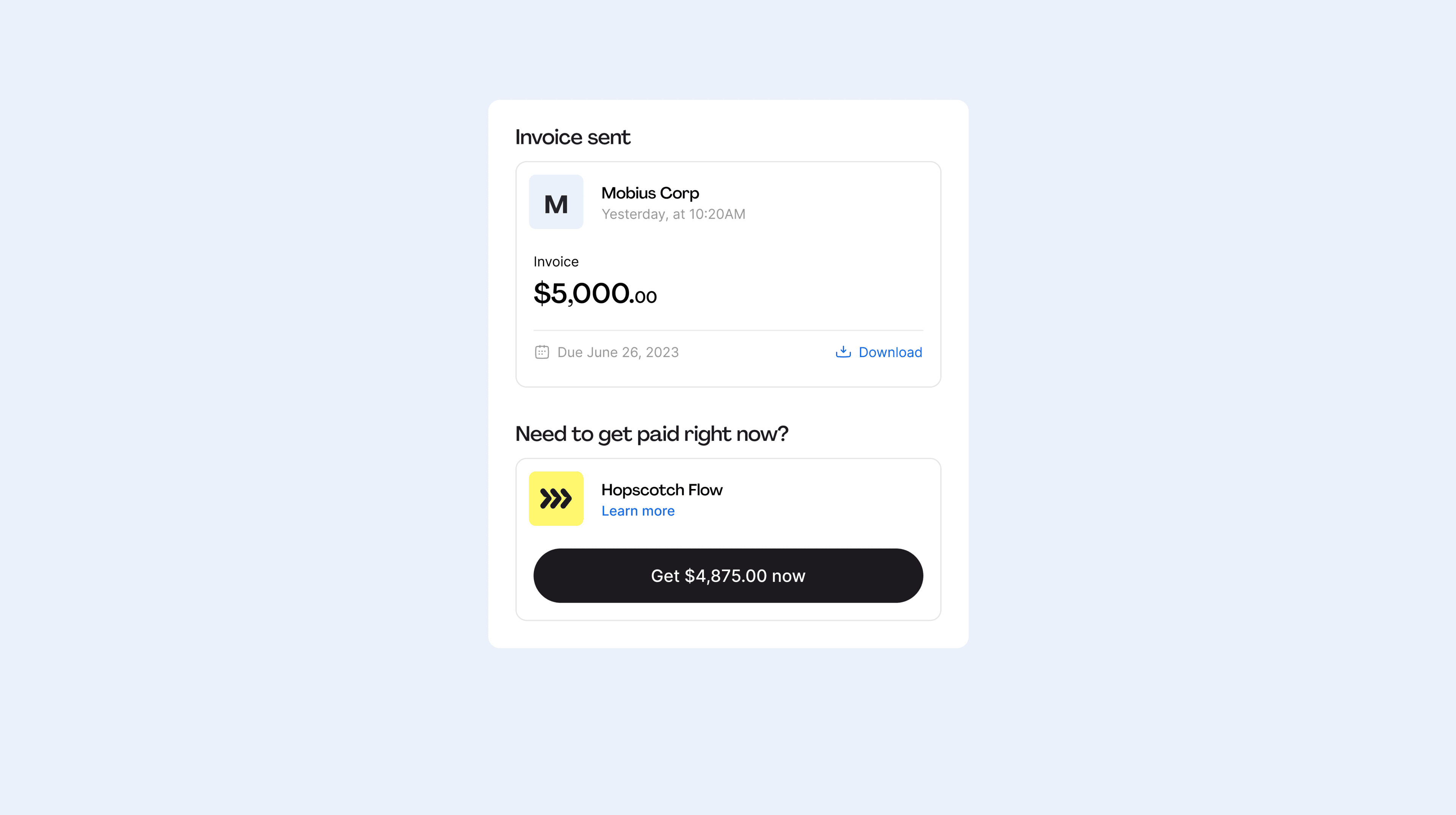

Hopscotch Flow offers all the perks of invoice factoring without the downsides. Flow is completely private, there’s no credit check, and you can get 90% of your invoice immediately. Plus, the average cost to Flow an invoice is just 3.4%. Hopscotch is diligent about protecting your business and brand, providing a professional payment experience for your clients.

Want to see your factoring limit? Create a Hopscotch account and get approved for Flow in minutes.

Bret Lawrence

Writer

Bret Lawrence writes about invoicing and cash flow management at Hopscotch. Her previous roles include senior financial writer at Better Mortgage, where she covered lending and the home buying process. Her writing is not financial advice.